How To Reprint Property Tax Receipt

CollectorAssessor Drop Box in front of the County Administration Building at 201 N. Enter your driver license number the last four digits of your Social Security number and your birth date and then click Log In to see your personal DMV information.

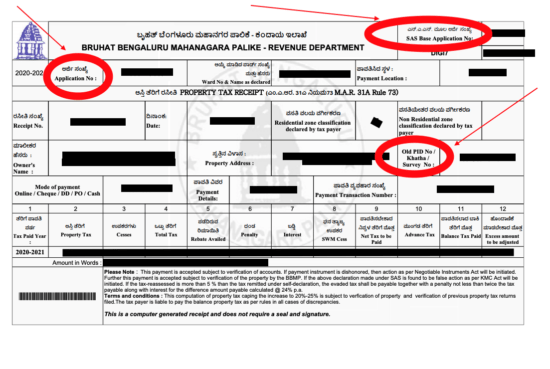

We Paid The Bbmp Property Tax Online But We Can Not Download The Receipt We Keep On Getting Error Quora

111825r of the Texas Property Tax Code the Gregg County Appraisal District gives public notice of the capitalization rate to be used for tax year 2021 to value properties receiving exemptions under this section.

How to reprint property tax receipt. Coimbatore is well known for its textile industries and has excellent potential for industrial growth. The Taney County Collectors Office will be mailing 2020 tax statements by November 6th. Louis City in which the property is located and taxes paid.

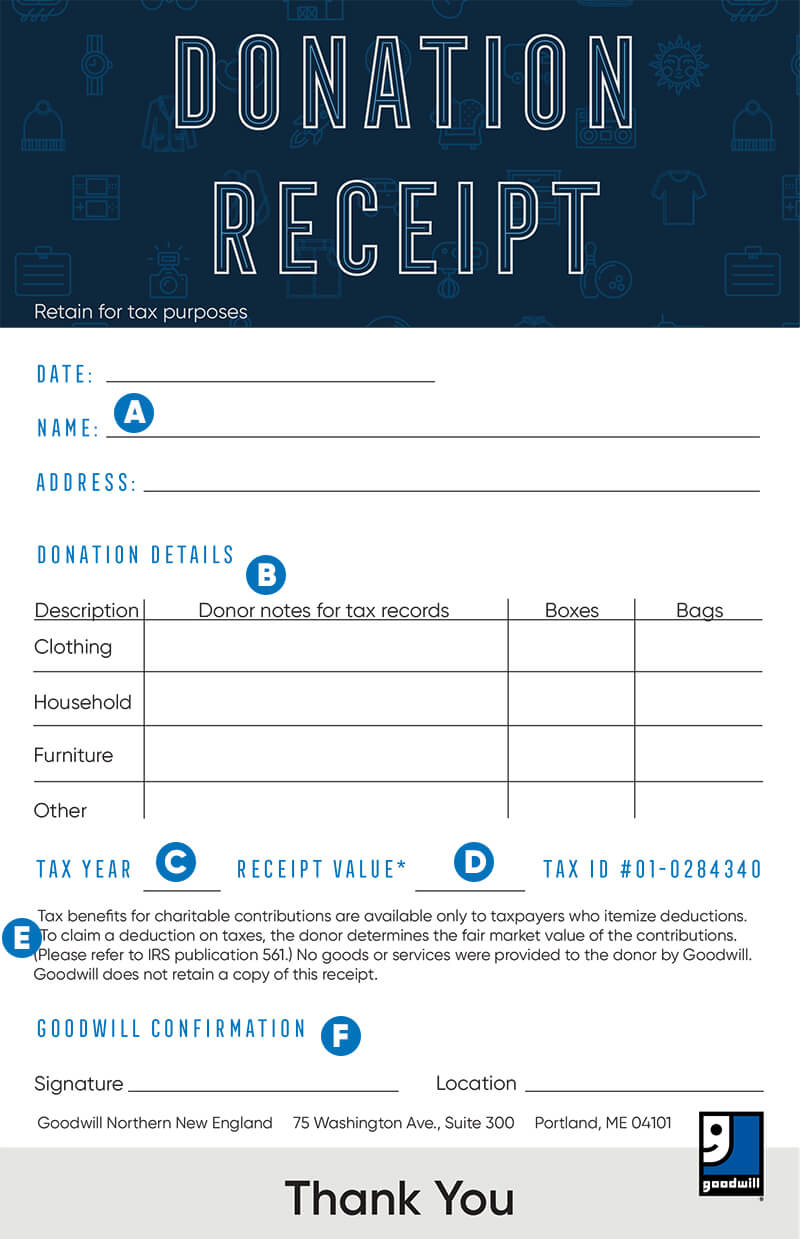

Welcome to our online records search center. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. Current Year Tax Receipt.

Youll get a list of the county vehicle property taxes you paid in 2017. Coimbatore popularly known as Manchester of South India is situated in the western part of the state of Tamil Nadu. Learn more about how to request a receipt for the property taxes you paid.

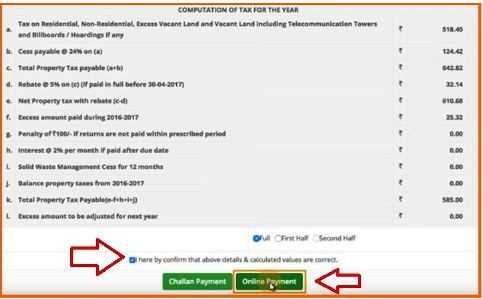

Coimbatore City is the district head quarter. Step 2 Use the information from your current paid property tax receipt such as your account numbers property legal description and county information to access the website for your county tax office. Welcome to the Records Search Center Hillsborough County Tax Collector.

To obtain your property tax receipt visit the Online Payment Program. You may click on this collectors link to access their contact information. Sign in to ROS 1 The Property ID and PIN will have been posted to the address of the person liable for LPT on the property.

To obtain a paper copy of a tax receipt please submit a written request with your name account number address and a 1 statutory fee by check or money order via one of the following methods. Because of its proximity to the hills of the Western Ghats Coimbatore enjoys an excellent climate throughout the year. The 2020 property taxes are.

Under Correspondence click 2017 VEH PROP TAX FEE. You may also obtain a duplicate of your original property tax receipt from our offices. Almost all property tax bills are due on receipt.

Click on the Online Services tab at the top of the website. Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. Once your account is displayed you can select the year you are interested in.

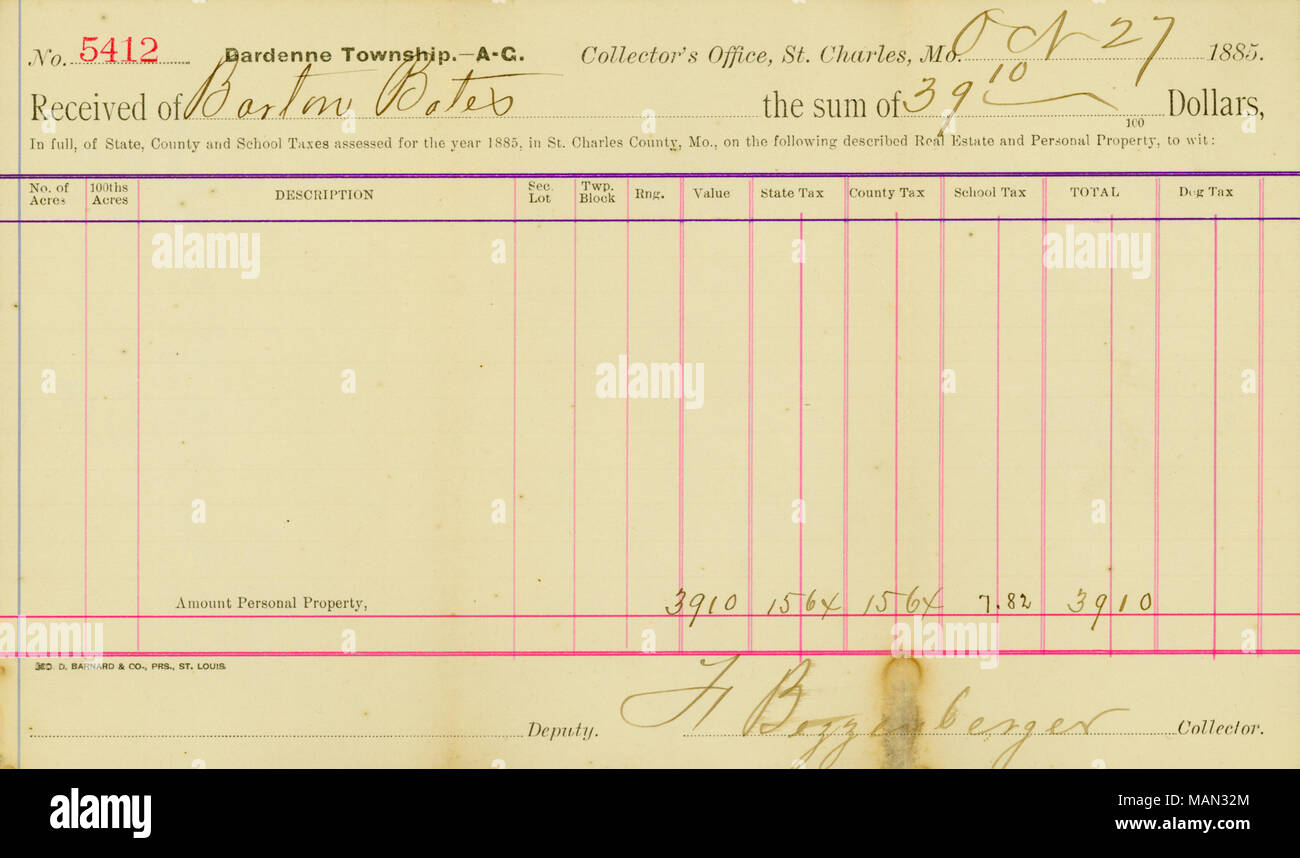

You can obtain a property tax receipt for either the current year or prior years. Charles County Collector of. Obtaining a property tax receipt Property Tax Receipts are obtained from the county Collector or City Collector if you live in St.

Please note that personal property account numbers begin with the letter. Issued in December upon request free of charge. Property Assessment Appeals Information on how to appeal your Property Assessment from the Assessors Office.

Click on the View Property List button in the Local Property Tax tab. Click on the Property ID. There WILL NOT be a fee charged to process an electronic check online or the 1-800 number at that time.

Request must be received no later than December 31 st each year provided that taxes are paid in full. Tax Code Section 3101g provides that failure to send or receive the tax bill does not affect the validity of the tax penalty interest the due date the creation of a tax lien or any procedure instituted to collect a tax. Select the information requested from the pull down menus Tax Year - individual year or ALL.

Rent restricted properties vary widely. Select the Tax Bill Payment option which is the 6 th option. Search for your account by account number address or name and then click on your account to bring up the information.

Click on the link for Personal PropertyMVLT and Real Estate. The property tax account is being reviewed prior to billing. I hope you find this site easy to navigate and that having the option to pay your taxes online and print receipts provides a convenient service to you.

Your online resource to search property taxes tax certificates business tax receipts hunting and fishing license information and driver license status. Second Street in St. Property Taxes Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF Information for Property Owners.

The Tax Commissioner must issue a ruling by the end of February of the calendar tax year. On the home screen click the View Property History button. Nassau County Tax Lien Sale Annual Tax Lien Sale Public Notice.

There is a 1 fee for each duplicate receipt. When you receive a paid property tax receipt make a copy of it at that time and keep a duplicate file of all your paid property receipts. Tax Waiver Statement of Non-Assessment How to obtain a Statement of Non-Assessment Tax Waiver.

Select Yes I accept. Steps to viewprint property tax payment information. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements.

These variations can have an effect on the valuation of the property.

Read more »