Tangible Personal Property Tax Return Examples

WHAT TO REPORT ON THIS RETURN. Include on your return.

Http Www Mclennancad Org Pdfs Personal 20property 20presentation 20 20final 202003 20to 202007 20pdf Pdf

The costs listed on the return are utilized in the valuation of the property.

Tangible personal property tax return examples. The FAQs below contain general information to assist in the administration of tangible personal property tax. Tangible personal property owned claimed possessed or controlled in the conduct of a profession trade or business may be subject to property taxes. In the absence of owner input they will be forced to estimate a value based on the best available information.

Tangible Personal Property Tax Return Form DR-405 must be filed by April 1 or the first business day after should the due date fall on a weekend or holiday. A single personal property assessment is made for all taxable personal property of the owner located in the city or town. Include all goods chattels and other articles of value but not certain vehicles capable of manual possession and whose chief value is intrinsic to the article itself.

A Penalty Value will be shown if a Tan-gible Personal Property Tax Return was not filed or filed late. 1 Tangible Personal Property. Tangible Personal Property Tax T.

Value of tangible personal property and exemptions allowed. See section 1961832 FS. Business personal property and fixtures are valued annually as of the January 1 lien date.

You may request an extension for filing the Return. He tangible personal property tax which applies to property used in business in Ohio is gradually being phased out as part of a broader series of tax reforms enacted in 2005 by the General Assembly. Enter your Federal Employer Identification Number or Social Security.

Tangible personal property is everything other than real estate that is used in a business or rental property. The Property Appraiser also requires that all personal property used be shown on the return even if someone owns it other than the business. These regulations apply to corporations S corporations partnerships LLCs and individuals filing a Form 1040 or 1040-SR with Schedule C E or F.

Goods chattels and other articles of value except certain vehicles that can be manually possessed and whose chief value is intrinsic to the article itself. Additionally per statute a penalty of 25 will be applied. Real property includes land buildings structures and affixed improvements generally classified as immovable eg paving fencing.

Personal property is assessed separately from real estate where it is located. See section 19200111d FS. For a definition.

Property Tax Tangible Personal Property T he tangible personal property tax which applies to prop erty used in business in Ohio is gradually being phased out as part of a broader series of tax reforms enacted in 2005 by the General Assembly. Business site refers to a site where the owner of tangible personal property transacts business. Complete lines 1 through 9 on the Tangible Personal Property Tax Return HC-405.

Examples would be Never started business Employee only Closed Sold and Moved out of the County. Equipment on some vehicles. THERE IS NO FILING EXTENSION PROVISION FOR TANGIBLE PERSONAL PROPERTY TAX RETURNS.

If the federal income tax charitable deduction claimed for a gift of tangible personal property exceeds 5000 you must obtain an appraisal from a qualified appraiser and submit a special IRS form with the tax return on which the deduction is claimed. All property can be divided into two major categoriesreal property and personal property. Tangible personal property tax returns filed after May 17 2021 will not be allowed a discount.

Tangible personal property is subject to ad valorem taxes. Inventory held for lease. The tax is calculated by multiplying the assessed value of the property by the personal property tax rate of the city or town.

Report any discrepancies to the Property Appraiser. During the 2006 tax year taxes levied on tangible personal property totaled approximately 135 billion on a. Business inventory is personal property but is 100 percent exempt from taxation.

On all returns schedules attachments and correspondence. Attach a signed written explanation to the return detailing why you have no assets to report. In 2009 for the fi rst time in 163 years the vast majority of Ohio businesses no longer faced.

Who must file a. Tangible Personal Property is everything other than real estate that has value by itself. The final tangibles regulations affect you if you incur amounts to acquire produce or improve tangible real or personal property in.

The Property Appraiser to correct your record. In most states a business that owned tangible property on January 1 must file a tax return form with the property appraisal office no. Location of tangible property.

The Property Appraisers Office is required to place an assessed value on all tangible personal property regardless of whether or not a tax return is filed FS. Examples of tangible personal property are computers furniture tools machinery signs equipment leasehold improvements supplies and leased equipment. Any property owner firm or corporation owning tangible personal property is required to file a tangible personal property tax return Form VC-405 with the Property Appraisers Office.

Equipment furniture or fixtures after their first lease or rental. TPP in this document refers to tangible personal property.

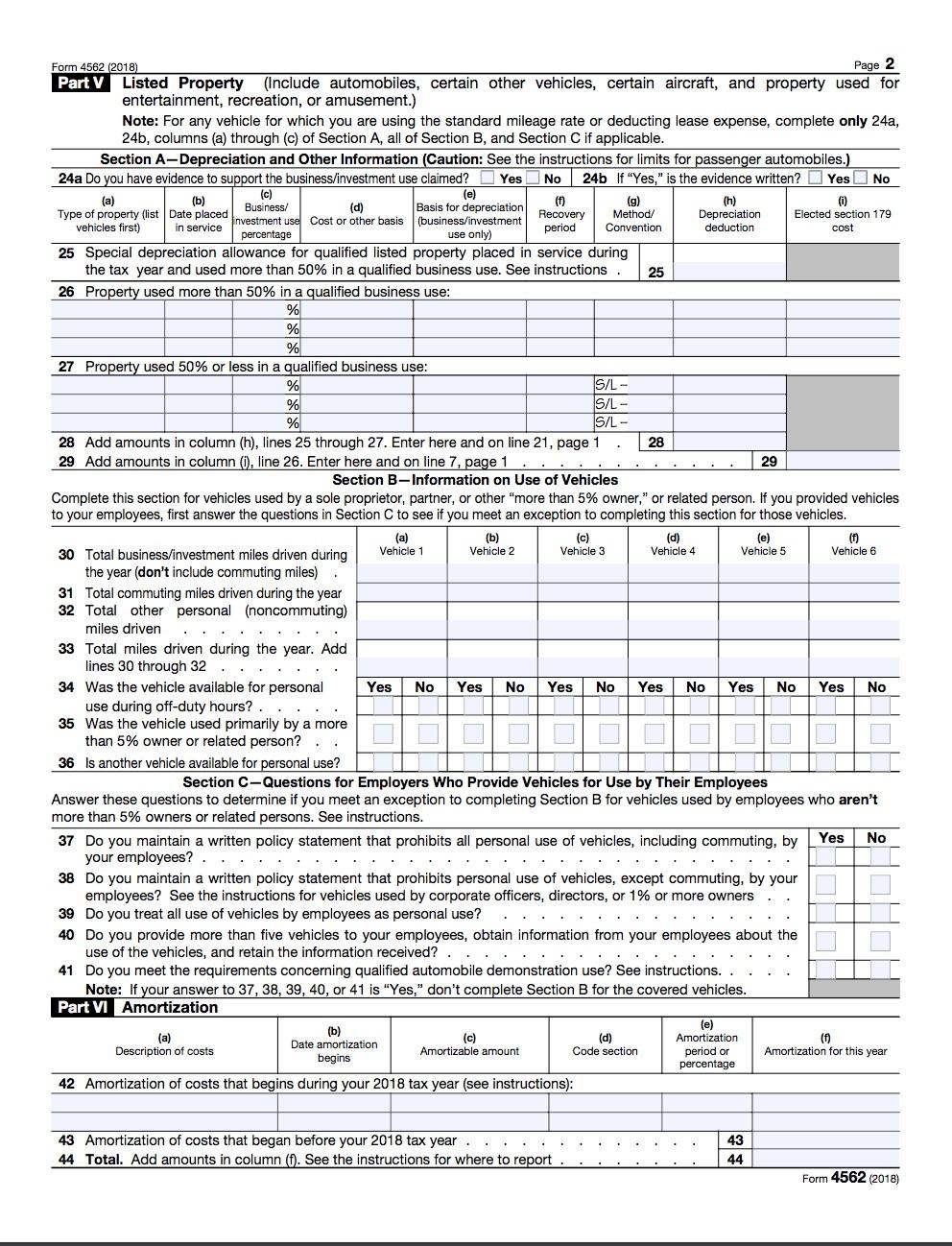

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Https Www Ocpafl Org Content Dynamic File Dynamic Fid 149733

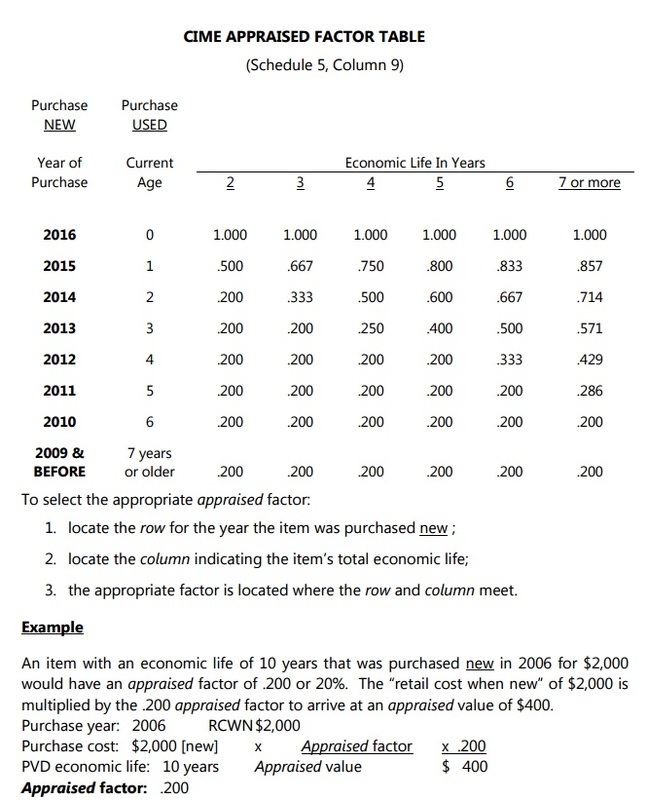

Http Www Mclennancad Org Pdfs Personal 20property 20presentation 20 20final 202003 20to 202007 20pdf Pdf

Personal Property Declaration Form Instructions Town Of Smithfield Ri

Personal Property Declaration Form Instructions Town Of Smithfield Ri

Personal Property Memorandum Template Fill Online Printable Fillable Blank Pdffiller

Personal Property Memorandum Template Fill Online Printable Fillable Blank Pdffiller

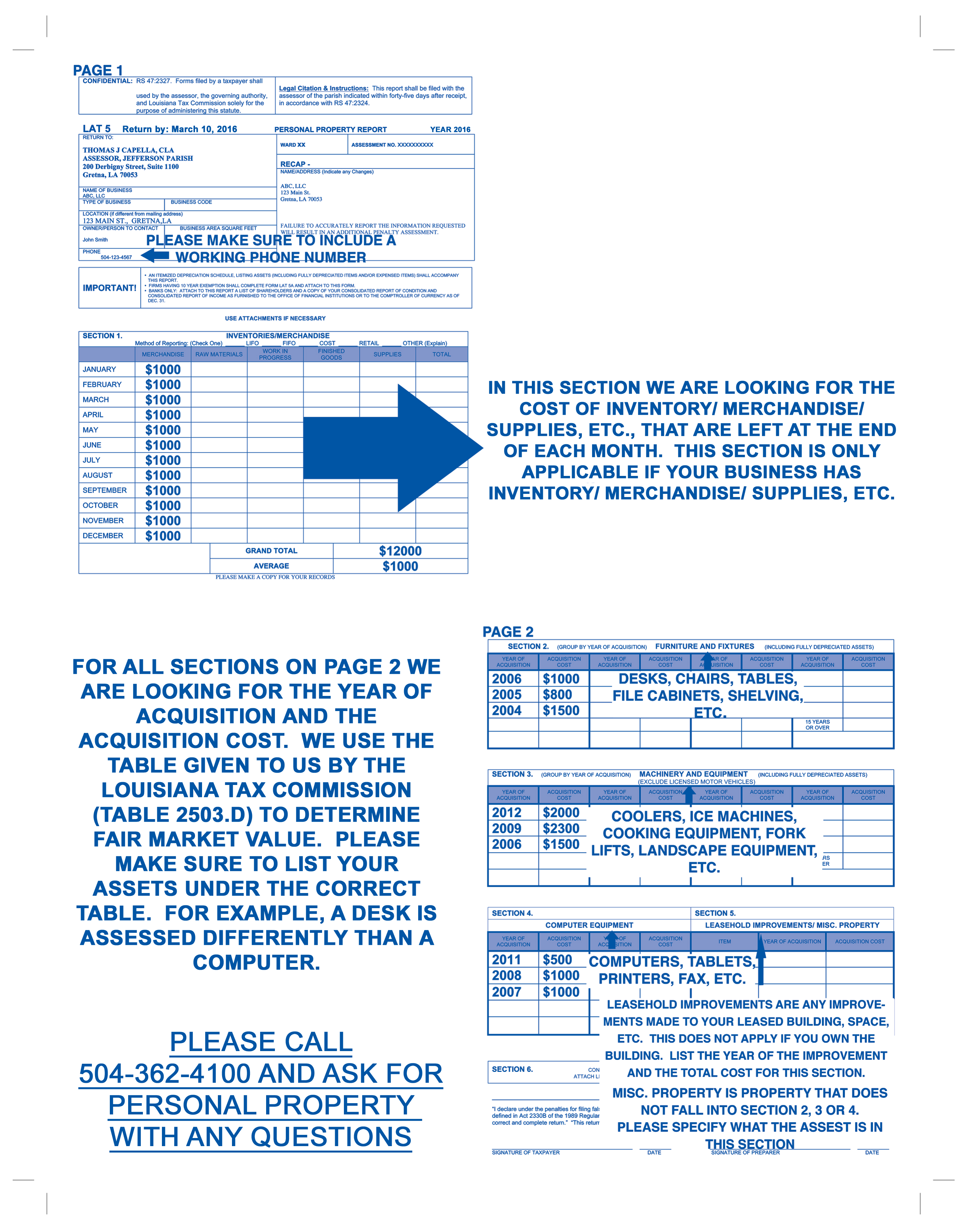

Jefferson Parish Assessor S Office Personal Property

Jefferson Parish Assessor S Office Personal Property

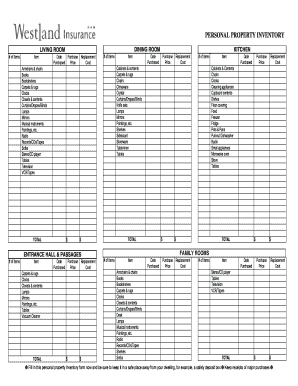

21 Printable Personal Property Inventory Sheet Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

21 Printable Personal Property Inventory Sheet Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Form Dr 405 Fillable Tangible Personal Property Tax Return R 12 11

Fl Florida Tangible Personal Property Tax

Fl Florida Tangible Personal Property Tax

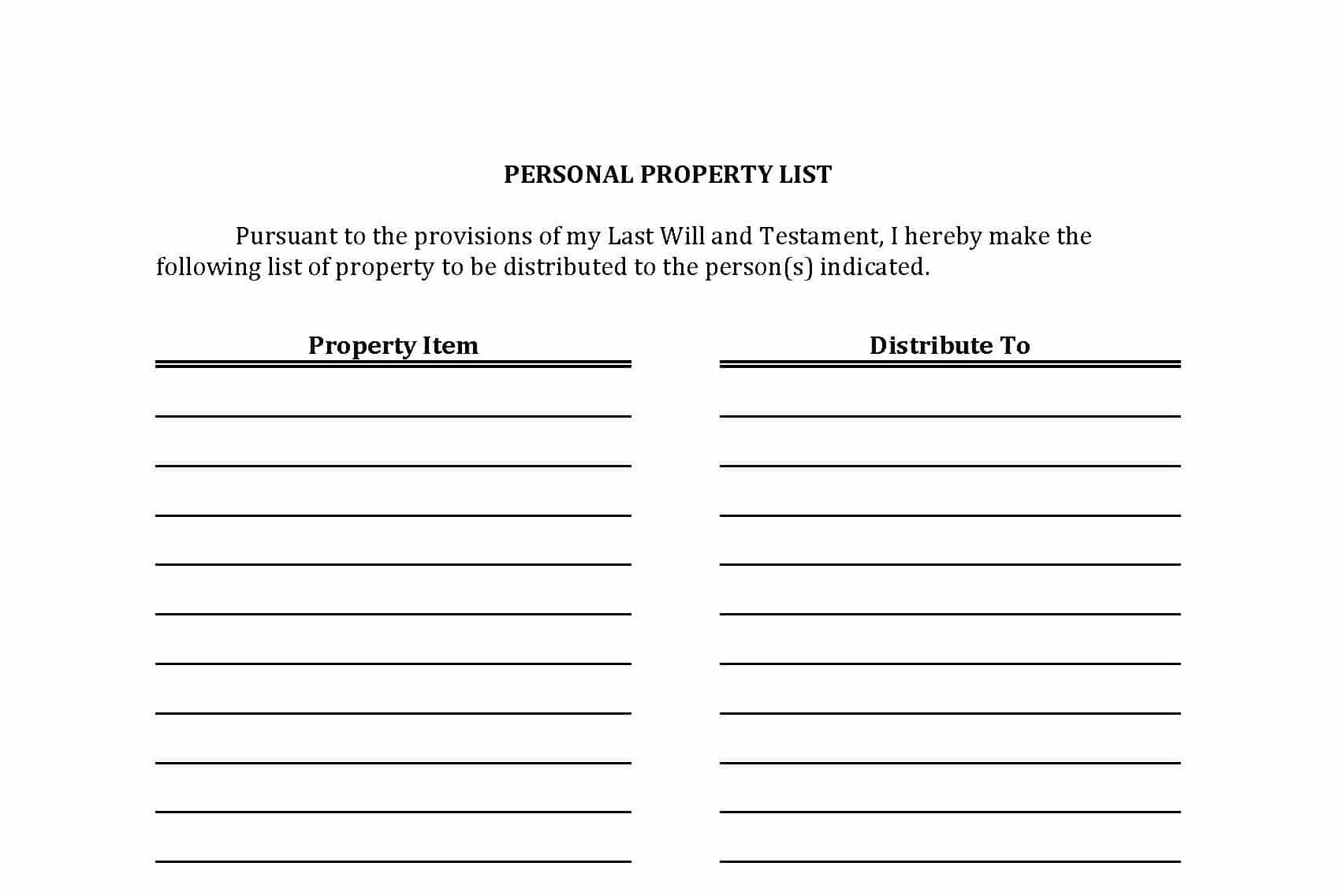

Examples Of Personal Property Memorandum Fill Online Printable Fillable Blank Pdffiller

Examples Of Personal Property Memorandum Fill Online Printable Fillable Blank Pdffiller

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Personal Property Declaration Form Instructions Town Of Smithfield Ri

Personal Property Declaration Form Instructions Town Of Smithfield Ri

The Personal Property List An Important Part Of Your Plan Fleming And Curti Plc

The Personal Property List An Important Part Of Your Plan Fleming And Curti Plc

Form Dr 405 Fillable Tangible Personal Property Tax Return R 12 11

Https Floridarevenue Com Forms Library Current Gt800038 Pdf

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Http Www Mclennancad Org Pdfs Personal 20property 20presentation 20 20final 202003 20to 202007 20pdf Pdf

Business Tangible Personal Property Taxes Taxes Payments

Business Tangible Personal Property Taxes Taxes Payments

21 Printable Personal Property Inventory Sheet Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

21 Printable Personal Property Inventory Sheet Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home