Property Tax Rate El Paso Tx

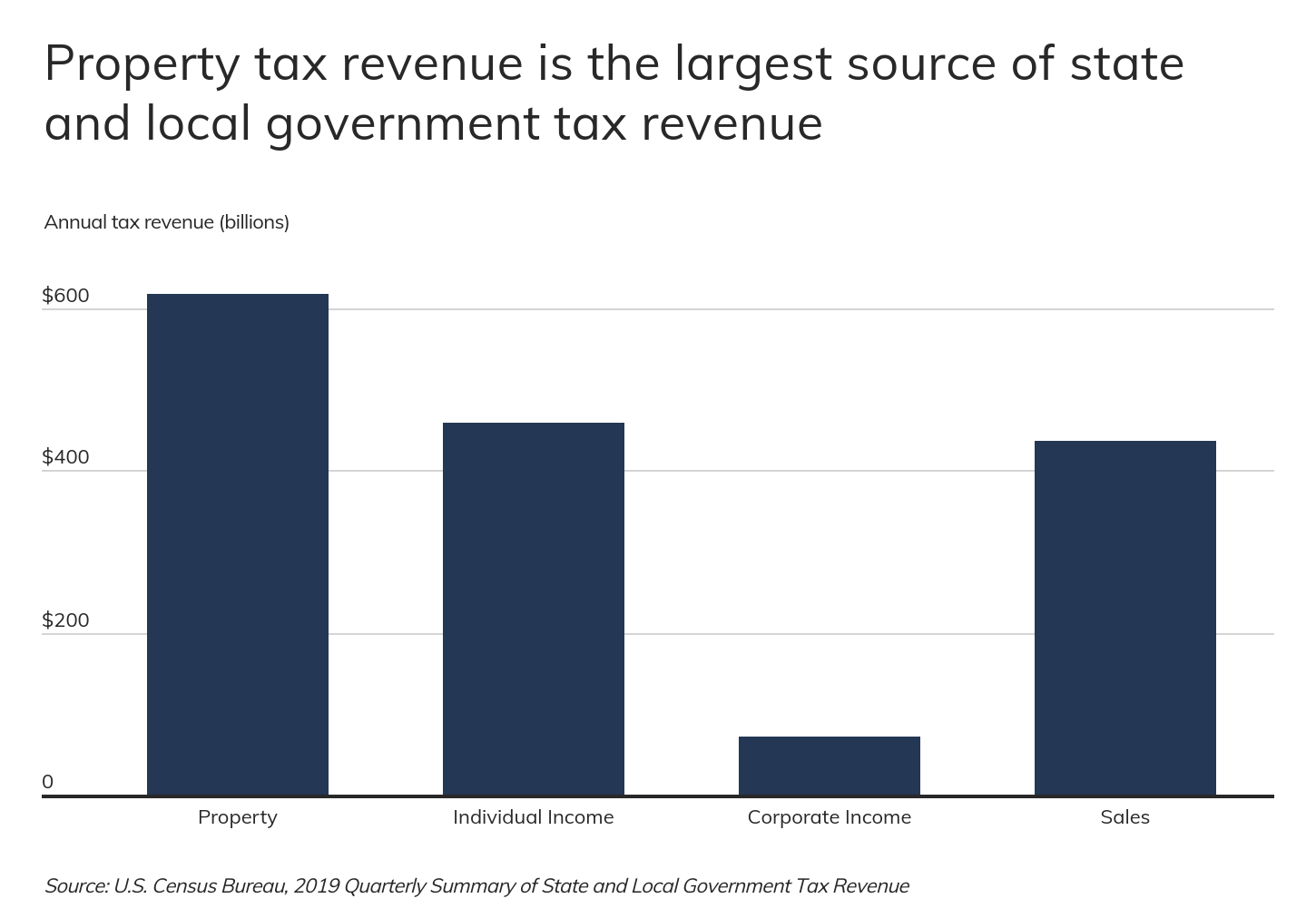

The median property tax also known as real estate tax in El Paso County is 212600 per year based on a median home value of 10180000 and a median effective property tax rate of 209 of property value. El Paso County collects on average 209 of a propertys assessed fair market value as property tax.

EFFECTIVE TAX RATE 0450682 per 100 ROLL BACK TAX RATE 0488997 per 100 Theeffectivetax rate is thetotal tax rateneeded toraisethe same amount of propertytax revenue for the County of El Paso Texas from the same properties in both 2018 tax year and the 2019 tax year.

Property tax rate el paso tx. The average home valuation in El Paso increased by 13 between 2020 and 2021 said Dinah Kilgore CAD executive director and chief appraiser. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the El Paso County Tax Appraisers office. For fiscal year 2021 the El Paso City Council set its total tax rate at 907301 cents per 100 of taxable value.

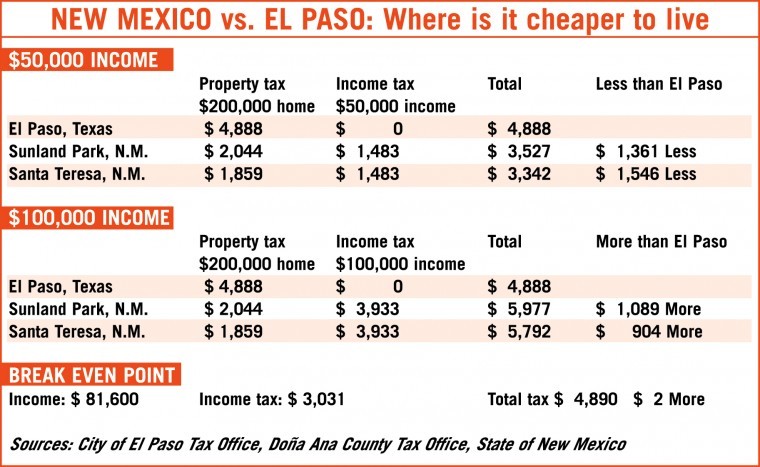

The city of El Paso is trying to find out where it stands with the rest of Texas when it comes to property taxes. Cities and towns may extend into multiple counties. El Paso County Commissioners Court approves increasing county property tax rate 92 percent and Hospital District rate 63 percent.

In order to determine the tax bill your. El Paso County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. So our tax rate currently is 84 cents when youre looking at the tax rate and youre looking at the value of your home what youre actually paying in taxes its much less than again.

Collin County The sixth. While the median home value is 116600 which is lower than the national average the average homeowner pays hundreds of dollars more than the typical American a perfect example of Texas high property taxes. In-depth El Paso County TX Property Tax Information.

254 rows The average effective property tax rate in El Paso County is 224. Jackson then click Property Address all accounts with statements requested by fiduciary no. Therollbacktax rate is thehighesttax ratethat the County of El PasoTexas mayadopt before voters are.

In accordance with Sec. 2066 then click Fiduciary No 907 then click Geo No. Newly published documents reveal that Sun City imposes a much higher property tax rate than its peers.

2605 of the Texas Tax Code the City. Cities and towns are included in this list if any part of them is within the county. Please contact the Appraisal District for the most current information on city tax rates and levies.

Yearly median tax in El Paso County The median property tax in El Paso County Texas is 2126 per year for a home worth the median value of 101800. 2066 that are located in the El Paso tax district. The median property tax on a 10180000 house is 184258 in Te.

El Paso has had a stigma of having some of the highest taxes in the stateIts. This years no-new-revenue tax rate 1000483827 This years voter-approval tax rate 048949 1003. Tax rates are per 10000 valuation.

This notice concerns 2020 property tax rates for County of El Paso Texas. That average was not. Tax Rate Budget Information.

Many El Paso homeowners are seeing a significant spike in their property appraisals pushed upward by a hot real-estate market during the pandemic Central Appraisal District officials said. With a population of more than 800000 El Paso Countys average effective property tax rate is 222. The median property tax on a 10180000 house is 212762 in El Paso County.

The next highest tax rate was set by Dallas at 7765 cents per 100 of value. City boundaries are not maintained by the Texas Association of Counties.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home