How To File Homestead In Texas Online

The exemptions apply to your residence homestead that you own and occupy as your principal residence. File the completed application and all required documents with the appraisal district for the county in which the property is.

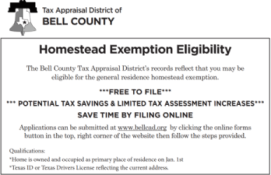

Homestead Exemptions Can Now Be Filed Online Bell Cad Official Site

Homestead Exemptions Can Now Be Filed Online Bell Cad Official Site

A Texas homeowner may file a late county appraisal district homestead exemption application if they file no later than one year after the date taxes become delinquent.

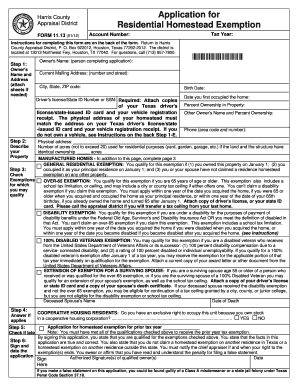

How to file homestead in texas online. The Application for Residence Homestead Exemption is required to apply for a homestead exemption. The HCAD Info and Exemptions app found in the App Store or Google Play. Download Form You can download the homestead exemption form with the following link.

How do You Apply for a Homestead Exemption in Texas. Application for Exemption for Vehicle Used to Produce Income and for Personal Activities. Chaparral Suite 101 Corpus Christi TX 78401.

See Step 3 of the application for additional details regarding the forms of identification. Box 922012 Houston Texas 77292-2012 along with the supporting documentation from above. Homestead Exemption Online Form Disabled Veterans Exemption.

Charitable Organization Property Tax. The Williamson Central Appraisal District is pleased to announce that we now have an online application to service Homestead Exemptions Over 65 Exemptions 100 Disabled Veteran Exemptions and Disabled Person. Property tax in Texas is a locally assessed and locally administered tax.

There are several different types of homestead exemptions including Age 65 or Older or Disabled Persons Exemption Homestead Exemption for Disabled Veterans and Optional Exemptions. If your property is located in Harris county you can download the app and file online or print out the Harris County Application for Residential Homestead Exemption form fill it out and mail back to Harris County Appraisal District P. Exemption applications filed at the Central Appraisal District on or after September 1 must include a copy of the applicants Texas Drivers License or DPS Identification Card.

Application for Exemption of Goods Exported from Texas and three associated forms Freeport Exemption Application for Exemption of Goods in Transit. The date of occupancy on your residence. To submit the homestead application utilizing the mobile app you will need 4 items.

Central Belton TX 76513 Phone. You must furnish all information and documentation required by the application. Click here for the 2021 Residence Homestead.

Application for Pollution Control Property Tax Exemption. Texas Property Tax Code Section 1143j requires the applicant to provide a copy of a Texas Drivers License or Texas Personal Identification Certificate. Your appraisal district should automatically send an application form to all new property owners around the örst of February.

Disabled Veterans Section 1122. Please note there is no fee to file for exemptions and no need to reapply annually. If a county collects a special tax for farm-to-market roads or flood control a residence homestead is allowed to receive a 3000 exemption for this tax.

Here is a video we did on how to properly fill out the Texas Homestead Exemption For for 2019. Contact the Appraisal District of the county in which you reside and request they send you the necessary forms for Declaring Your Homestead or download the form from the appraisal district website. There is no state property taxProperty tax brings in the most money of all taxes available to local government to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local government.

Homestead Exemption Affidavits NOTE. You can WebFile or use the downloadable. This application requires a copy of the applicants Texas drivers license matching the address on the property Residence Homestead Section 1113.

In order to qualify for this exemption the home must be your p. You may file for late HS exemption up to one year after the date the taxes become delinquent. Central Temple TX 76501.

Application for September 1 Inventory Appraisal. Your TX drivers license. Address on the drivers license or identification card MUST be the same as the address on which you are filing an Application for Residence Homestead Exemption.

Use WCADs online exemption form for quicker filing and expedited processing time. Killeen TX 76541 Phone. All residence homestead owners are allowed a 25000 homestead exemption from their homes value for school taxes.

You may also mail the above information to the Nueces County Appraisal District 201 N. The typical delinquency date is February 1. An iPhone or Android phone.

How To File Homestead Exemption In Texas 2021 Youtube

How To File Homestead Exemption In Texas 2021 Youtube

How To File Your 2019 Homestead Exemption Twin Realty Group

How To File Your 2019 Homestead Exemption Twin Realty Group

Gibraltar Lending How To File A Homestead Exemption Application In Texas

Gibraltar Lending How To File A Homestead Exemption Application In Texas

Residence Homestead Exemption Information Youtube

Residence Homestead Exemption Information Youtube

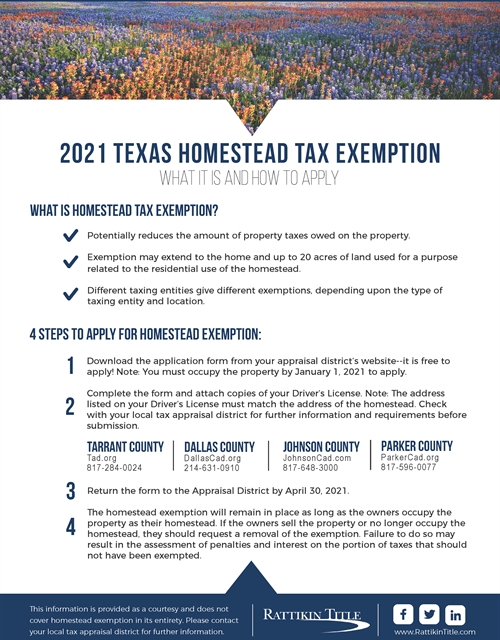

2021 Texas Homestead Tax Exemption

2021 Texas Homestead Tax Exemption

How To File Homestead Exemption Application In Texas Tcp Real Estate

How To File Homestead Exemption Application In Texas Tcp Real Estate

How Much Savings Is My Texas Homestead Exemption Lisa Creed

How Much Savings Is My Texas Homestead Exemption Lisa Creed

How To Fill Out Your Texas Homestead Exemption Form Youtube

How To Fill Out Your Texas Homestead Exemption Form Youtube

2021 Update Houston Homestead Home Exemptions Step By Step Guide

2021 Update Houston Homestead Home Exemptions Step By Step Guide

Tax Information For New Homeowners Republic Title

Tax Information For New Homeowners Republic Title

How To File For Homestead Exemption In Texas Houston Harris County Montgomery County For Free Youtube

How To File For Homestead Exemption In Texas Houston Harris County Montgomery County For Free Youtube

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Fillable Online Form 50 114 Residence Homestead Exemption Application Texas Fax Email Print Pdffiller

Fillable Online Form 50 114 Residence Homestead Exemption Application Texas Fax Email Print Pdffiller

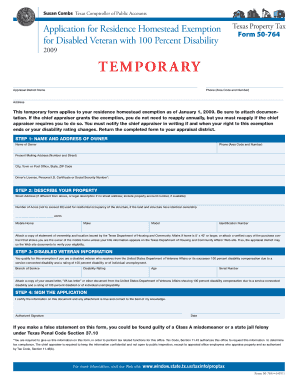

1113 Form Fill Online Printable Fillable Blank Pdffiller

1113 Form Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption What You Need To Know The Loken Group

Homestead Exemption What You Need To Know The Loken Group

2021 Update Houston Homestead Home Exemptions Step By Step Guide

2021 Update Houston Homestead Home Exemptions Step By Step Guide

How Can Filing A Homestead Exemption Can Help Homeowners

How Can Filing A Homestead Exemption Can Help Homeowners

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home