Can You Get Your Property Tax Bill Online

If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. If you feel you are over-assessed you should contact your township assessors office.

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your.

Can you get your property tax bill online. Enter your parcel number name or street name to view your invoice. If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment. It offers premium security and ease of use.

You will need to use the AIN and Personal Identification Number PIN which is printed on your original Secured Property Tax Bill to complete the transaction. The information on the bill can also help you determine whether your assessment is accurate. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

Jefferson County Sheriffs Office Tax Department. Your Property Tax Overview. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

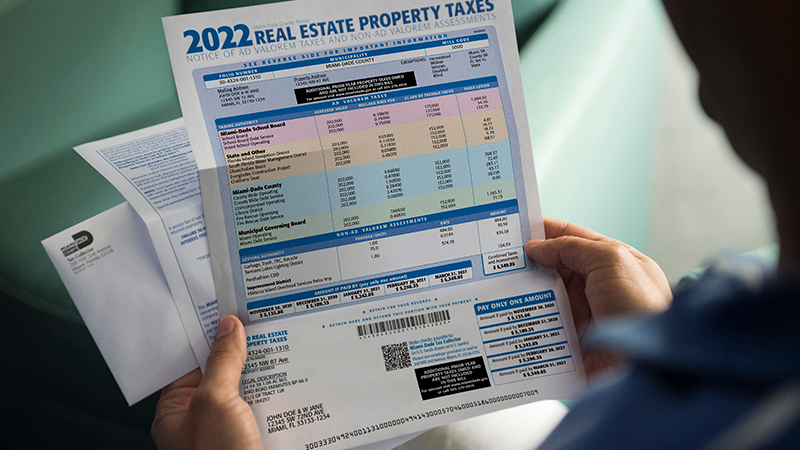

Beyond the amount of taxes you owe the bills indicate where your taxes are going and how much more is being collected by your local governments each year. Click Get Started button above or use one of the other payment options below. Bills are generally mailed and posted on our website about a month before your taxes are due.

See local governments debt and pensions. You do not need to request a duplicate bill. Online or phone payments can be made from your home.

Each electronic check transaction is. The only exception is that a property tax collector may wait to send a bill until the total taxes due for all taxing units the collector serves is 15 or more. See if a refund is available.

Then if necessary file an assessment appeal. Pay online for free using your checking account and the Personal Identification Number PIN which is printed on the Annual Property Tax Bill. Sign up to receive tax bills by email.

A property owner may file a written request with the collector that a tax bill not be sent until the total amount of taxes due on the property is 15 or more. If so your lender divides your estimated tax bill by 12 and includes that amount in your. PAMS in partnership with Invoice Cloud accepts ACHelectronic check electronic fund transfer from your checking or savings account and creditdebit card payments of bills.

You can always download and print a copy of your Property Tax Bill on this web site. You can make online payments 24 hours a day 7 days a week until 1159 pm. You may also print a copy of your tax bill from our website.

Use an e-Check or credit card to make a payment. Assessment appeals filed in 2019 are applicable for tax bills paid in 2020. If you have not received your tax bill by the second week of November please contact our Tax Department and a duplicate bill will be sent to you.

Property tax bills and receipts contain a lot of helpful information for taxpayers. No partial payments can be made at a Wells Fargo Bank. Download a copy of your tax bill.

Find out if your delinquent taxes have been sold. Pacific Time on the delinquency date. The IRS also has a mobile application IRS2Go that you can use to pay your tax bill via Direct Pay or by debit or credit cardIf you are getting a refund on your federal taxes you can track it.

Pay Your Taxes Now Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee. If you have further questions please contact our office at 951955-3900 or e-mail. On a single page you can.

Partial payments are only accepted for current tax bills after March 31st no partial payments are accepted for delinquent taxes. Then click on the payment type. There is no cost to you for electronic check eCheck payments.

Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments. To pay by phone call 240-777-8898. If you have a mortgage your property taxes may be rolled into your monthly mortgage payment.

Once you receive your assessment notice visit taxlakecountyilgov for details on your home and check for accuracy. Online partial payments cannot be made unless you contact our office to enable this function for your property account. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

Begin by entering your account number or bill number or street address for the bill you want to pay in the box below. After you make an online payment it can take up to five business days for your tax bill to be updated with your new balance. PAMS offers customers an easy and secure way to view print and pay their Real Estate Tax bills online.

You can access this new web site by clicking the link below or by directing your browser to.

Property Tax Online Payment How To Pay Mcd House Tax Delhi Property Tax Online Payment Tax Payment

Property Tax Online Payment How To Pay Mcd House Tax Delhi Property Tax Online Payment Tax Payment

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Real Estate Advice

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

San Diego County Public Records Public Records San Diego Records

San Diego County Public Records Public Records San Diego Records

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

10 Ways To Lower Your Property Taxes Property Tax Tax Tax App

10 Ways To Lower Your Property Taxes Property Tax Tax Tax App

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home