Property Plant And Equipment Classification

Are held for use in the production or supply of goods or services for rental to others or for administrative purposes. It is the second long term asset section after current assets.

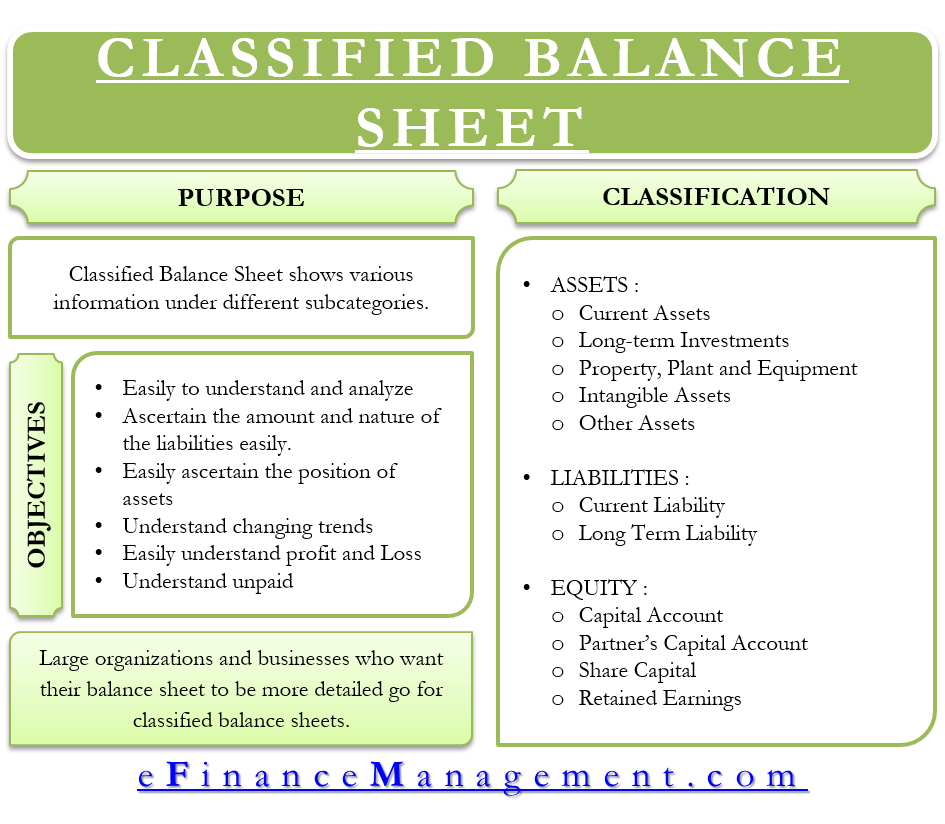

Classified Balance Sheet Meaning Importance Format And More

Classified Balance Sheet Meaning Importance Format And More

PROPERTY PLANT AND EQUIPMENT CLASSIFICATION Executive Summary Tools such as the Federal Supply Classification system also known as the NATO Codification System and the United Nations Standard.

Property plant and equipment classification. 500 Recreation and entertainment. 1380 a Classification of fixed asset expenditures. 6 Accounting for Property Plant and Equipment PDF.

That are owned by the company. In certain asset-intensive industries PPE is the largest class of assets. 10 Accounting for Internal Use Software PDF.

Recoverable amount is the higher of an assets fair value less costs to. SIC-23 Property Plant and Equipment - Major Inspection or Overhaul Costs. How to Locate the proper property type classification code.

300 Vacant land. 44218 Accounting for property plant and equipment. Fixed assets land including the perpetual usufruct right to.

And are expected to be used during more than one period. IRM 21491 Asset. Property plant and equipment are the recognition of the assets the determination of their carrying amounts and the depreciation charges and impairment losses to be recognized in relation to them.

The machinery was to be tested before it could be used. Property plant and equipment are assets with relatively long useful lives that ARE currently used in. The PPE addition are authentic and it is recorded properly at its cost while such costs are being able to distinguish from the repairs and maintenance expenses.

PROPERTY PLANT AND EQUIPMENT DEFINITION IDENTIFICATION AND CLASSIFICATION 1. Included are land buildings leasehold improvements equipment furniture fixtures delivery trucks automobiles etc. Assets like property plant and equipment PPE are tangible assets.

10 rows Property plant and equipment. The property plant and equipment PPE exists and owned by the business organization. SIC-14 was superseded by and incorporated into IAS 16 2003.

Property plant and equipment includes bearer plants related to agricultural activity. 3 PPE refers to long-term assets such as equipment that is vital to a. Following successful testing an operating.

This can include items acquired for safety or environmental reasons. An item of property plant or equipment shall not be carried at more than recoverable amount. Property plant and equipment PPE includes tangible items that are expected to be used in more than one reporting period and that are used in production for rental or for administration.

600 Community services. 1381 Property Plant and Equipment and related liabilities must be recorded in the Unrestricted Fund since segregation in a separate fund would imply the existence of restrictions on the use of the asset. SIC-14 Property Plant and Equipment Compensation for the Impairment or Loss of Items.

IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment. Property plant and equipment definition A major classification on the balance sheet. SIC-23 was superseded by and incorporated into IAS 16 2003.

Due to rapid expansion of its operations the company acquired additional machinery on 1 March 2011 for RM10000000. Anas Bhd is a leading garment manufaturer. IRM 1144 Personal Property Management.

44 Accounting for Impairment of General Property Plant and Equipment Remaining in Use PDF. Cost of construction in. If so inquire with the local assessor to verify their code definitions.

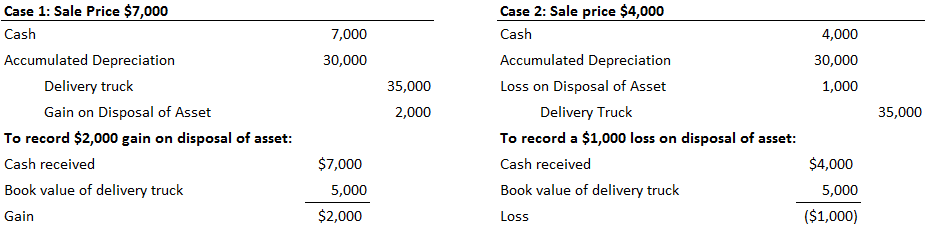

42 Deferred Maintenance and Repairs PDF. Property plant and equipment are tangible items that. The difference between long term investments and property plant and equipment are long-term assets such as land or building that a company is NOT currently using in its operating activities.

Read more »Labels: classification, equipment, property