Property Plant And Equipment Meaning In Accounting

Kaya asahan ang kaunting. Included are land buildings leasehold improvements equipment furniture fixtures delivery trucks automobiles etc.

Plant Assets What Are They And How Do You Manage Them The Blueprint

Plant Assets What Are They And How Do You Manage Them The Blueprint

Property plant and equipment PPE are the long-term tangible assets that a company owns.

Property plant and equipment meaning in accounting. Hindi review kundi first view. Items of property plant and equipment should be recognised as assets when it is probable that. If a company spent 100000 on a new piece of equipment one year for example its financial statements for that year wouldnt show the full 100000 as an expense.

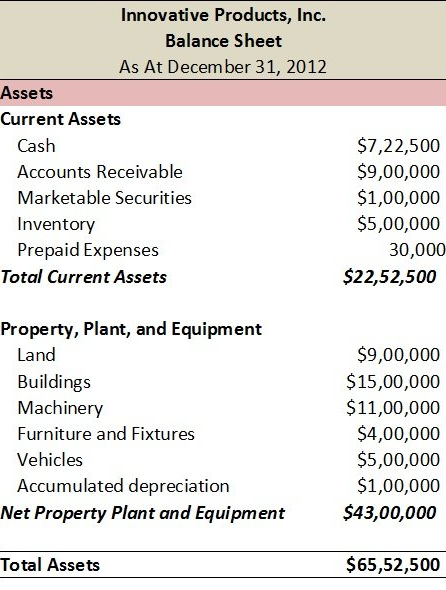

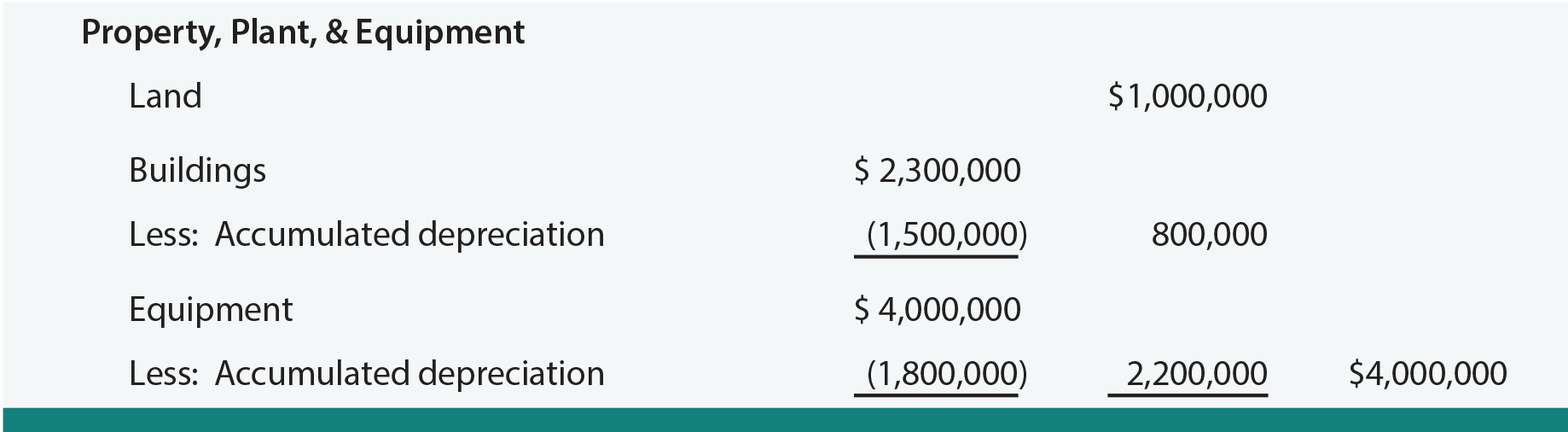

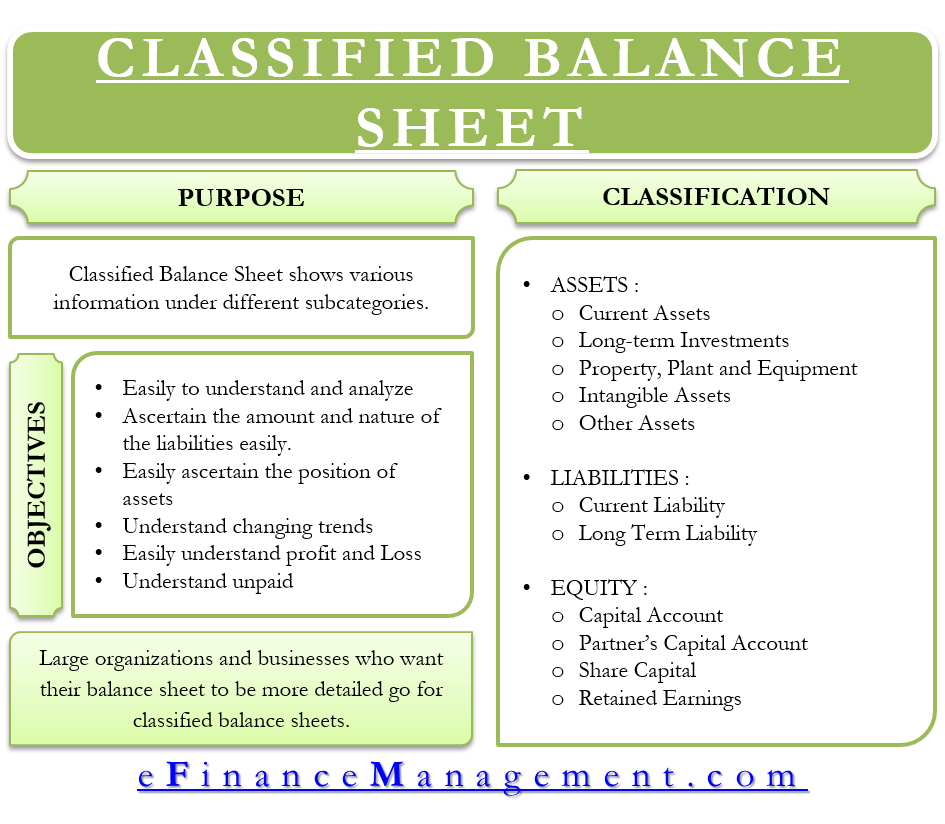

Definition of Property Plant and Equipment Property plant and equipment is the long-term asset or noncurrent asset section of the balance sheet that reports the tangible long-lived assets that are used in the companys operations. They are most often fixed assets. This revision of AS 10 has been made to be as par with IndAS and IFRS.

Why so much of accounting standards Recognition a. B are expected to be used during more than one period. PPE consists of building computer equipment office equipment furniture vehicle or truck and machinery etc its also called fixed assets or tangible assets.

Accounting Standard 10. In certain asset-intensive industries PPE is the largest class of assets. Property plant and equipment PPE includes tangible items that are expected to be used in more than one reporting period and that are used in production for rental or for administration.

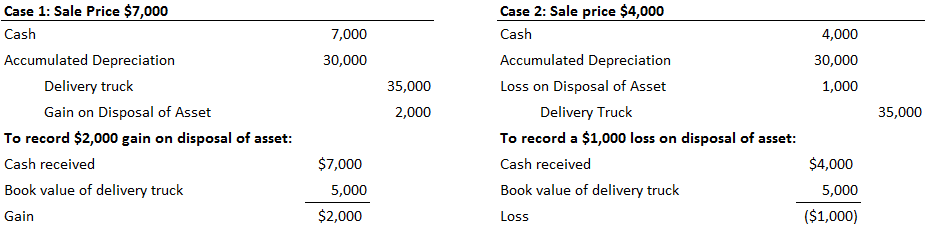

This is revised accounting standard 10 PropertyPlant and Equipment PPEwhich has replaced AS 6 Depreciation and AS 10 Accounting for fixed assets. IAS 167 it is probable that the future economic benefits associated with the asset will flow to the entity and the cost of the asset can be measured reliably. The financial accounting term disposition of property plant and equipment refers to the disposal of the companys assets.

Property Plant and Equipment PPE is one among item of the assets element presented in the financial statements. 1Property plant and equipment are tangible. Property Plant And Equipment.

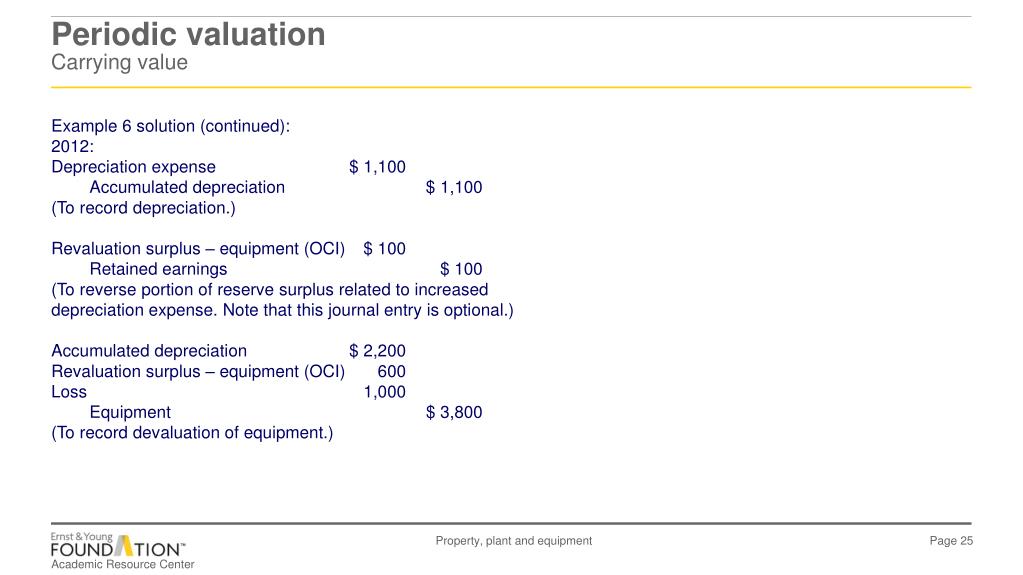

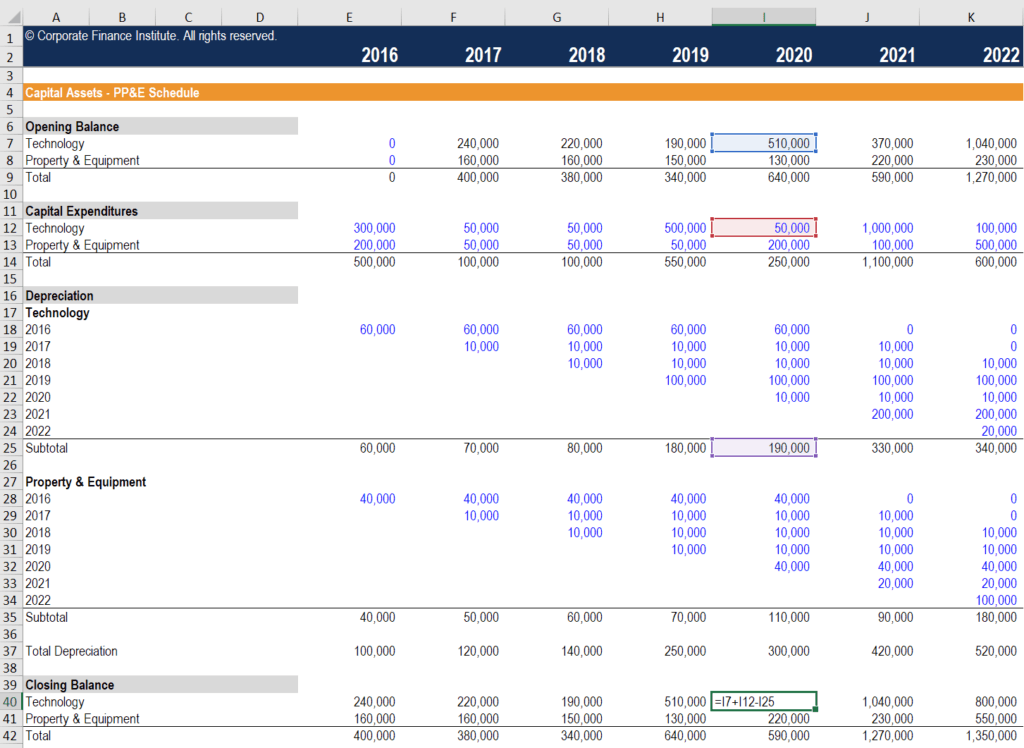

Accounting for Property Plant and Equipment Definition of PPE What is the role of Accounting standards. Accounting for property plant and equipment mostly deals with initial recognition depreciation revaluation impairments and derecognition of an asset. It is the second long term asset section after current assets.

A major classification on the balance sheet. Is a long-term fixed asset that is used to produce or sell products and services for the company. These assets are tangible in nature and are expected to produce benefits for more than one year.

Ang accounting discussion online pero classroom approach. Welcome to Sir Win - Accounting Lectures. These assets are commonly referred to as the companys fixed assets or plant assets.

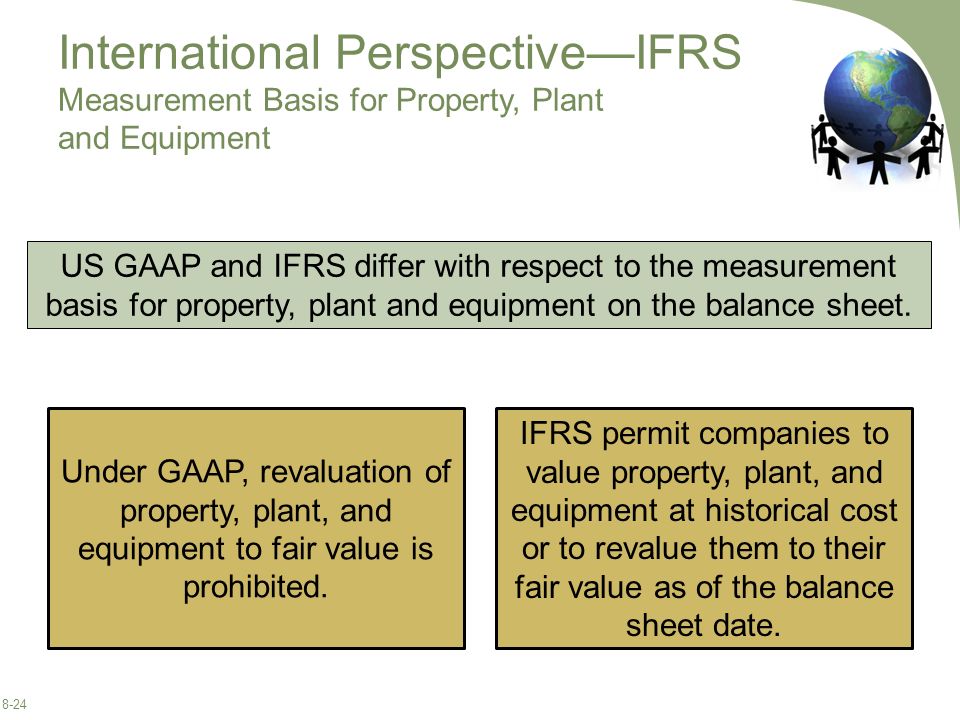

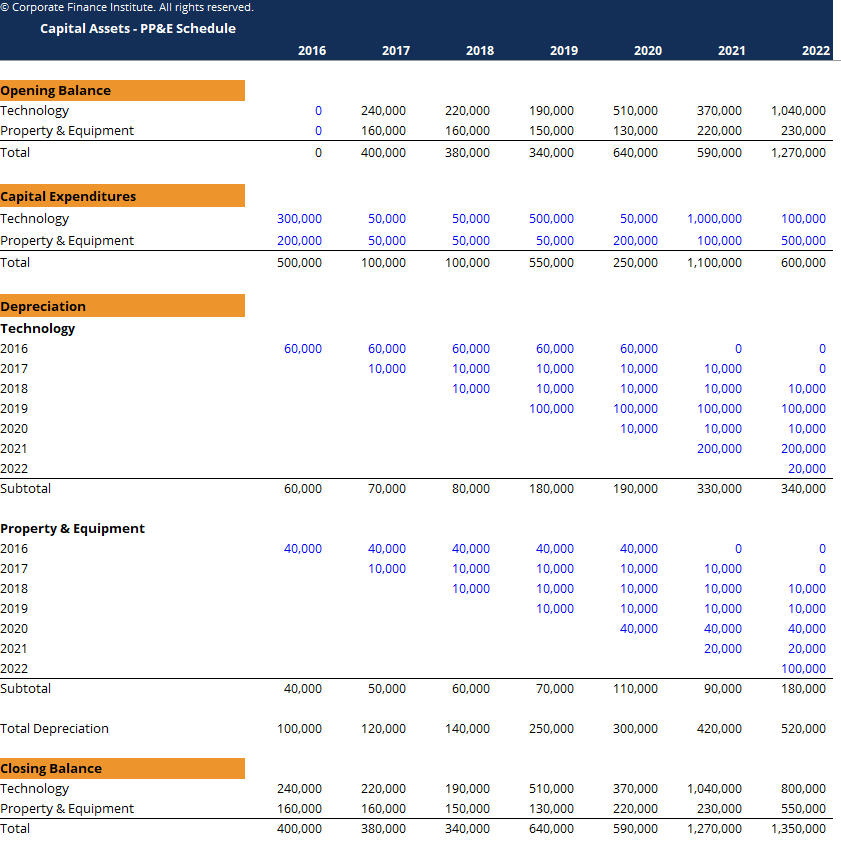

Depreciation is the systematic allocation of the depreciable amount of the asset over its. Property plant and equipment are tangible assets that. Under US GAAP and IFRS property plant and equipment can be treated using either the cost model or revaluation model.

To learn more see Explanation of Balance Sheet. PROPERTY PLANT AND EQUIPMENT Definition. That are owned by the company.

A are held by an enterprise for use in the production or supply of goods or services for rental to others or for administrative purposes and. PPE which includes trucks machinery factories and land allow a. This can include items acquired for safety or environmental reasons.

Also called property plant and equipment. The objective of Accounting Standard AS 10 Property Plant and Equipment is to prescribe the accounting treatment for property plant and equipment so that users of the financial statements can discern information about investment made by an enterprise in its property plant and equipment and the changes in such investment. Property plant and equipment definition.

Read more »Labels: accounting, property

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)