Columbus Ohio Property Tax Estimator

To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. If you estimate that you will owe more than 500 in tax for 2021 after subtracting your estimated withholding and credits then you should make quarterly estimated payments.

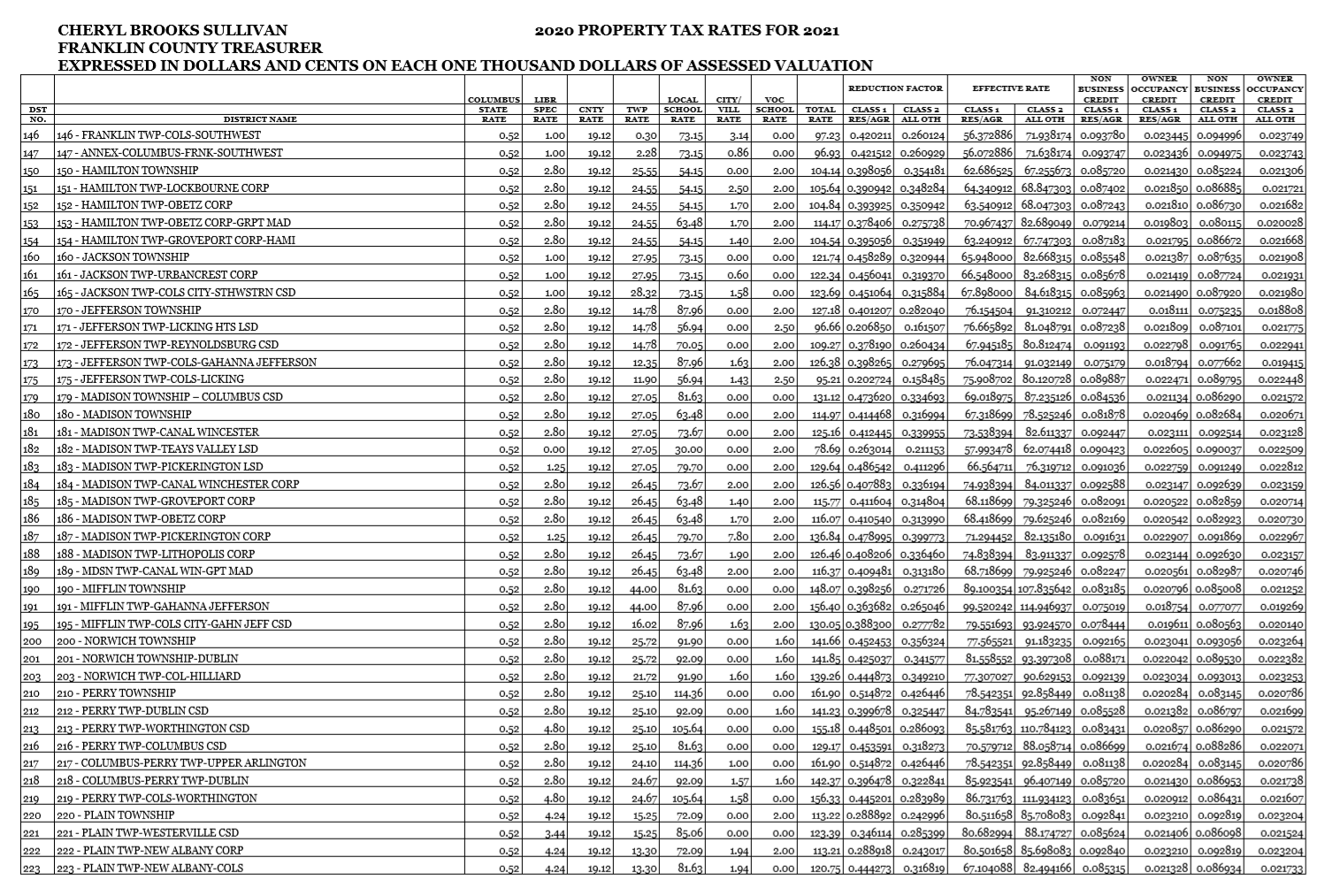

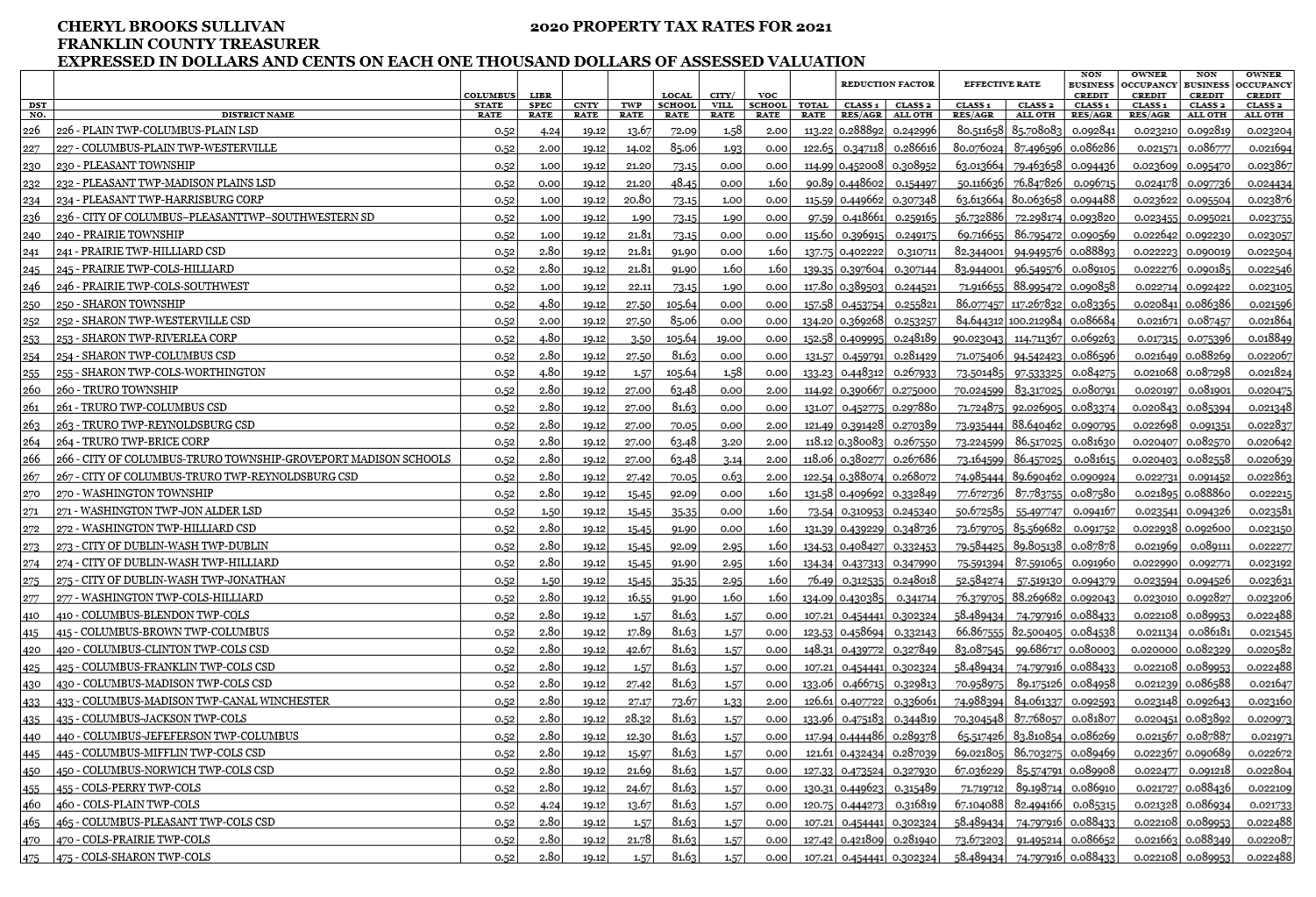

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Tax rates are established for the next year by the State of Ohio Department of Taxation.

Columbus ohio property tax estimator. See how your monthly payment changes by making updates to. Overview of Ohio Taxes. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected.

This calculator does not take into consideration any special. To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. Fill-in Forms and Instructions Filter by year 2021 2020 2019 2018 2017 2016 2015 2014 2013 Submit.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Tax Estimator Real Estate Sales Dashboard Appraisers In Your Community Unmanned Aerial Vehicles Web Reporter GIS Data Extract Open Data Portal. Taxpayers may use the secure drop box located in the lobby of the 77 N.

Quarterly estimated payments can be made electronically. This estimator is provided to assist taxpayers in making informed decisions about real estate taxes and to anticipate the impact of property value fluctuations. Filter by year All 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004.

Hilliard - 100000 x 208 208000. Due to the COVID-19 pandemic the Division is currently closed to the public. Columbus - 100000 x 148 148000.

Fill-in forms use the features provided with Acrobat 50 products. On average the county has the third-highest property tax rate in Ohio with an average effective rate of 205. Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States.

Whitehall - 100000 x 172 172000. For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300. So for a home worth 150000 you could expect to pay a property tax bill of roughly 3660.

Multiply the market value of the property by the percentage listed for your taxing district. Tax amount varies by county. This tool is updated after our office receives the effective tax rates from the State each year.

In order to use Easy File you must be assigned a PIN to initially access your account. City of Columbus Income Tax Division 77 N. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the.

Currently there is no computation validation or verification of the information you enter and you are still responsible for entering all required information instructions may require some information to. If paying by check or money order use the Ohio IT 1040ES andor SD 100ES payment vouchers using the correct year. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

A simple percentage used to estimate total property taxes for a property. Your actual property tax may be more or less than the value calculated in the estimator. 148 average effective rate.

Columbus city rate s 58 is the smallest possible tax rate 43265 Columbus Ohio 75 is the highest possible tax rate 43085 Columbus Ohio The average combined rate of every zip code in Columbus Ohio is 7394. Ohio has a progressive income tax system with six tax brackets. Use this free Ohio Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Franklin County is located in central Ohio and contains the state capital Columbus. Rates range from 0 to 4797. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000.

Front Street building to drop. For the 2020 tax year which you file in early 2021 the top rate is 4797. Monday through Friday 900 am.

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. Starting in 2005 Ohios state income taxes saw a gradual decrease each year. Housing Advocates Franklin County Auditor Show Support for property Tax Relief proposal.

614 645-7193 Customer Service Hours. Taxes for a 100000 home in. Columbus Income Tax Division PO Box 182158 Columbus OH 43218-2158.

Property Tax Estimator Use this tool to estimate the current level of full year property taxes based on your opinion 2020 value associated with your property. Real Estate Property Tax Rates. Easy File allows individuals to file and pay their Columbus Annual Income Tax Returns IR-25 via credit card debit card or electronic check.

136 of home value. Delinquent tax refers to a tax that is unpaid after the payment due date. Front Street 2nd Floor.

3850 cents per gallon of regular gasoline and 4700 cents per gallon of diesel.

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Compare Car Insurance Rates Ohio Upcomingcarshqcom Compare Car Insurance Car Insurance Car Insurance Rates

Compare Car Insurance Rates Ohio Upcomingcarshqcom Compare Car Insurance Car Insurance Car Insurance Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Delaware County Rents Most Affordable In Nation Delaware County Rent National

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Franklin County Auditor Tax Estimator

Franklin County Auditor Tax Estimator

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Slight Uptick In Rates On Loans For New Homes Home Loans New Homes Conventional Mortgage

Slight Uptick In Rates On Loans For New Homes Home Loans New Homes Conventional Mortgage

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home