Property Lines Map Chesapeake Va

NorthingEasting in VA State Plane EastingX 1181033703. The property maps represented on this site are compiled from information maintained by your local county Assessors office and are a best-fit visualization of how all the properties in a county relate to one another.

Perform a free Virginia public GIS maps search including geographic information systems GIS services and GIS databases.

Property lines map chesapeake va. The AcreValue Chesapeake County VA plat map sourced from the Chesapeake County VA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. Under Virginia State Law these records are public information.

The Virginia GIS Maps Search links below open in a new window and take you to third party websites that provide access to VA public records. Property lines or boundaries is for general information only and shall. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Property lines approximate This map was created by a user. AcreValue provides an online parcel viewer delineating parcel boundaries with up-to-date land ownership information sourced from county assessors. Learn how to create your own.

The AcreValue Virginia Beach County VA plat map sourced from the Virginia Beach County VA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Designed for easy access to property information within the City of Chesapeake. Click to add multiple points defining a line on the map.

The ability to search by address will be added soon With the new map users will be able to print their own maps. Current location of the property lines and the proposed adjustments shown. Chesapeake County maps are available in a variety of printed and digital formats.

In accordance with Section 152-22721 of the Code of Virginia. Search by address or Tax ID number for property details using the Address Search box or the Magnifier button on the toolbar. This parcel viewer can be used to search for property by account number tax number or property owner.

BEFORE ACCESSING ASSESSMENT INFORMATION. Plat maps with property lines are available on AcreValue in 44795971 counties. If you believe any data provided is inaccurate or if you have any comments about.

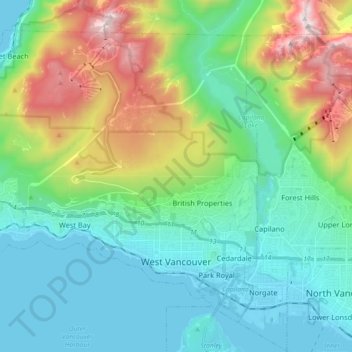

Rockford Map provides highly accurate Chesapeake County parcel map data containing land ownership property line info parcel boundaries and acreage information along with related geographic features including latitudelongitude government jurisdictions school districts roads waterways public lands and aerial map imagery. Virginia like many other states has enacted laws addressing these issues. They are a valuable tool for the real estate industry offering both buyers.

Display of this information on the Internet is specifically authorized by the Code of Virginia 581-31222 1998 c. Lot Line Vacations require the subject properties be deeded in the. Within the map view the property lines for each parcel in addition to the parcel number acreage and owner name.

Virginia has extensive statutes addressing boundary fences also known as partition or division fences which exist along a property line. The division also provides products and services. West Virginia Property Viewer.

Read on to learn more about fence and property line laws in Virginia. Search for Virginia plat maps. The property lines are determined by examining detailed property descriptions on deeds and by using surveys created by a.

Link to the Real Estate Assessment application. We are pleased to introduce Suffolks new parcel viewer website. This property is subject to the Caroline County Chesapeake Bay Preservation Area Overlay District.

It is tasked with developing maintaining coordinating and distributing GIS data and technology to Fairfax County government agencies and residents. Virginia Property Line and Fence Laws. Search Layers Basemap Tools Clear Help Imagery.

GIS Mapping Services is a division within Fairfax Countys Department of Information Technology. Editors frequently monitor and verify these resources on a routine basis. Find City facilities like parks and schools using the Place Name Finder in the drop-down list of the Address Search box.

MunicodeNEXT the industrys leading search application with over 3300 codes and growing. Virginia law specifies. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books.

Plat maps include information on property lines lots plot boundaries streets flood zones public access parcel numbers lot dimensions and easements. The line thickness color and transparency values can be altered using the controls in the Drawing Tool Settings Dialog. City of Suffolk Parcel Viewer.

They are maintained by various government offices in Chesapeake Virginia State and at the Federal level.

Read more »Labels: chesapeake, property