How To File For Homestead Exemption In Florida Polk County

Polk County Property Appraiser Request to Block Information from Public Records. Qualify for and receive Homestead Exemption.

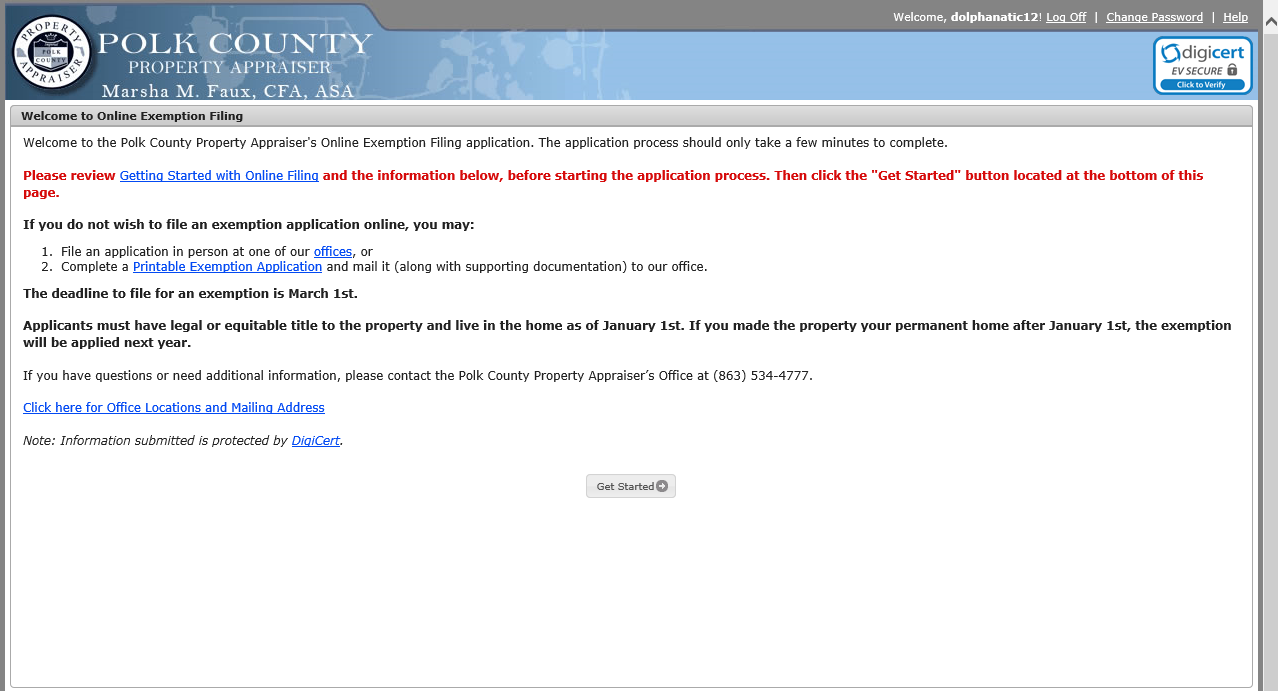

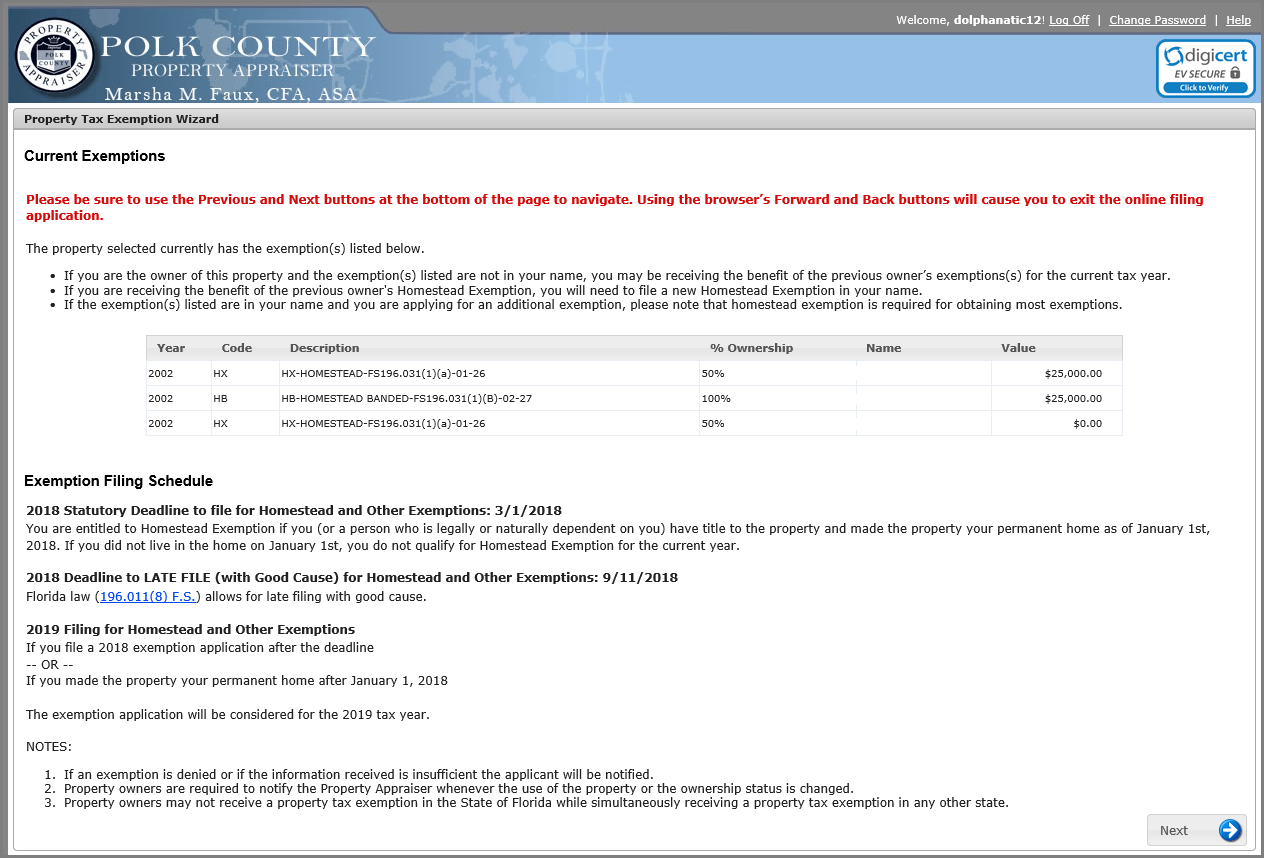

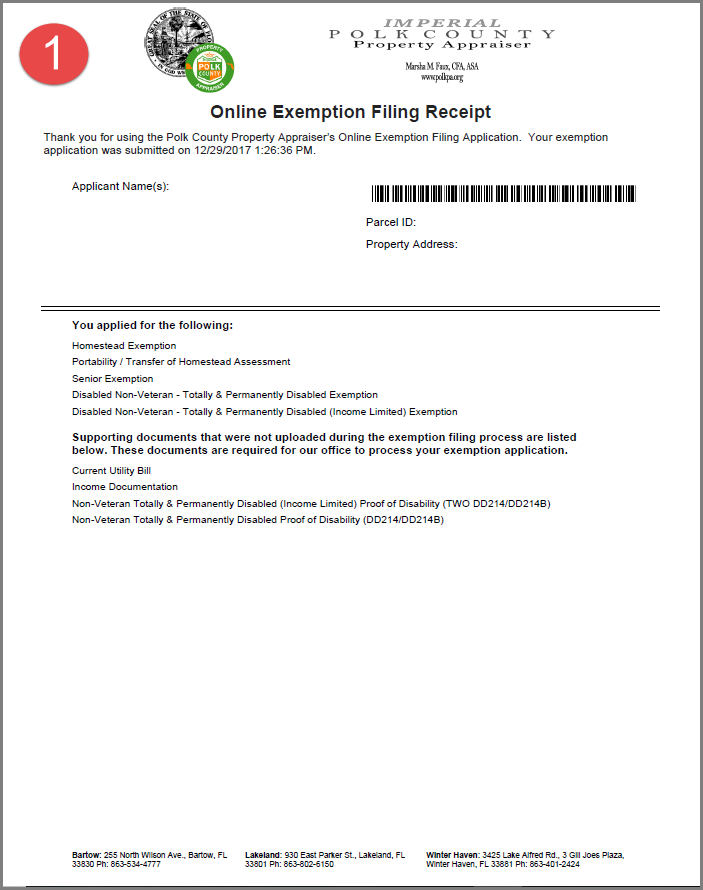

Filing An Exemption Application Online

Filing An Exemption Application Online

If you would like to file in person our office address is 231 E.

How to file for homestead exemption in florida polk county. The annual household income limitation is adjusted gross income as defined by s. The additional exemption up to 25000 applies to. Please provide a copy of the title or registration.

IRS tax return showing the dependent status of the children as well as birth certificate and other documents listed below. Broward County Property Appraiser - Marty Kiar. See Senate Bill 248 which takes effect on July 1 2019 for additional information.

62 United States Internal Revenue Code. Result of military service. 1- Florida Driver License or Florida ID card with your new address on it 2- Florida Vehicle Registration.

Visit one of our convenient office locations. You may also apply in person or by mail fax email. Exemption carries over if property was held as an estate by the entirety UNTIL spouse remarries.

The first 25000 applies to all property taxes including school district taxes. The application for homestead exemption Form DR-501 and other exemption forms are on the Departments forms. Mail or email the completed application for Homestead Exemption Form DR-501 along with supporting documentation to the Property Appraisers Office.

Non-citizens may apply on behalf of their children who are citizens. For local information contact your county property appraiser. This exemption is based on income received in the prior year.

Applicants may file for homestead exemption on a mobile home if they own the land also. Homestead Property Tax Exemption. Click here for county property appraiser contact and website.

The residence must also receive homestead exemption. The applicant must have documented evidence ie. Additional Low-Income Senior Exemption.

Contact your local property appraiser if you have questions about your exemption. Submit all applications and documentation to the property appraiser in the county where the property is located. If the property appraiser denies your application you may file a petition with the countys value adjustment board.

Forsyth Street Suite 260 Jacksonville Florida 32202. The property appraiser has a duty to put a tax lien on your property if you received a homestead exemption. Applicants must have legal or equitable title to the property on January 1st.

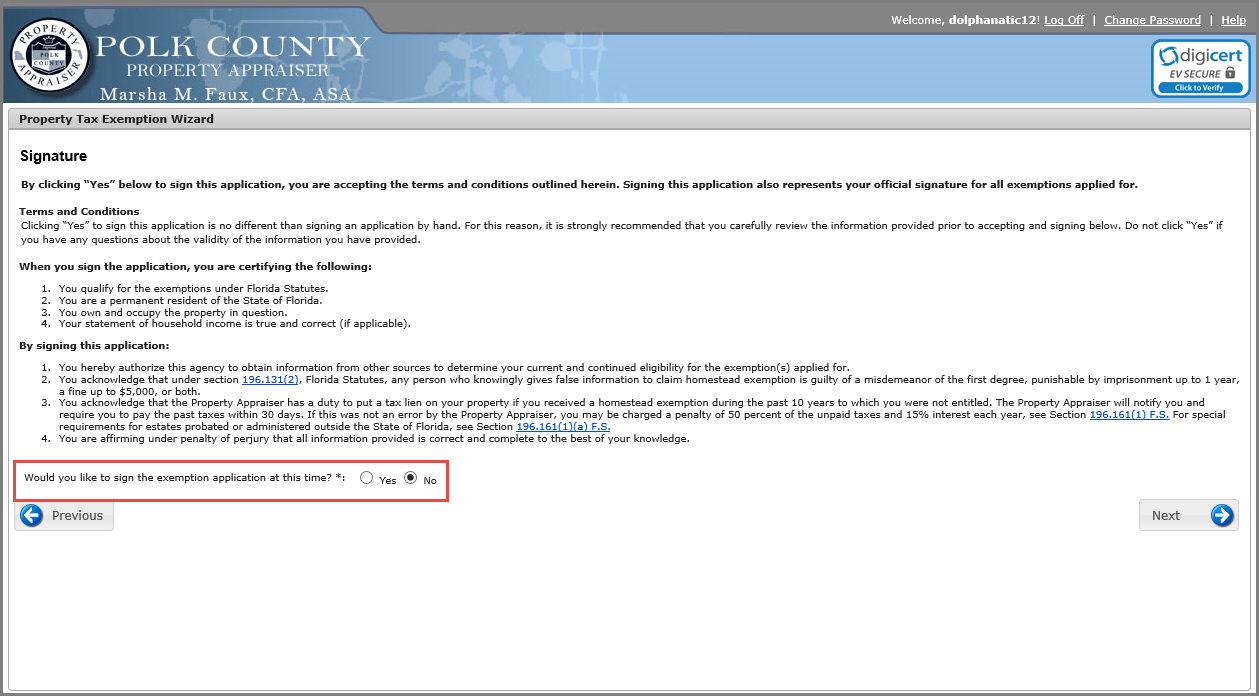

Apply using the Online Exemption Filing Application. Applicants must reside on the property and live in the home as of January 1st. In order to apply for homestead for the first time an owner must have moved into the home prior to January 1 and it must be considered your primary residence.

In order to qualify for the homestead exemption the property must be the permanent residence of the children. Applicant must have legal or equitable title to the property as of January 1st. 2 have been discharged under honorable conditions.

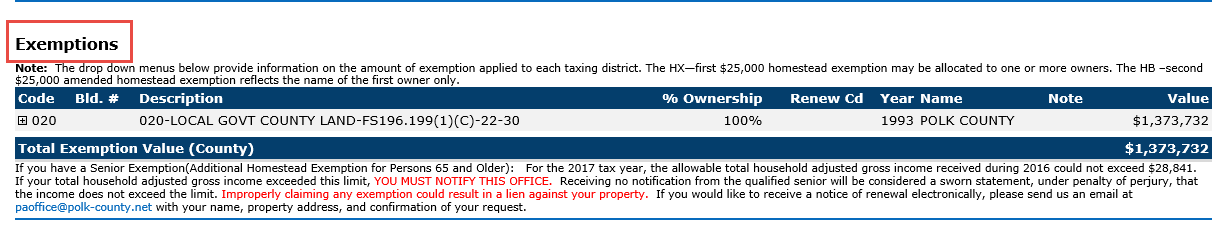

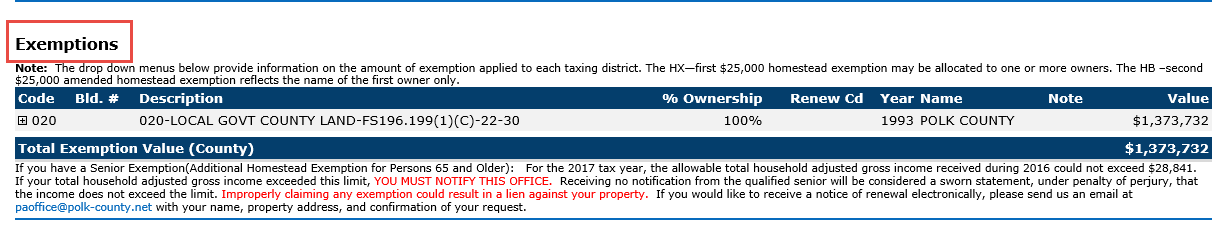

Applicant must be 65 years of age or older as of January 1 even if other household members are under age 65 have the Homestead Exemption on the property and the total household adjusted gross income for last year 2020 must not exceed 31100. You should complete and file all required forms and applications for these exemptions with your county property appraiser. We will renew your homestead exemption annually as long as you continue to qualify for the exemption.

HOMESTEAD EXEMPTION REQUIRED DOCUMENTS All applicants must submit a completed DR-501 with no less than four 4 forms of identification as listed below for each applicant. Visit one of our five service centers to file in person. Filing period is January 1 through March 1 of each year.

Polk County Voters Registration card. Other personal exemptions such as widows. Same as 001-Veteran Total Disability see above SURVIVING SPOUSE.

There are three easy ways to apply for a property tax exemption. With the completed homestead application an owner must provide the following. In addition the Polk County Property Appraiser mapping site has been modified to accommodate the statutory change.

3 be confined to a wheelchair as a. Use the Online Exemption Filing Application. Page and on most property appraisers websites.

All homestead exemption applications must be submitted by March 1. At least one owner is 65 years of age or older on January 1. Property owner and spouse if married must also occupy the home and consider it their primary residence as of January 1st.

Exemptions you may Apply for Online. Petitions to the Value Adjustment Board. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer.

File the signed application for exemption with the county property appraiser. 3Mail email or USPS. Every person who owns and resides on real property in Florida on January 1st and makes the property his or her permanent residence is eligible to receive a Homestead Exemption up to 50000.

If you are looking for how to file for homestead exemption in Polk County keep reading. Signature property appraiser or deputy Date Entered by Date. The following applications may also be filed on-line with the homestead exemption application.

For more information see. Social Security CardNumber REQUIRED By law the social security number of the applicant and the applicants spouse must be. Ways to Apply for an Exemption.

To request an exemption from public records click the links below. Do I need to reapply for a homestead exemption every year.

Filing An Exemption Application Online

Filing An Exemption Application Online

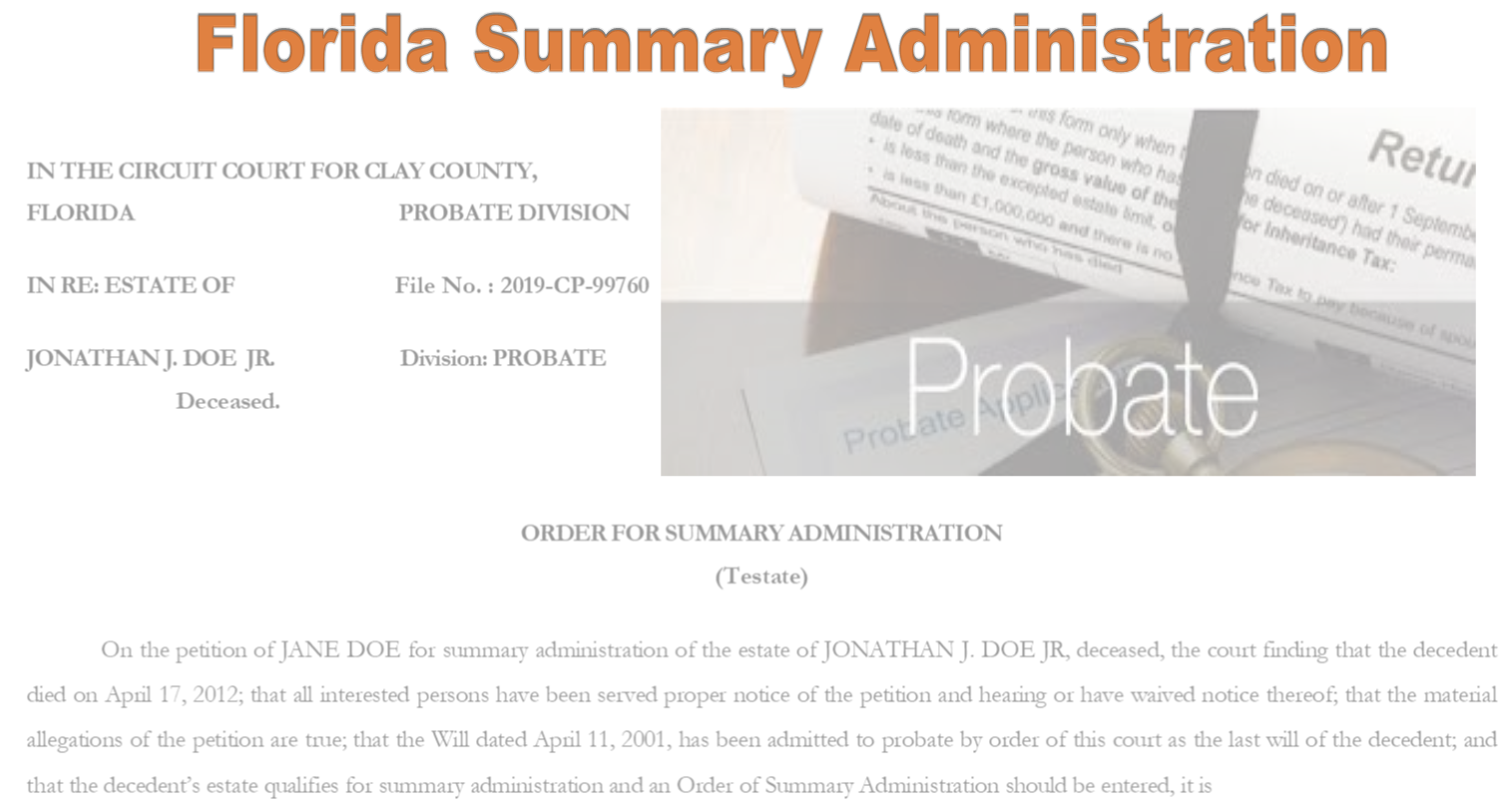

Petition To Determine Exempt Property Probate Petition Circuit Court

Petition To Determine Exempt Property Probate Petition Circuit Court

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

Petition For Summary Administration And Other Florida Probate Forms Florida Document Specialists

Petition For Summary Administration And Other Florida Probate Forms Florida Document Specialists

Http Images Kw Com Docs 0 7 7 077943 16957 Pdf

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

What Is The Florida Homestead Exemption

What Is The Florida Homestead Exemption

Order Determining Homestead Probate Status The Heirs

Order Determining Homestead Probate Status The Heirs

Filing An Exemption Application Online

Filing An Exemption Application Online

Polk County Homestead Haven Realty Investments

How To File For The Homestead Tax Exemption Property Tax Tallahassee

How To File For The Homestead Tax Exemption Property Tax Tallahassee

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

How To File For Florida Homestead Exemption Tampa Bay Title

How To File For Florida Homestead Exemption Tampa Bay Title

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

Http Www Polkpa Org Downloads Files Exemptions Pdf

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home