Property Tax Franklin County Va

Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. VA Department of Motor Vehicles.

Residents Virginia S Mountain Playground

Residents Virginia S Mountain Playground

Website information is up to date as of 5PM of the previous business day.

Property tax franklin county va. Your payment will be considered accepted and paid on the submitted date. Delinquent Taxes for Franklin County VA. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

PAY TAXES ONLINE To pay your taxes by credit card or eCheck click the button below. 19858 Total Number of Records. If you have any questions contact or visit us today.

Public Service Real Property - 013100 of assessed value. Search through the names below by clicking the page numbers across the bottom. Type in the full name or a part of the full name into the Name box.

The median property tax in Franklin County Virginia is 73300 All of the Franklin County information on this page has been verified and checked for accuracy. Franklin Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Franklin Virginia. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues.

Franklin County collects on average 047 of a propertys assessed fair market value as property tax. If you have any issues or questions contact Customer. Type of Property Tax Rate per 100.

Tax Amount Due. Pursuant to Article X Section 6-A of the Constitution of Virginia the General Assembly exempted from taxation the real property including the joint real property of husband and wife of any Veteran who has been approved by the US. Certain Tax Records are considered public record which means they are available to the public.

Machinery Tool Tax - 017100 of assessed value based on original cost and declining depreciation over a seven 7 year period until the effective rate at year seven 7 is 007100 assessed. Save your search results. Yearly median tax in Franklin County The median property tax in Franklin County Virginia is 733 per year for a home worth the median value of 156100.

Or enter a name or partial name in the box above and click GO. Please reference our Franklin County OLP Portal User Guide. Effective January 1 2011 a new law was imposed by the Commonwealth of Virginia allowing a 100 real estate tax exemption for qualifying disabled armed forces veterans and their spouses.

The Code of Virginia Section 5813503 provides for the types of property assessed and the methods of. The Franklin County Treasurers Office makes every effort to produce and publish the most accurate information possible. The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance for which you may be entitled.

Public Service Personal Property - 051100 of assessed value. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000. Tax Records include property tax assessments property appraisals and income tax records.

Taxpayer Name Real EstatePerProp. Personal Property Tax - 051100 of assessed value. The Commissioner of the Revenues Office is responsible for the administration of local taxes prescribed by t he Code of Virginia and Local Ordinances.

We are here to serve Franklins Citizens. However it may take 2-4 business days for processing. Real Property tax- 013100 of assessed value.

Use the as a wild card to match any string of characters for example. However this material may be slightly dated which would have an impact on its accuracy. Effective July 1 2019.

PAY TAXES ONLINE. Susan Wray Franklin County Treasurer 1255 Franklin Street Suite 101 Rocky Mount VA 24151. The Commissioner of the Revenue is responsible for the assessment of all tangible personal property ie vehicles trailers watercrafts aircrafts recreational vehicles mobile homes business personal property machinery and tools and farm equipment with taxable status in Franklin County.

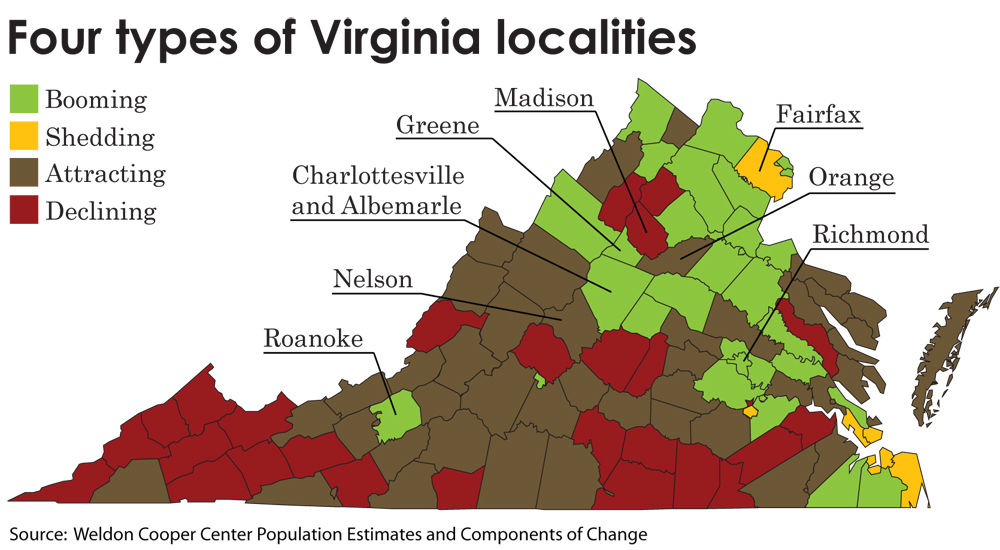

Opinion Commentary Virginia Population Growing Overall But Shifts Are Prominent Opinion Dailyprogress Com

Opinion Commentary Virginia Population Growing Overall But Shifts Are Prominent Opinion Dailyprogress Com

Bath County Virginia Genealogy Familysearch

Mecklenburg County Virginia Genealogy Familysearch

Mecklenburg County Virginia Genealogy Familysearch

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Franklin County Virginia Map 1911 Rand Mcnally Rocky Mount Neva Gogginsville Taylors Store Stanopher Redwood S Franklin County Virginia Map Virginia

Settlement Map Nw Franklin County Va 1786 1886 Made For Franklin Co Historical Society Virginia Is For Lovers Genealogy Map Franklin County

Settlement Map Nw Franklin County Va 1786 1886 Made For Franklin Co Historical Society Virginia Is For Lovers Genealogy Map Franklin County

Lee County Virginia Genealogy Familysearch

Lee County Virginia Genealogy Familysearch

Carter House Ferrum Franklin County Virginia Appalachian Mountains Appalachia Virginia History Appalachian Mountains

Carter House Ferrum Franklin County Virginia Appalachian Mountains Appalachia Virginia History Appalachian Mountains

Bath County Virginia Genealogy Familysearch

Bath County Virginia Genealogy Familysearch

How Healthy Is Franklin County Virginia Us News Healthiest Communities

How Healthy Is Franklin County Virginia Us News Healthiest Communities

Westmoreland County Virginia Familypedia Fandom

Westmoreland County Virginia Familypedia Fandom

Old Blackwater School Lee County Virginia Old Country Churches Old Churches Country Church

Old Blackwater School Lee County Virginia Old Country Churches Old Churches Country Church

Welcome To Southampton County Va

Welcome To Southampton County Va

Franklin County Va For Sale By Owner Fsbo 19 Homes Zillow

Franklin County Va For Sale By Owner Fsbo 19 Homes Zillow

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home