How Much Is Personal Property Tax In West Virginia

The median property tax on a 9450000 house is 46305 in West Virginia. Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a.

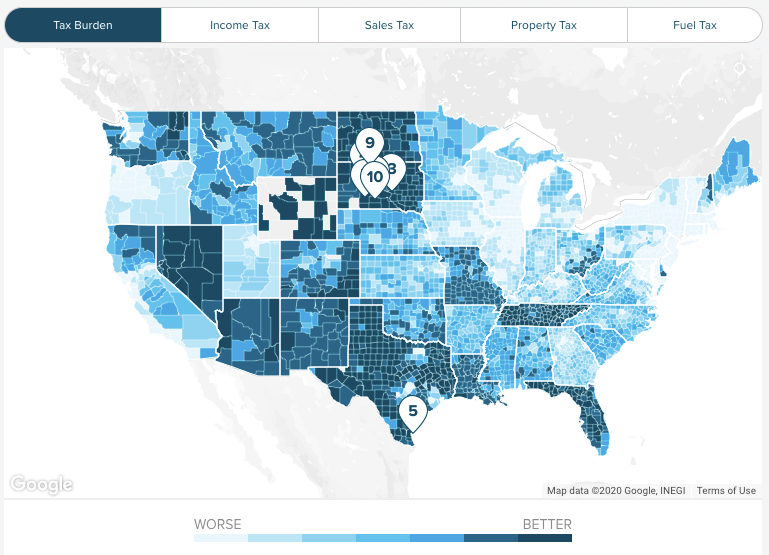

Below we have highlighted a number of tax rates ranks and measures detailing West Virginias income tax business tax sales tax and property tax systems.

How much is personal property tax in west virginia. Virginia is ranked number twenty one out of the fifty states in order of the average amount of property taxes collected. 1430 2860 5720 5720. Pay Personal Property Taxes Online.

Hampshire Hancock Hardy Harrison Jackson Jefferson. The price of items purchased through this service include funds to develop maintain and enhance the states official web. This online service is provided by a third party working in partnership with the state of West Virginia.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. It collects a median of 244 from home owners for a home worth a median of 32800. Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year.

Sales Taxes will be increased as much as 31-percent. This is the largest tax increase in the history of West Virginia. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000.

If you have questions about personal property tax or real estate tax contact your local tax office. Click the tabs below to explore. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

The median property tax on a. The yearly property tax amounts to about 74 percent of a propertys value. The average effective property tax rate here is 057.

McDowell County has one of the lowest tax rates not only in West Virginia but in the country. The regular rates of levy may not exceed the following amounts. The first step towards understanding West Virginias tax code is knowing the basics.

The median property tax in West Virginia is 46400 per year for a home worth the median value of 9450000. Personal property tax is assessed by the County Assessor and collected by the County Sheriff. WV code sections 11-8-6b c and d dictate the division for counties cities.

Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle. Contact the nearest county courthouse if questions arise concerning this tax or click here for links to all counties that currently have online tax. Its average effective property tax rate of 057 is the ninth-lowest state rate in the US as comes in at about half of the national average.

How does West Virginia rank. Barbour Berkeley Boone Braxton Brooke Cabell Calhoun Clay Doddridge Fayette Gilmer Grant Greenbrier. The state is set by the West Virginia Constitution at 50 cents for class I 1 on class II and 2 on class 3 and 4.

Tax rates differ depending on where you live. West Virginia has some of the lowest property tax rates in the country. Page Content Please input the value of the vehicle the number of months that you owned it during the tax year and click the Calculate button to compute the tax.

The Tax Commissioner must issue a ruling by the end of February of the calendar tax year. 025 050 100 100. Tax amount varies by county.

WV will have the highest consumer sales tax in the nation at the rate of 79 then add the 1 municipal tax Higher than California New York and surrounding states. However since West Virginias average home values are also relatively low the states property tax rates rank slightly higher. The Tax Commissioner must issue a ruling by the end of February of the calendar tax year.

Counties in West Virginia collect an average of 049 of a propertys assesed fair market value as property tax per year. Proof of payment of the tax or an affidavit from the Assessor is required before license plate renewal. Maximum Property Tax Regular Levy Rates.

Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. Out of state customers may dial 304-558-3900. Personal Property Tax Links.

West Virginia Code For more information please call 1-800-642-9066 West Virginia residents only. Rates are given in cents per 10000 Taxing Authority Class I Class II Class III Class IV.

West Virginia Property Tax Calculator Smartasset

West Virginia Property Tax Calculator Smartasset

West Virginia Cigarette Tax And Vaping Tax Increases Tax Foundation

West Virginia Cigarette Tax And Vaping Tax Increases Tax Foundation

West Virginia Income Tax Calculator Smartasset

West Virginia Income Tax Calculator Smartasset

Chart 2 New York Tax Burden By Type Of Tax Fy 1950 To 2015 Jpg Types Of Taxes Burden Tax

Chart 2 New York Tax Burden By Type Of Tax Fy 1950 To 2015 Jpg Types Of Taxes Burden Tax

West Virginia Property Tax Calculator Smartasset

West Virginia Property Tax Calculator Smartasset

Chart 1 New Hampshire State And Local Tax Burden Fy 2015 Jpg Tax South Dakota Burden

Chart 1 New Hampshire State And Local Tax Burden Fy 2015 Jpg Tax South Dakota Burden

Property Site For Lots 8 9 Bowden Estates Drive Maxwelton Wv 24957 Lewisburg Clifton Gps Coordinates

Property Site For Lots 8 9 Bowden Estates Drive Maxwelton Wv 24957 Lewisburg Clifton Gps Coordinates

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Property Taxes In America Property Tax Business Tax Tax

Property Taxes In America Property Tax Business Tax Tax

Pin By Nyoka Sanders On Family Genealogy Family Genealogy Genealogy West Virginia

Pin By Nyoka Sanders On Family Genealogy Family Genealogy Genealogy West Virginia

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map 30 Year Mortgage Northern California

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map 30 Year Mortgage Northern California

Property Taxes By State Property Tax Property States

Property Taxes By State Property Tax Property States

Pin On Kermit The Frog Noneofmybusiness

Pin On Kermit The Frog Noneofmybusiness

Chart 2 Mississippi State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Mississippi

Chart 2 Mississippi State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Tax Mississippi

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms Virginia State Tax

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms Virginia State Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home