Can You File For Homestead Exemption Online In Florida

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. When you file for homestead exemption you must provide a copy of your recorded property Deed.

Have You Filed For Your Florida Homestead Exemption Yet Stern Realty Team Blog

Have You Filed For Your Florida Homestead Exemption Yet Stern Realty Team Blog

Every Florida resident who has legal or beneficial title in equity to real property in the State of Florida who resides on said real property and in good faith makes the same his or her permanent residence on or before January 1st of the year application is made shall be entitled to the 25000 Homestead Exemption.

Can you file for homestead exemption online in florida. Further benefits are available to property owners with disabilities senior citizens veterans and active duty military service. When you purchase a home and want to qualify for an exemption you may file online or in person at one of our offices. Complete the form online and select the states e-file option.

The State of Florida allows a property tax exemption of 50000 for a home. My office is pleased to provide this service to new homeowners in Palm Beach County. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.

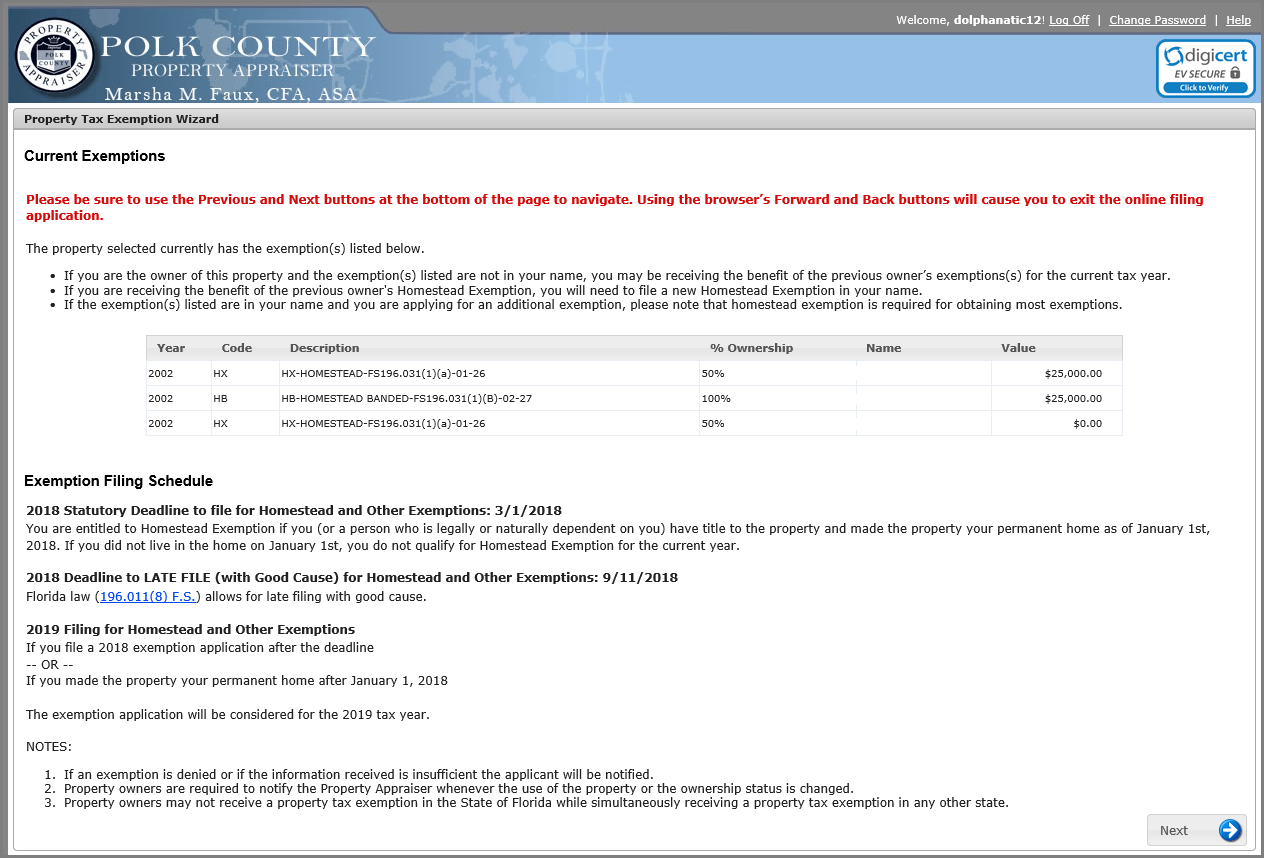

If you are filing for the first time be prepared to. Under Florida law e-mail addresses are public records. Homestead Exemption can provide significant property tax savings and this interactive system will walk you through the qualifications and application process.

Page and on most property appraisers websites. Instead contact this office by phone or in writing. You may file anytime during the year but before the states deadline of March 1 for the tax year in which you wish to qualify.

Forsyth Street Suite 260 Jacksonville Florida 32202. Homestead Property Tax Exemption. Property owners who owned their property and made it their permanent residence as of January 1 2020 may file for 2020 homestead and all other exemptions by September 18 2020.

This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st. This exemption is allowed only on your primary residence. Homestead Exemption in Florida.

Welcome to the Sarasota County Property Appraisers online homestead exemption application. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference Portability can file online.

A bankruptcy judge in the Middle District of Florida recently sustained a Chapter 7 trustees objection to a non-Florida resident debtors attempted claim of the Florida homestead exemptionAlthough the debtor had lived in her Florida home for more than 20 years she was not a United States citizen or a permanent resident with a so-called green card. To qualify for the Florida homestead exemption on your 2019 taxes you must have filed this paperwork by March 1 2019. You can file for homestead exemption from January 1 to March 1 at the Bay County Property Appraisers Office located at 860 W.

The exemption results in approximately a 500 - 1000 property tax savings to Florida residents. Learning about this exemption is a great way to ensure that you are taking full advantage of this tax-saving benefit in the State of Florida. When you apply for the homestead exemption you can also apply for other personal exemptions such as widows widowers blind disability and service connected disability.

The exemption can cut a propertys value by up to 50000 which means lower tax bills. Welcome to Homestead Exemption online filing. If you would like to file in person our office address is 231 E.

Other personal exemptions such as widows. You have three options for completing and submitting it. The absolute deadline to LATE FILE for any 2022 exemption -- if you miss the March 1 timely filing deadline -- is September 19 2022.

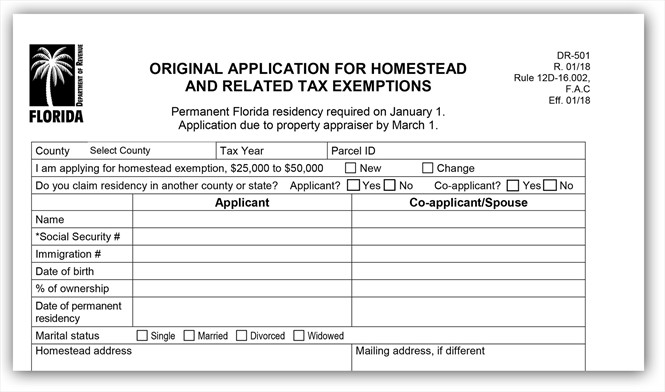

Every year thousands of homeowners use Floridas homestead exemption to help them save money on property taxes. The application for homestead exemption Form DR-501 and other exemption forms are on the Departments forms. Stat does not allow late filing for exemptions after this date regardless of.

The timely filing period for Homestead Exemption for 2022 is March 2 2021 through March 1 2022. In order to file online the property you wish to file on must reflect ownership in your name. Click here for county property appraiser contact and website information.

The form you have to complete is DR-501. The following applications may also be filed on-line with the homestead exemption application. Additional Homestead Exemption up to 25000 -.

Florida Homestead Exemption Chrisluis Com

Florida Homestead Exemption Chrisluis Com

Florida Homestead Exemptions Emerald Coast Title Services

Florida Homestead Exemptions Emerald Coast Title Services

Don T Forgot To Apply For Your Homestead Exemption In Florida

Don T Forgot To Apply For Your Homestead Exemption In Florida

Can Foreign Non Resident Investors Claim Florida Homestead Exemption Epgd Business Law

Can Foreign Non Resident Investors Claim Florida Homestead Exemption Epgd Business Law

What Is The Florida Homestead Exemption

What Is The Florida Homestead Exemption

Florida Property Taxes Your Guide To Filing For Homestead Exemption

Florida Property Taxes Your Guide To Filing For Homestead Exemption

Homestead Exemption For Duval County Florida

Homestead Exemption For Duval County Florida

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

How Do I Register For Florida Homestead Tax Exemption

How Do I Register For Florida Homestead Tax Exemption

The Fund 2019 Florida Homestead Exemption Download

How To File For The Homestead Tax Exemption Property Tax Tallahassee

How To File For The Homestead Tax Exemption Property Tax Tallahassee

Florida Homestead Tax Exemption

Florida Homestead Tax Exemption

How To File For Florida Homestead Exemption Tampa Bay Title

How To File For Florida Homestead Exemption Tampa Bay Title

File For Homestead Exemption In Alachua County Fl

File For Homestead Exemption In Alachua County Fl

Https Www Ocpafl Org Content Dynamic File Dynamic Fid 400696

The Fund 2019 Florida Homestead Exemption Download

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home