Does Your Council Tax Change When You Have A Baby

Tax credits for childcare while you work. We will add 100 for every 500 between 10000 and 16000.

Https Www Kirklees Gov Uk Beta Council Tax Pdf Council Tax Booklet Pdf

If you give incorrect or misleading information in connection with your application for CTR or you fail to report a change of circumstances after you have been awarded a reduction you may be committing fraud.

Does your council tax change when you have a baby. Strange but OK. Spouses and partners who live. But you categorically should not have had a band amendment for the extension you did.

This will then put a marker on the VOA website telling you that a banding change may take place on sale of the propertyYou do not need to inform anybody. If you 60 years or over we disregard the first 10000. Youre not eligible if your total household income goes over 119000 or.

Students cannot normally get a Council Tax. To work out your reduction amount your council will look at how much money you and your partner if you have one have coming in including earnings benefits and tax credits. The VOA will send a letter if your Council Tax band changes.

What is on your W4 does not have to be the same as what you file on your tax return. If you have eight or more children subtract two allowances. If your circumstances change while youre getting Council Tax Reduction CTR you should tell your local authority as soon as possible.

If your expected income is between 90000 and 119000 add one withholding allowance per child. The biggest reduction you can get is 100 off your annual bill. The amount of council tax you pay is dependent on the size and value of your property depending on the price it would have sold for in April 1991.

Tell us about a change in your circumstances. If you have been getting Council Tax Reduction CTR and your circumstances change you must tell the local authority about the change. Otherwise you may get too much CTR and have to pay some of it back.

If you are eligible for Council Tax Benefit which is means tested it can increase the amount of benefit you are entitled to therefore reducing your bill. There is no law that says you have to change your W4. The total tax impact of having children depends on how much money you make the number of children you have and your childcare expenses.

Your W4 is only to determine how much taxes are taken out of your paycheck. That comes under the category wishful thinking. You should still be on the same band with a improvement indicator on the VOA Valuation Office Authority website.

You dont have to change it at all and you can wait to 2016 if you want to change it. For single parents the limits are 61000 to 84000. Discounts wise nothing changes having a baby.

Up to 2005. I used to work in Council tax. Youll usually have to pay Council Tax if youre 18 or over and own or rent a home.

If you are in receipt of Guarantee Credit the capital limit of 16000 does not apply. You need to tell us about any other change that could affect the amount of Council Tax you have to pay. They look at lots of things when judging your case including your age family size disabilities and.

Up to 12250 a week 1 child Up to 210 a week 2 or more children You will not get 100 of your childcare costs. Council Tax Reduction - reporting a change of circumstance. Youve an annexe thats attached to your property which was occupied by a relative or family member and has now become unoccupied.

Well aim to action your change within 10 working days. In which case yes they probably currently pay nothing the minute you put your name on the electoral roll there the council tax more than likely is reassessed. The W4 is only for taxes taken from your.

This advice applies to England. Or you might get too little. For every 250 or part 250 above 6000 we add 100 to your weekly income.

For instance if you make 70000 a year face a top income tax rate of 25 percent and dont pay for child care the dependent exemption saves you 925 and the child tax credit saves you 1000 for each child that you have. A full Council Tax bill is based on at least 2 adults living in a home. If you receive this letter and do not agree with it you have 6 months to make an appeal.

You can hardly prove you dont live there to dispute it either when all your bank accounts are still addressed there.

Https Www Huntingdonshire Gov Uk Media 1300 Your Council Tax Support Letters Explained Pdf

Https Lewisham Gov Uk Media Files Imported Codeofcollection Ashx

How To Get Student Council Tax Exemption Save The Student

How To Get Student Council Tax Exemption Save The Student

United Kingdom Wirral Council Tax Bill Template In Word Format Bill Template Word Template Templates

United Kingdom Wirral Council Tax Bill Template In Word Format Bill Template Word Template Templates

Pin By Breanna Haugen On Itworks Network Marketing Quotes Marketing Quotes It Works Marketing

Pin By Breanna Haugen On Itworks Network Marketing Quotes Marketing Quotes It Works Marketing

Kids Can Sew Beaver Bags Check Your Council To Borrow A Free Sewing Machine For This Project How Much You Prep Depends On Sewing Free Sewing Sewing Machine

Kids Can Sew Beaver Bags Check Your Council To Borrow A Free Sewing Machine For This Project How Much You Prep Depends On Sewing Free Sewing Sewing Machine

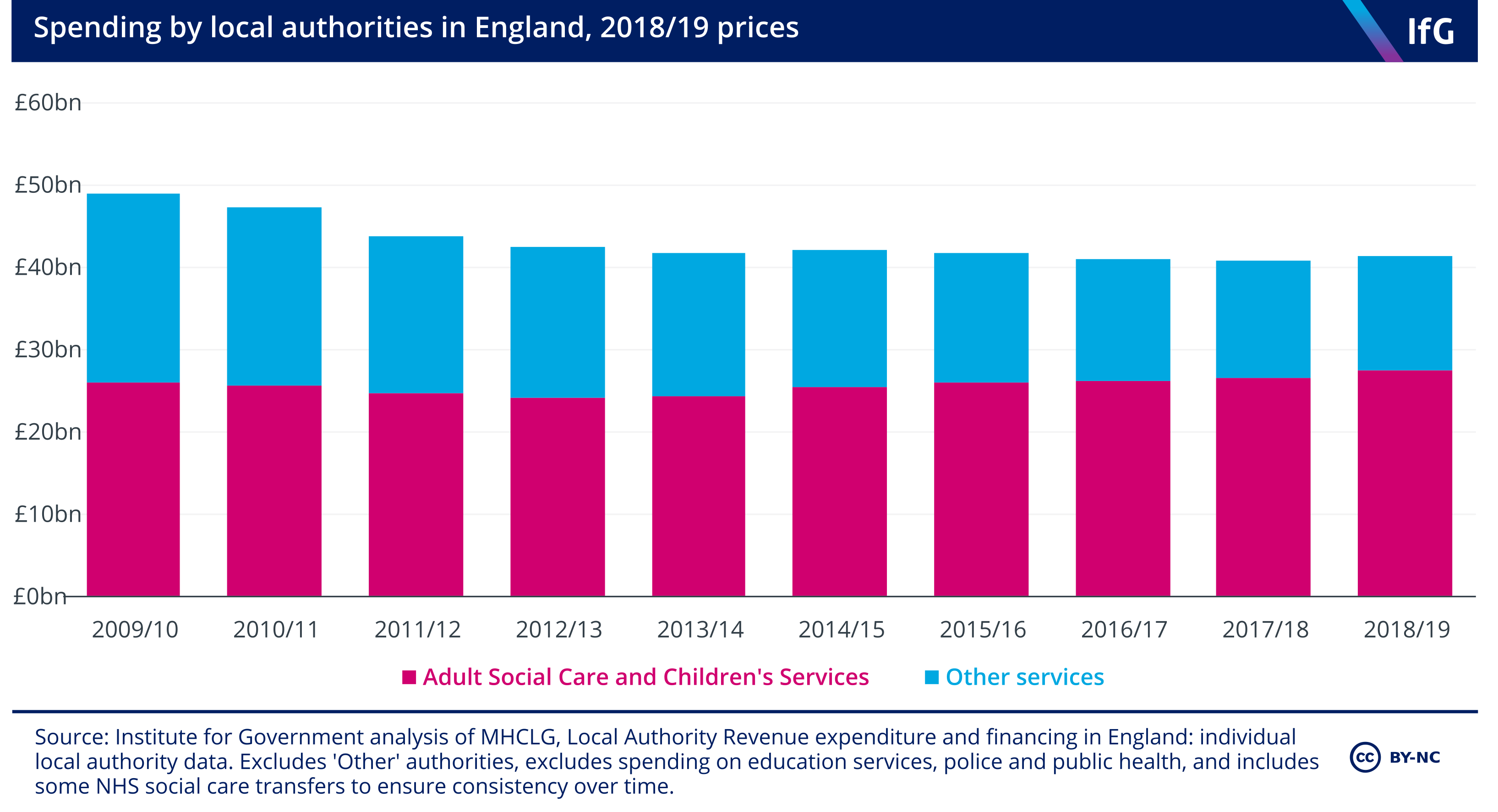

Higher Council Tax Bills Fail To Close Care Funding Gap Latest News Latest News Fails Council

Higher Council Tax Bills Fail To Close Care Funding Gap Latest News Latest News Fails Council

Pin By Tish On A Happy Day Name Change Checklist Name Change Names

Pin By Tish On A Happy Day Name Change Checklist Name Change Names

Council Tax Reduction How To Reduce Council Tax Totaljobs

Council Tax Reduction How To Reduce Council Tax Totaljobs

Change Of Address Checklist For The Uk And Who To Notify When Moving

Change Of Address Checklist For The Uk And Who To Notify When Moving

United Kingdom Oldham Council Tax Bill Template In Word Format Bill Template Templates Word Template

United Kingdom Oldham Council Tax Bill Template In Word Format Bill Template Templates Word Template

Naming Ceremony Flyer Naming Ceremony Step Kids Adopting A Child

Naming Ceremony Flyer Naming Ceremony Step Kids Adopting A Child

How To Find Your Council Tax Account Number Chelmsford City Council

How To Find Your Council Tax Account Number Chelmsford City Council

Https Www Huntingdonshire Gov Uk Media 1300 Your Council Tax Support Letters Explained Pdf

Local Government Funding In England The Institute For Government

Local Government Funding In England The Institute For Government

![]() Where You Can Find Your Council Tax Account Number Islington Council

Where You Can Find Your Council Tax Account Number Islington Council

![]() Important Benefits For Intelligent Single People Cashlady Blog

Important Benefits For Intelligent Single People Cashlady Blog

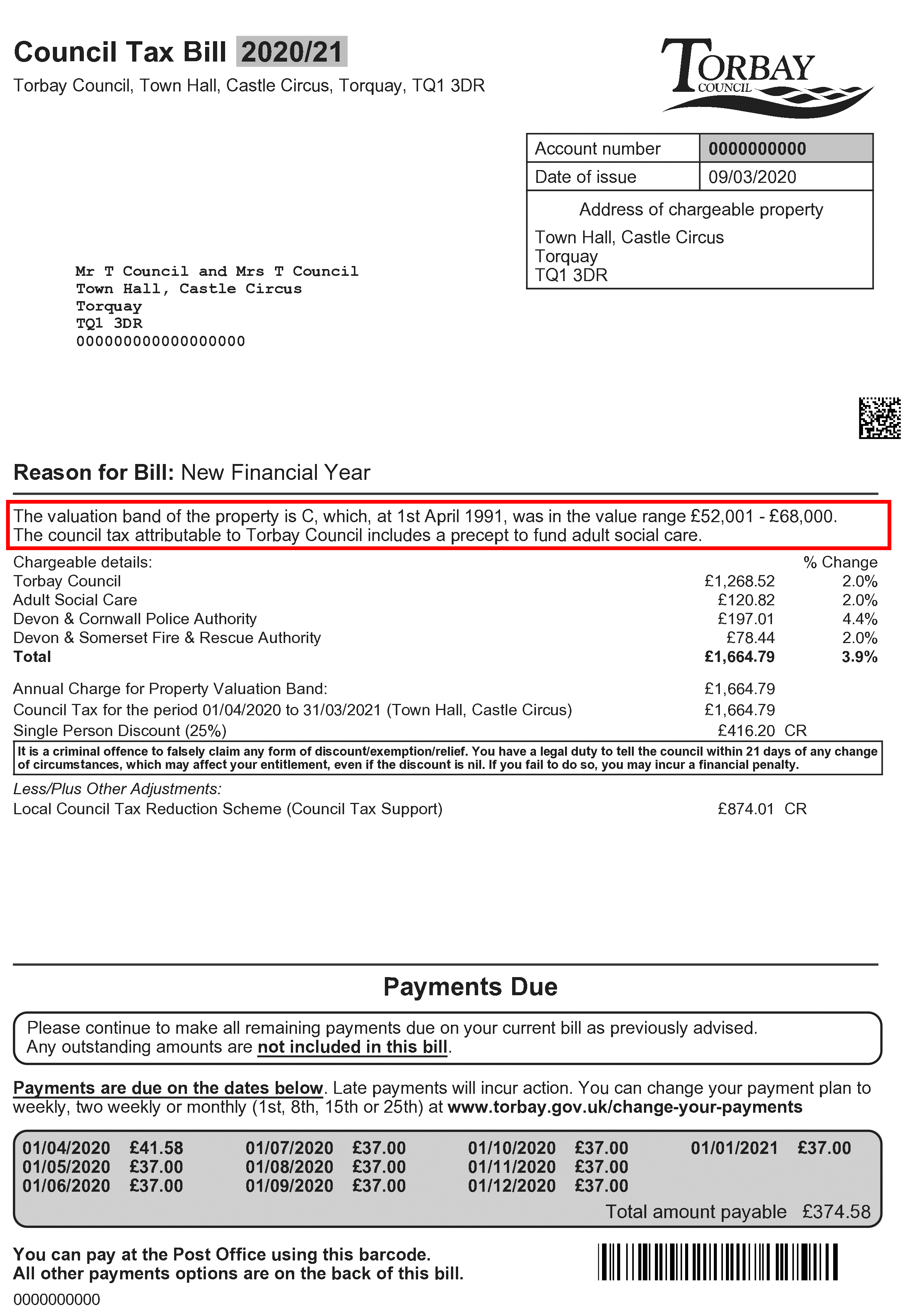

Your Bill Explained Torbay Council

Your Bill Explained Torbay Council

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home