How Do I File For Homestead Exemption In Galveston County

Visit your local county office to apply for a homestead exemption. This exemption is available to those homeowners who are 65 years of age or older.

Homestead Exemption What You Need To Know The Loken Group

Homestead Exemption What You Need To Know The Loken Group

Call the Property Tax Department 409 766-2481 for additional information.

How do i file for homestead exemption in galveston county. Miscellaneous Exemption Application. Download the Galveston County Homestead Exemption Form. Filing in Galveston County.

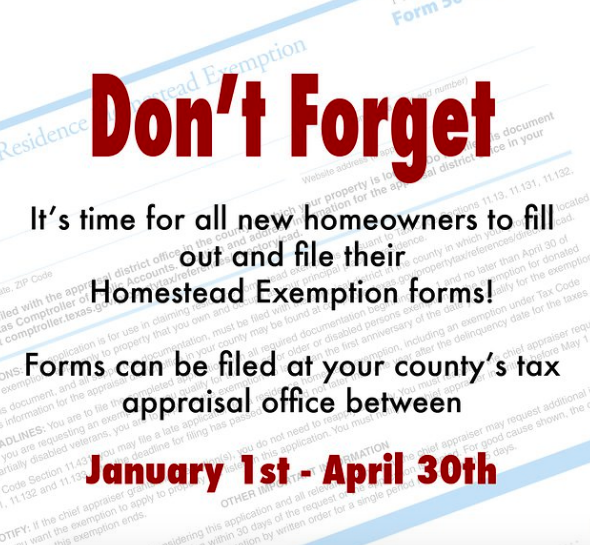

You may qualify for this exemption if for the current year and if filing a late application for the year for which you are seeking an exemption. This can be a savings of 87 to134 depending on which area of the county you are located. The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30.

Private School Exemption Application. Occupy the property as your primary residence in the year in which you apply. The general deadline for filing an exemption application is before May 1.

Cemetery Exemption Application. The deadline to file is March 1 2022. We are currently accepting timely 2022 exemption applications.

Exemption Application for Chambers of Commerce. Filing in Harris County. Here is a video we did on how to properly fill out the Texas Homestead Exemption For for 2019.

R equest to REMOVE Homestead Exemption. Appraisal district chief appraisers are responsible for determining whether or not property qualifies for an exemption. Youth Development Organization Exemption Application.

Homestead Exemption is an exemption of 1000 off the assessed valuation. Once you receive the exemption you do not need to reapply unless the chief appraiser sends you a new application. If you do not have Adobe Acrobat Reader software on your computer you may download a free copy below.

View 2013 Homestead Exemption Act memorandum. Do not file this form with the Texas Comptroller of Public Accounts. Download the Fort Bend County Homestead Exemption Form.

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located Tax Code Sections 1113 11131 11132 11133 11134 and 11432. Applications for property tax exemptions are filed with appraisal districts. For the 25000 general homestead exemption you may submit an Application for Residential Homestead Exemption PDF and supporting documentation with the appraisal district where the property is located.

In order to qualify for this exemption the home must be your p. Homestead Exemption Affidavit. If you move in any time after that date you will not qualify until next January.

You can only qualify for a homestead exemption if you own and live in your home on January 1 of that tax year. 2 you occupied it as your principal residence on January 1. Homestead Exemption Online Submission.

Complete the application process Own the property in the year in which you apply. Download Homestead Exemption Application The above Collin County appraisal district form is in Adobe Acrobat PDF format. We are pleased to offer you the convenience of filing by mail for your Homestead exemption.

Click on the large red button and pay online via electronic check debit or credit card fees apply. Contact the county appraisal district to get the exemption added to the property. Application for Exemption of Goods Exported from Texas Freeport Exemption.

Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system cities and Fulton County. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Payment Methods Options.

You have several methods of paying property taxes in Galveston County. In order to qualify for this exemption the property owner needs to meet the following requirements. Application for Theater School Tax Exemption.

A Texas homeowner may file a late county appraisal district homestead exemption application if they file no. Galveston County Appraisal District Information. And 3 you and your spouse do not claim a residence homestead exemption on any other property.

How to file for the Homestead Exemption A qualified Texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. To Qualify You must be the homeowner who resides in the property on January 1. View the 2020 Homestead Exemption Guide Once granted exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership.

The deed must be executed on or before January 1 and filed with the County Clerks Office on or before February 1. 1 you owned this property on January 1. Harris County residents can now file Homestead Exemption through a mobile app for iPhone and Android.

To make application for Homestead exemption you must own and occupy your home prior to January 1st of the year in which are eligible to apply. Residence Homestead Section 1113.

Top Things To Do In The Woodlands With Kids Mommypoppins Things To Do In New York City With Kids Woodlands The Woodlands Texas Texas Vacations

Top Things To Do In The Woodlands With Kids Mommypoppins Things To Do In New York City With Kids Woodlands The Woodlands Texas Texas Vacations

Photo By Heather Picmonkey Photo Editing Made Of Win Mansions New Homes Enjoyment

Photo By Heather Picmonkey Photo Editing Made Of Win Mansions New Homes Enjoyment

21 Words You Don T Actually Understand Unless You Re From Houston Visit Houston American Cities City

21 Words You Don T Actually Understand Unless You Re From Houston Visit Houston American Cities City

Grimaldi S The Woodlands Texas Restaurants In The Woodlands Woodlands

Grimaldi S The Woodlands Texas Restaurants In The Woodlands Woodlands

Best Places To Live In The Woodlands Texas Best Places To Live The Woodlands Texas Woodlands

Best Places To Live In The Woodlands Texas Best Places To Live The Woodlands Texas Woodlands

Google Realty How To Find Out House Styles

Google Realty How To Find Out House Styles

Demographics In The Woodlands Changing The Woodlands Tx Real Estate News Woodlands New Homes The Woodlands Texas The Woodlands Tx Woodland

Demographics In The Woodlands Changing The Woodlands Tx Real Estate News Woodlands New Homes The Woodlands Texas The Woodlands Tx Woodland

Website For Galveston County Property Tax Trends

Website For Galveston County Property Tax Trends

Homestead Exemption What You Need To Know The Loken Group

Homestead Exemption What You Need To Know The Loken Group

How To File Homestead Exemption Application In Texas Tcp Real Estate

How To File Homestead Exemption Application In Texas Tcp Real Estate

What Is Homestead Exemption Find Houston Homes

What Is Homestead Exemption Find Houston Homes

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

What Is A Homestead Exemption Homesteading House Styles Mansions

What Is A Homestead Exemption Homesteading House Styles Mansions

Yucatan Taco Stand Tequila Bar Grill Potential Hot Spot In The Woodlands Taco Stand Bar Grill Tequila Bar

Yucatan Taco Stand Tequila Bar Grill Potential Hot Spot In The Woodlands Taco Stand Bar Grill Tequila Bar

Map Search Properties In The Woodlands Lake Conroe Spring Tx Woodlands The Woodlands Tx The Woodlands Texas

Map Search Properties In The Woodlands Lake Conroe Spring Tx Woodlands The Woodlands Tx The Woodlands Texas

Filing For A Homestead Exemption Time Sensitive

Filing For A Homestead Exemption Time Sensitive

Just Sold In Houston Tx Houston Houston Tx Lake City

Just Sold In Houston Tx Houston Houston Tx Lake City

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home