Property Tax Rate Quincy Ma

5 the Quincy City Council approved tax rates of 1417 per 1000 of assessed valuation for residential proprieties and 2871 for commercial properties the Boston Globe reported. Colleen Healy the citys chief assessor told councilors Monday night that the average Quincy homeowner will pay 6126 in property taxes in 2020 up from 5855 in 2019.

16 Moody St Unit 16 Quincy Ma 02169 Realtor Com

16 Moody St Unit 16 Quincy Ma 02169 Realtor Com

Upon Approval Taxpayer Is Entitled To Defer Delay Payment Of Any Portion Of The Property Tax Bill.

Property tax rate quincy ma. Must have a total gross income of less than 60000 per year. The Assessors Office is responsible for the administration of all laws and regulations regarding property tax assessment. Massachusetts Property and Excise Taxes Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown.

There are two online payment options. City of Quincy is a locality in Norfolk County MassachusettsWhile many other municipalities assess property taxes on a county basis City of Quincy has its own tax assessors office. Quincy Bill Payment Center Information.

This is above the national average which is 107. City Hall 1305 Hancock Street Quincy MA 02169. If your property is located in a different Norfolk County city or town see that page to find your local tax assessor.

Must have primary residence in Massachusetts for ten years and owned property in the state for five years and 3. FY2021 Residential Tax Rate 1214 per thousand of assessed value. 351 rows Massachusetts property real estate taxes are calculated by multiplying the propertys.

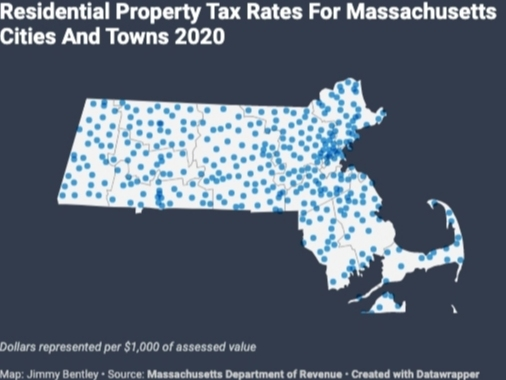

Social for Massachusetts Property and. Tax rates are set locally by cities and towns in Massachusetts with total rates generally ranging from 1 to 2 10 to 20 mills. This Department collects all taxes including auto excise boat excise personal property real estate and watersewer usage.

Mayor Thomas Kochs office told the city council Monday night that the. Pay via Electronic Check ACH with a 025 processing fee per transactionPlease note that Effective March 2 2021 UniPay Gold will be increasing the fee for an ACH transaction from 025 to 050 per transaction. Proposition 2 ½ limits the City of Quincy and all other Massachusetts communities the amount of citywide taxes that can be raised.

QUINCY Next year the average Quincy homeowner will pay about 120 more in property taxes. View transcript of Learn about Property Taxes. Must have occupied the property as of July 1 2020 and 4.

Boston currently sits at 1056. If the Form of List is not filed on time the assessor can only grant abatement if the taxpayer shows a reasonable excuse for late filing or. That number was up 38 cents from 2018.

The median single-family home in Quincy is worth 466551 according to market data and had an annual tax bill of 5855 in 2019. 59 sec 64 if no Form of List was filed for the fiscal year the assessor cannot grant abatement for overvaluation of personal property for the year. A Form of List is not considered filed unless it is complete.

In fact the median annual property tax payment is 4899. FY2020 Residential Tax Rate 1243 per thousand of assessed value. Incorporating all areas the states average effective tax rate is 117.

FY2021 Commercial Tax Rate 2422 per thousand of assessed value. Once the tax commitment list and warrant is duly and properly signed by the Assessors tax bills are mailed out to each person assessed resident and non-resident. FY2020 Commercial Tax Rate 2484 per thousand of assessed value.

Pursuant to Massachusetts General Law c. 1305 Hancock StQuincy MA 02169 P. Allowing for new growth can then increase this levy limit.

Red Door Real Estate reports that Quincys residential tax rate is now at 1243 compared to last years reported 1255. The Assessors as required by Chapters 59 60A 61 61B 121A of the Massachusetts General Laws and various Acts of the Legislature perform the appraisal of approximately 27000 parcels of property. The citys current tax rate is 1255 per 1000 of assessed property value for residential properties and 2515 per 1000 for commercial industrial and.

Phi Du Treasurers Office. Most surrounding suburbs are between 9 and 13. Proposition 2 ½ limits a community to raising citywide taxes by 25 from the previous years levy limit.

2020 Residential Property Tax Rates Decrease For Quincy Ma Homeowners Red Door Real Estate

2020 Residential Property Tax Rates Decrease For Quincy Ma Homeowners Red Door Real Estate

24 Shennen St Quincy Ma 02169 Realtor Com

24 Shennen St Quincy Ma 02169 Realtor Com

45 Virginia Rd Quincy Ma 02169 Realtor Com

45 Virginia Rd Quincy Ma 02169 Realtor Com

175 Centre St Quincy Ma 02169 Realtor Com

175 Centre St Quincy Ma 02169 Realtor Com

Fire On Hanna Street In Quincy Point Giving Rise To A Firestorm Of Media Coverage Quincy Media Coverage Hanna

Fire On Hanna Street In Quincy Point Giving Rise To A Firestorm Of Media Coverage Quincy Media Coverage Hanna

25 Kidder St Unit C Quincy Ma 02169 Realtor Com

25 Kidder St Unit C Quincy Ma 02169 Realtor Com

32 Verchild St Quincy Ma 02169 Realtor Com

32 Verchild St Quincy Ma 02169 Realtor Com

1 Prospect Hill St Unit 1 Quincy Ma 02169 Realtor Com

1 Prospect Hill St Unit 1 Quincy Ma 02169 Realtor Com

76 Myopia Rd Quincy Ma 02169 Realtor Com

76 Myopia Rd Quincy Ma 02169 Realtor Com

Quincy Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Quincy Massachusetts Ma Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

620 Adams St Quincy Ma 02169 Realtor Com

620 Adams St Quincy Ma 02169 Realtor Com

7 Crown Dr Quincy Ma 02169 Realtor Com

7 Crown Dr Quincy Ma 02169 Realtor Com

21 Ryden St Unit 1 Quincy Ma 02169 Realtor Com

21 Ryden St Unit 1 Quincy Ma 02169 Realtor Com

4 Billings St Quincy Ma 02171 Realtor Com

4 Billings St Quincy Ma 02171 Realtor Com

38 Holmes St Quincy Ma 02171 Realtor Com

38 Holmes St Quincy Ma 02171 Realtor Com

57 Edgewater Dr Quincy Ma 02169 Realtor Com

57 Edgewater Dr Quincy Ma 02169 Realtor Com

49 71 Federal Ave Quincy Ma 02169 Office For Sale Loopnet Com

49 71 Federal Ave Quincy Ma 02169 Office For Sale Loopnet Com

1500 Hancock St Quincy Ma 02169 Realtor Com

1500 Hancock St Quincy Ma 02169 Realtor Com

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home