What Documents Do I Need To File Homestead Exemption In Texas

A declaration of domicile may be obtained from the Clerk of the Circuit Court. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying.

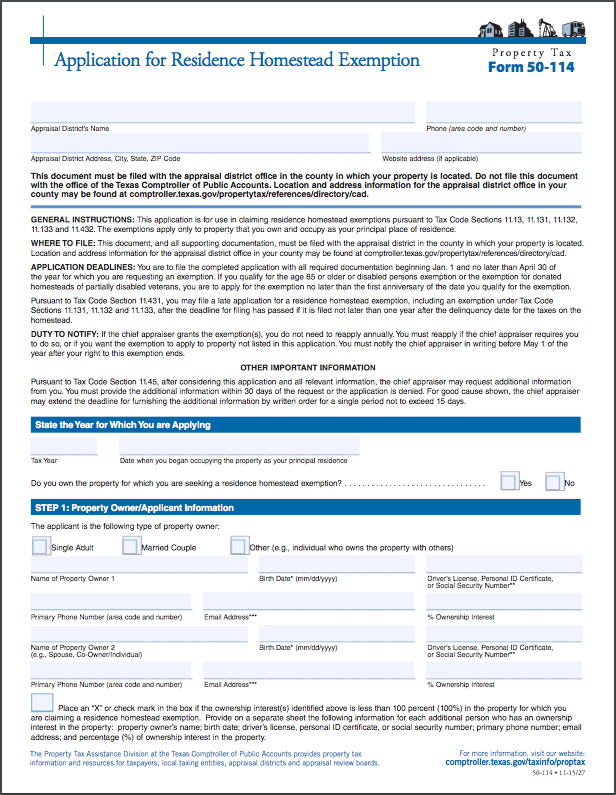

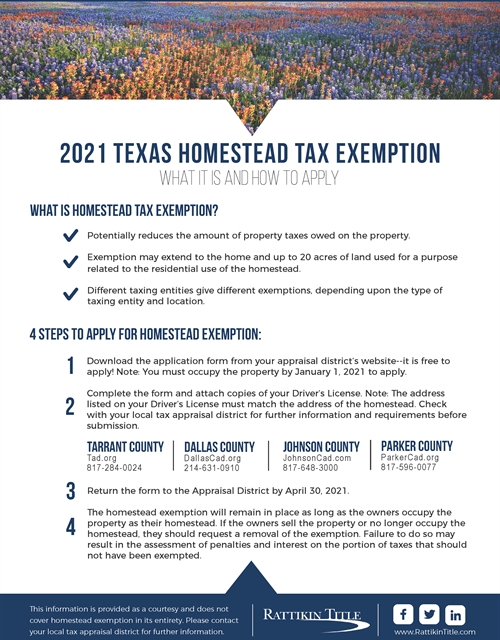

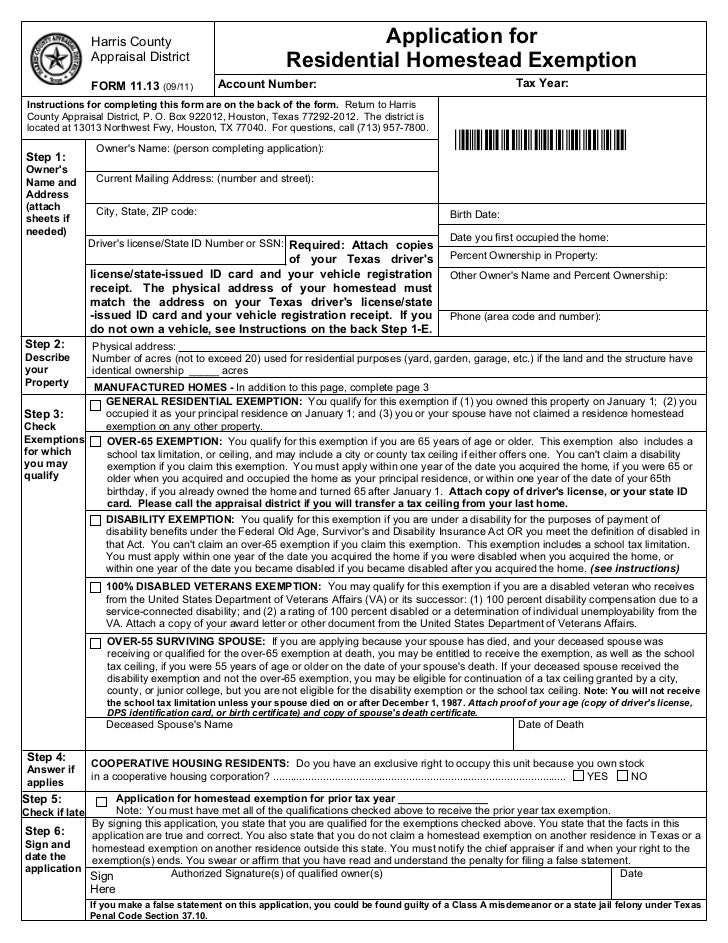

For the 25000 general homestead exemption you may submit an Application for Residential Homestead Exemption PDF and supporting documentation with the appraisal district where the property is located.

What documents do i need to file homestead exemption in texas. Everything You Need to Know to File in Texas Updated on 2021-04-16 Written by Baker Realty If you purchased a new home in 2017 the New Year means one thing its time to file your homestead exemption. To submit the homestead application utilizing the mobile app you will need 4 items. The application for homestead exemption Form DR-501 and other exemption forms are on the Departments forms.

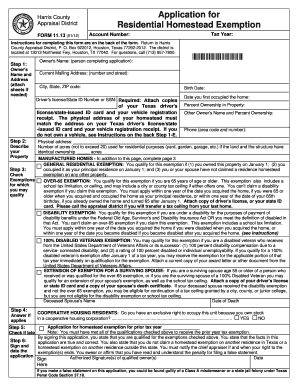

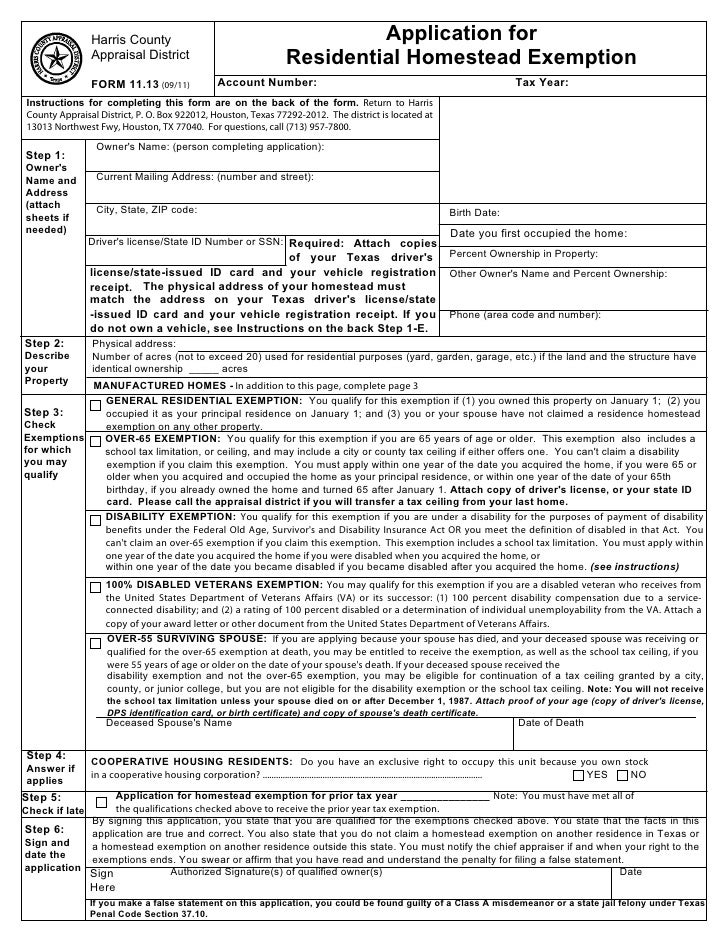

HOMESTEAD EXEMPTION REQUIRED DOCUMENTS All applicants must submit a completed DR-501 with no less than four 4 forms of identification as listed below for each applicant. Tax Code Section 1113 b requires school districts to offer a 25000 exemption on residence homesteads and Tax Code Section 1113 n allows any taxing unit the option to decide locally to offer a separate residence homestead exemption of up to 20 percent of a propertys appraised value. An iPhone or Android phone.

You can now electronically file your residential homestead exemption online utilizing the HCAD Mobile App. Your Homestead is filed with you local County office. If not a US.

Citizen a permanent visa and a declaration of domicile. To claim the exemption you must file an application with the appraisal district. See section 196031 Florida Statutes Homestead Property Tax Exemption.

The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. The local option exemption cannot be less than 5000. You file a homestead exemption with your county tax assessor and it reduces the amount of property tax you have to payFiling the homestead exemption will have no effect on your federal and state tax returns.

A Texas homeowner may file a late county appraisal district homestead exemption application if they file no later than one year after the date taxes become delinquent. Address on the drivers license or identification card MUST be the same as the address on which you are filing an Application for Residence Homestead Exemption. A homestead is defined as a single-family owner-occupied dwelling and the land thereto not exceeding 160 acres.

Once you receive the exemption you do not need to reapply unless the chief appraiser sends you a new application. Eligible providers of free assistance are. 2 real estate appraisers licensed or certified under Chapter 1103 of the Texas.

The typical delinquency date is February 1. Social Security CardNumber REQUIRED By law the social security number of the applicant and the applicants spouse must be. The application must include documentation of your disability.

Exemption applications filed at the Central Appraisal District on or after September 1 must include a copy of the applicants Texas Drivers License or DPS Identification Card. Your TX drivers license. The date of occupancy on your residence.

For a county the request consists of the ORIGINAL copies of the Certificate of Tax loss the Recapitulation of Homestead Exemptions Supplemental Roll Affidavit of Rolls and the homestead exemption applications. You should note that there are deadlines each year for filing a homestead exemption. 1 real estate brokers or sales agents licensed under Chapter 1101 of the Texas Occupations Code.

The application form is entitled Application for Residential Homestead Exemption This form can be obtained from the Information and Assistance Division for the Harris County Appraisal District. In order to receive a homestead exemption for property tax purposes applicants must now provide a copy of their Texas drivers license or Texas state-issued identification card and a copy of their. Recorded Deed or tax bill verifying ownership of the property on or before January 1st of the year for which an application is being filed.

The additional exemption up to 25000 applies to the assessed value between 50000 and 75000 and only to non-school taxes. The Texas Property Tax Code allows the Chief Appraiser to maintain a list of individuals available here and updated weekly who designate themselves as providers of free assistance to owner occupants of a residential homestead property.

Homestead Exemption Mysouthlakenews

Homestead Exemption Mysouthlakenews

Homestead Exemptions And Taxes Madison Fine Properties

Homestead Exemptions And Taxes Madison Fine Properties

Homestead Exemption Application Montgomery County Tx

Homestead Exemption Application Montgomery County Tx

Homestead Exemption Mysouthlakenews

Homestead Exemption Mysouthlakenews

What Is A Homestead Exemption And How Do I Apply For One All Your Questions Answered Twelve Rivers Realty

What Is A Homestead Exemption And How Do I Apply For One All Your Questions Answered Twelve Rivers Realty

What Is Homestead Exemption Find Houston Homes

What Is Homestead Exemption Find Houston Homes

1113 Form Fill Online Printable Fillable Blank Pdffiller

1113 Form Fill Online Printable Fillable Blank Pdffiller

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Application O Connor Property Tax Reduction Experts

Texas Homestead Application O Connor Property Tax Reduction Experts

Harris Co Tx Homestead Exemption

Harris Co Tx Homestead Exemption

6 Things To Know About Filing A 2017 Homestead Exemption

6 Things To Know About Filing A 2017 Homestead Exemption

How To File Your 2019 Homestead Exemption Twin Realty Group

How To File Your 2019 Homestead Exemption Twin Realty Group

2021 Texas Homestead Tax Exemption

2021 Texas Homestead Tax Exemption

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

2021 Update Houston Homestead Home Exemptions Step By Step Guide

2021 Update Houston Homestead Home Exemptions Step By Step Guide

Homestead Exemption What You Need To Know The Loken Group

Homestead Exemption What You Need To Know The Loken Group

Gibraltar Lending How To File A Homestead Exemption Application In Texas

Gibraltar Lending How To File A Homestead Exemption Application In Texas

Homestead Exempetion Mel In The City

Homestead Exempetion Mel In The City

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home