When Should I Receive My Property Tax Bill In California

For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at 8888072111 or 2139742111 press 1 2 and then press 9 to reach an agent Monday Friday 800am. To view your Property Tax Bill key in ANY of the following then click on the corresponding Find button below.

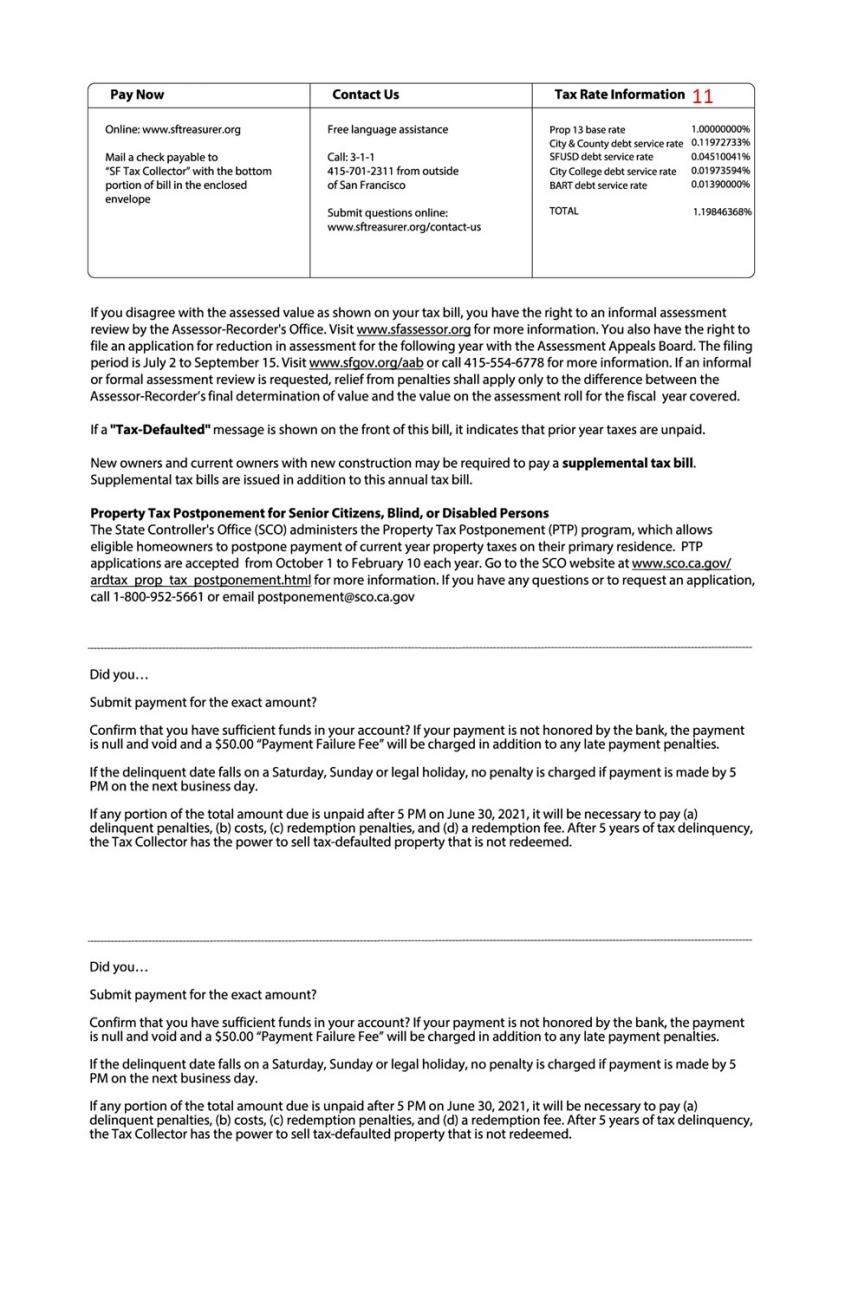

California Prop 19 Explained Measure Would Change Several Facets Of Property Tax Rules In California Abc7 Los Ange Property Tax Natural Disasters Tax Rules

California Prop 19 Explained Measure Would Change Several Facets Of Property Tax Rules In California Abc7 Los Ange Property Tax Natural Disasters Tax Rules

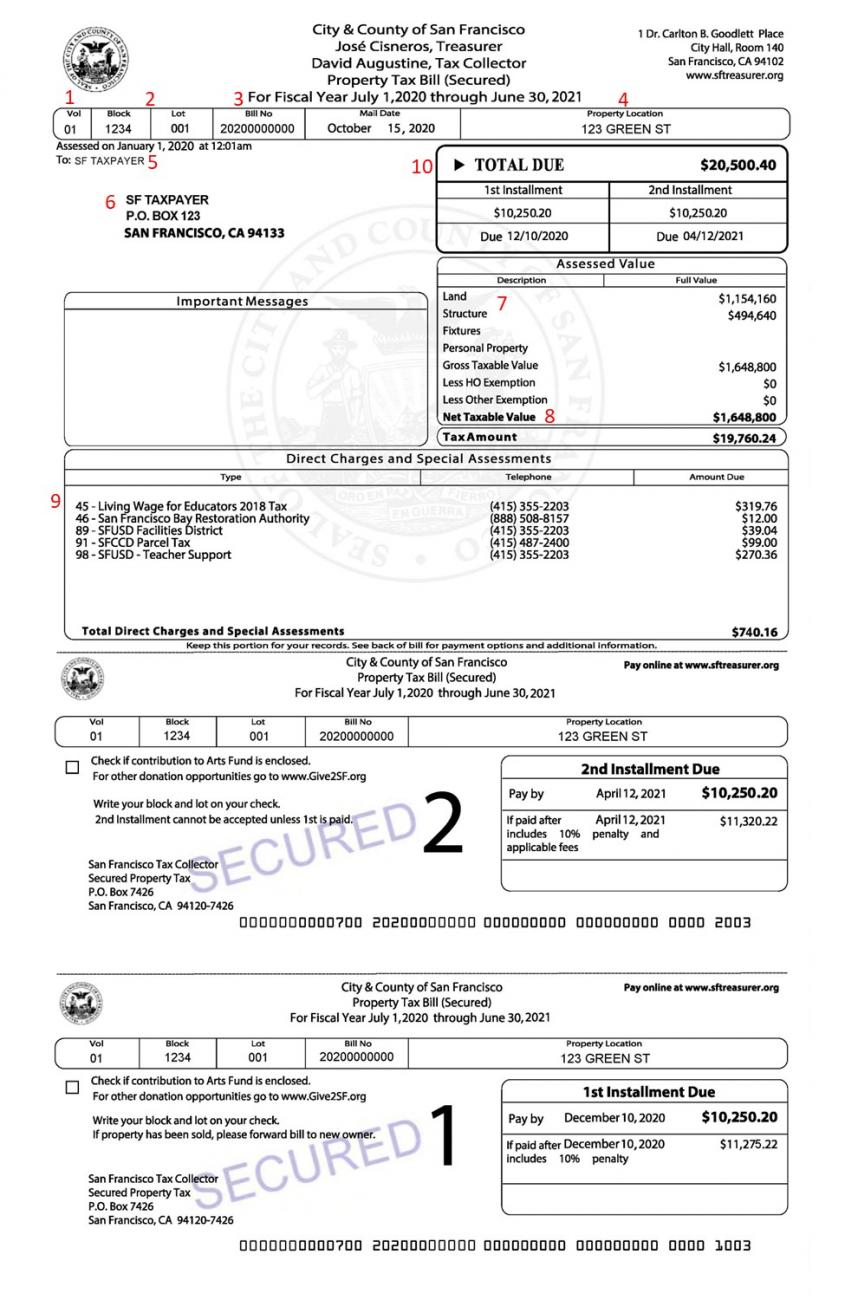

Property taxes are due in two installments.

When should i receive my property tax bill in california. We must start with the question of whether the home you sold is in your name or the name of the buyers. I have a somewhat specific question. Annual property tax bills are mailed in early October of each year.

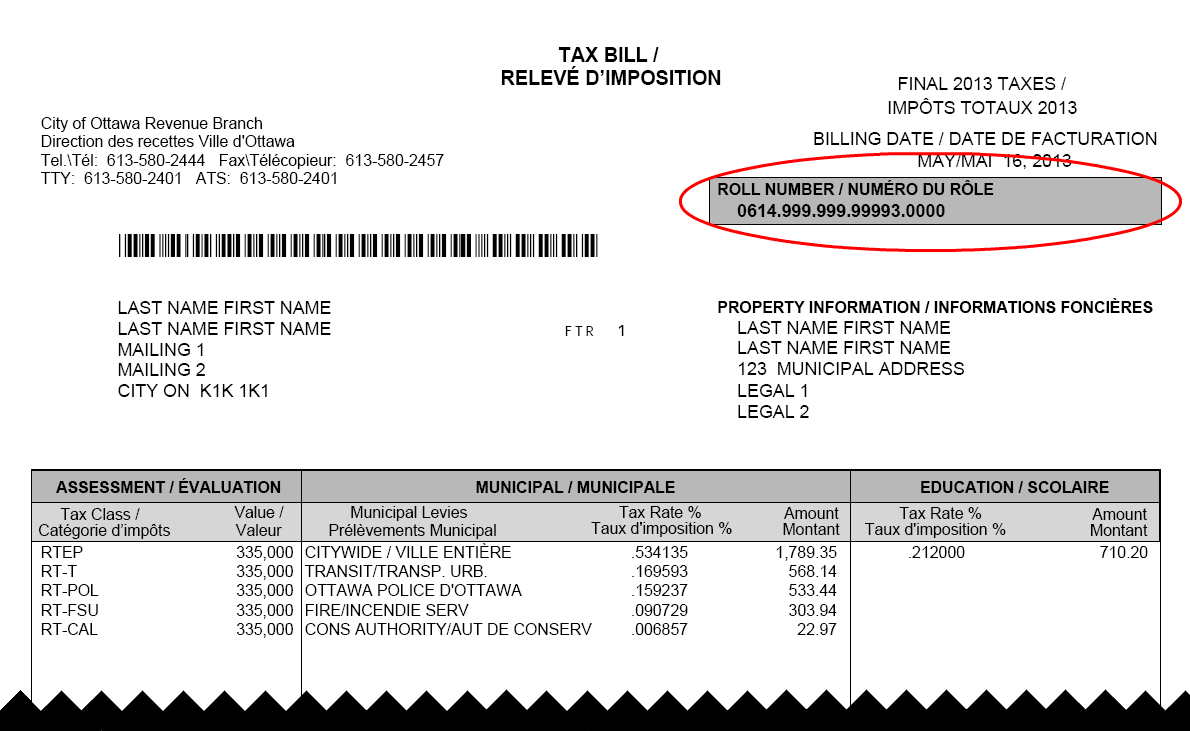

Any proration of property taxes between a seller and buyer during this period is usually handled through the escrow process. If there are any remaining unpaid property taxes and if you did not receive an Annual Secured Property Tax Bill from either the previous owner or the Treasurer and Tax Collector you may request a copy by calling the Treasurer and Tax Collectors automated Substitute Secured Property Tax Bill. For information about when you will receive your property tax bill or for questions related to your bill please contact your county treasurer.

Lets say for example you had a California personal income tax liability of 7000 last year and you expect a similar liability in 2018 and you paid 8000 of property taxes on your home. The second installment shall become delinquent on April 10 of the next year. Who should I contact.

To receive the exemption claim form BOE-266 Claim for Homeowners Property Tax Exemption must be filed with the county assessor where the property is located. The 1st installment is due on November 1 and is delinquent if the payment is not received by 500 pm. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

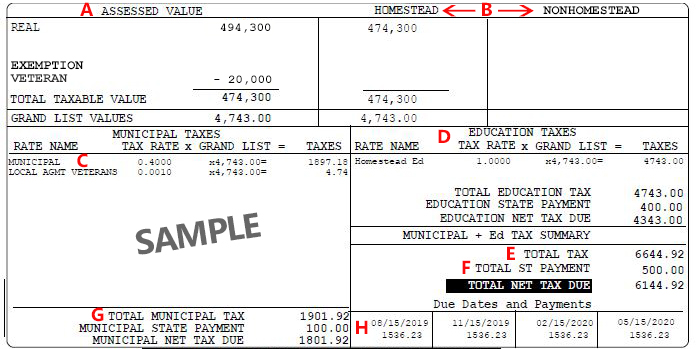

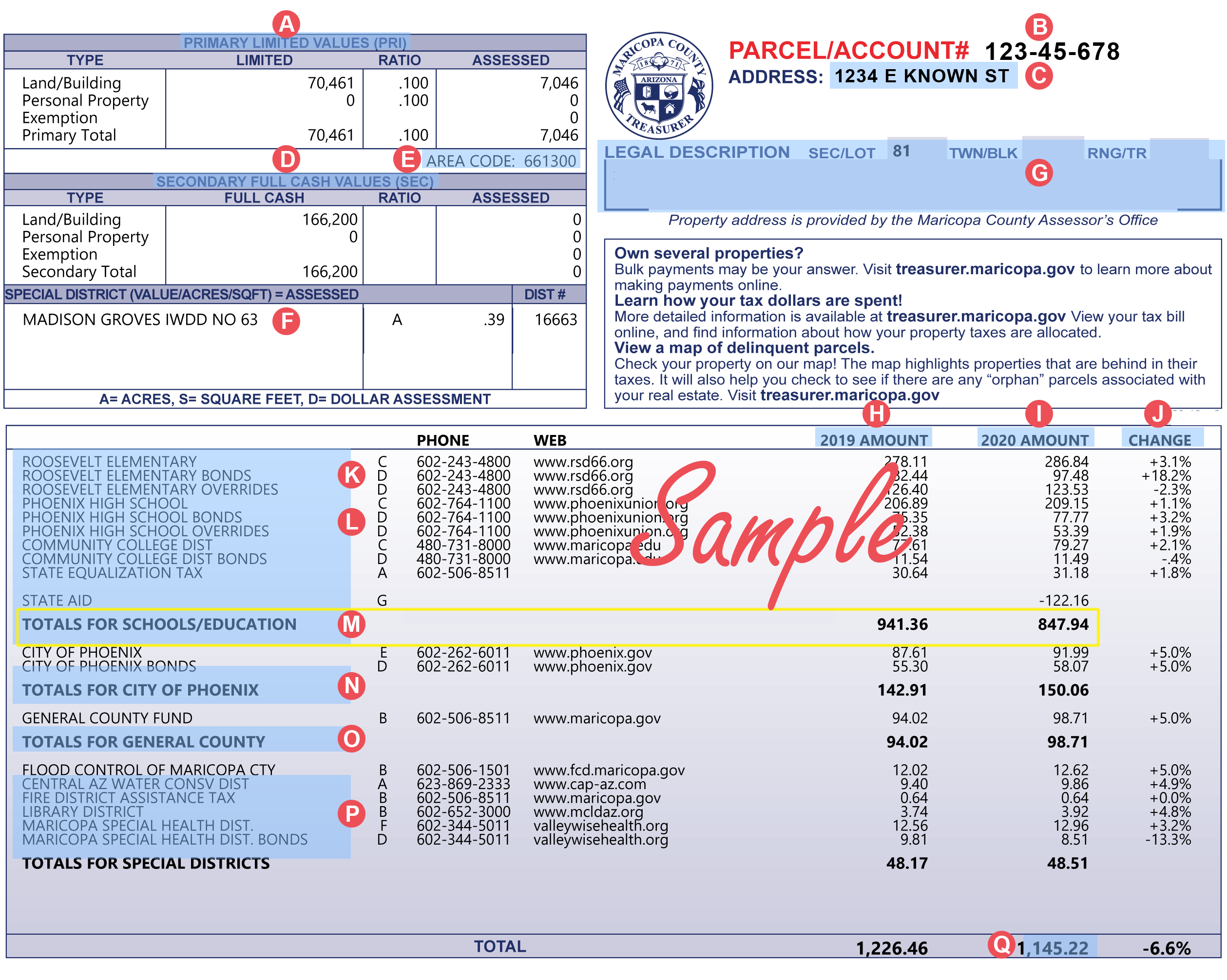

Assessed value tax bill and payments tax rates. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. Depending upon your question you should contact one of three county departments involved in the property bill process.

A fiscal year runs from July 1 through June 30. How will my property taxes change when I sell my property. When can I expect to receive a corrected tax bill.

Delinquent Secured Tax information is available all year except during the month of July. Revenue and Taxation Code sections 757572 detail the laws governing the supplemental assessment process. We purchased our house in October of 2019 for 630k.

The county treasurer may mail or transmit the tax statement one time each year at least 15 days before the date on which the first or only installment is due. In Orange County for example you can search by providing this information. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year.

It was purchased by a flipper in February of 2019 for 515k. The second installment is due February 1st and becomes delinquent if not paid on or before April 10th. Where can I view my tax bill.

Property Tax Bill Frequently Asked Questions FAQs I have a question about my property tax bill ie. In many California counties you can search for your tax bill on line. When will I receive my supplemental bill or supplemental refund.

The bill is payable in two installments. You will only receive a tax deduction of 3000 associated with your property tax payments of 8000. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

Or postmarked by December 10. Were pretty sure that if you closed through a title company settlement agent or. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

If payment is made on the delinquency date in person at the Tax Collectors office the law requires the delivery of the payment by 500 pm. Why am I receiving two supplemental bills. Qualified veterans who own real property valued at 5000 or less if single or 10000 or less if married may receive an exemption of up to 4000.

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your. 1 If the bill is mailed within the months of July through October the first installment shall become delinquent on December 10 of the same year. I would think my supplemental tax bill would only be for the 115k difference however I received a tax bill for the 392k difference between the 515k and 122k 1980s purchase price.

Property taxes assessed for a year are due in two equal installments on May 10 and November 10 of the following year. Tax amount varies by county. The property tax bill for property purchased after January 1 may still reflect the previous owners name and assessed property value.

However it is still a valid property tax bill for the tax year. I Received a Property Tax Bill After Selling the House Now What. Current year is available between October 1 and June 30 only.

The first installment is due November 1st and becomes delinquent if not paid on or before December 10th. The tax bill covers the period from July 1 to June 30 of each year. A 10 penalty is assessed for delinquent payments.

Read more »Labels: bill, california, property, when