How Do I Get A Personal Property Tax Receipt St Charles County

Department of Motor Vehicles DMV or mail a copy of your paid tax receipt and your decal fee to. Apply in person at a SC.

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

Include your property number if available.

How do i get a personal property tax receipt st charles county. To obtain a paper copy of a tax receipt please submit a written request with your name account number address and a 1 statutory fee by check or money order via one of the following methods. The Collectors Office mails tax bills during November. CollectorAssessor Drop Box in front of the County Administration Building at 201 N.

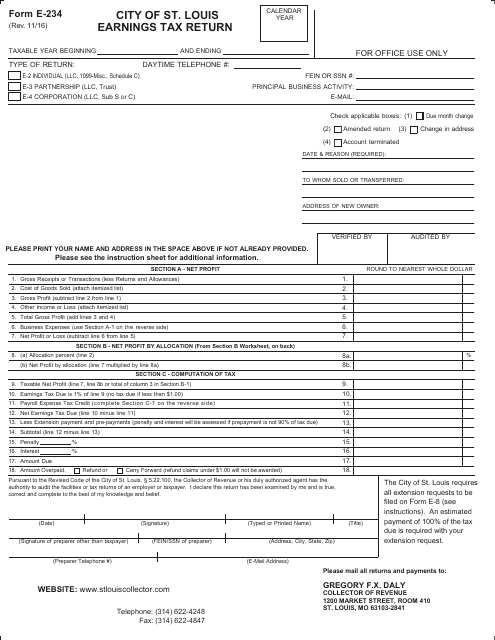

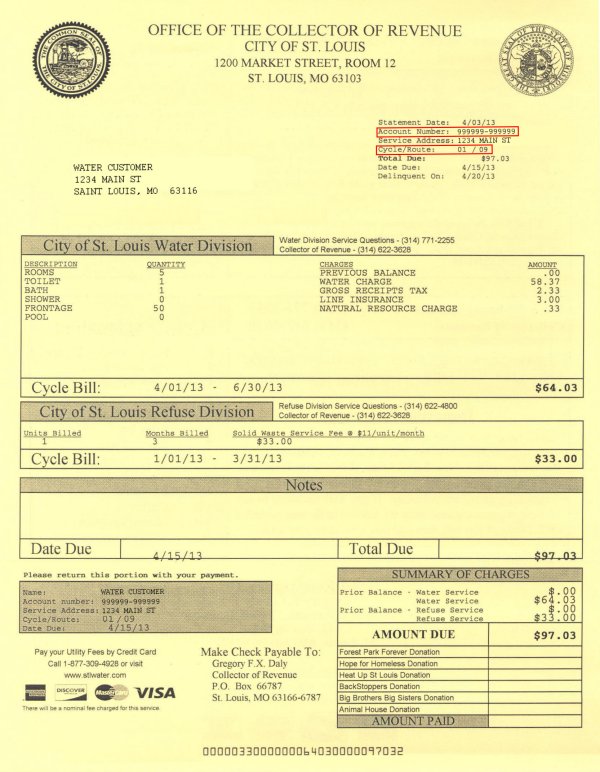

Collector of Revenue The Assessors office assesses property both real estate and personal property. Payments may be made at the St. Assessments are due March 1.

There will be a nominal convenience fee charged for these services. You may click on this collectors link to access their contact information. Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF Information for Property Owners.

Charles County Collectors Office located at 201 N. Louis Mo 63103 Monday Through Friday 8 AM - 5 PM Contact the Collector - Personal Property Tax and Real Estate Tax Department. Does your vehicle odometer average over 15000 miles annually based on its age.

Search for your account by account number address or name and then click on your account to bring up the information. Personal property and real estate taxes are paid to St. Tax receipts for payments received via the drop boxes will be mailed to payees within four days.

This office can be reached by phone by calling 636-949-7470. The County Clerk uses their assessed values and the taxing district levies to calculate the tax bills. Charles County Assessors Office also located at 201 N.

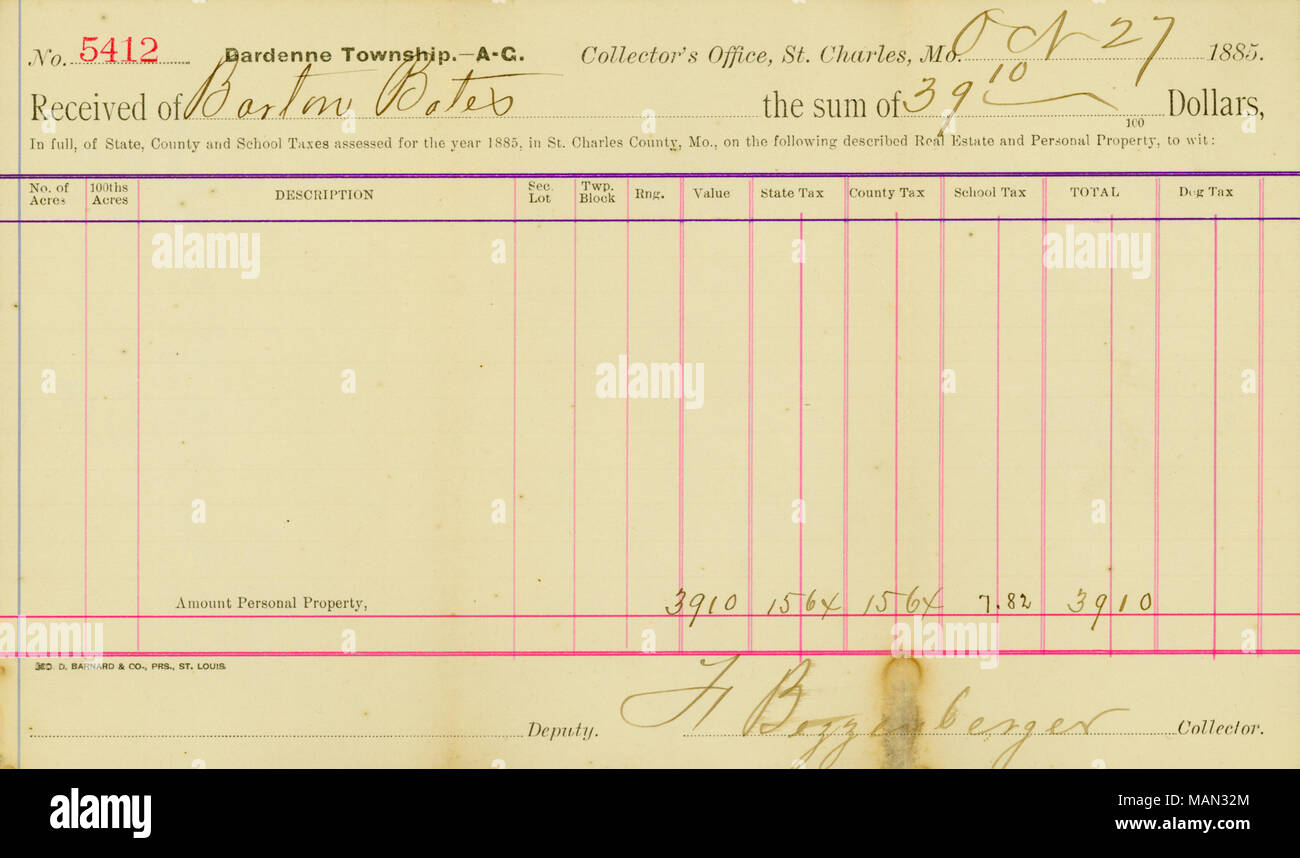

Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. The Collector of Revenue serves as the billing collecting and disbursing agent for more than 200 different taxing districts in St. Obtaining a property tax receipt.

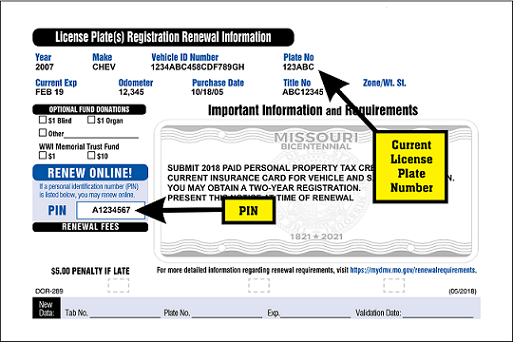

If you own property in Charles County please notify our office of any address changes. Questions regarding personal property and real estate taxes may be addressed to the St. Please allow 5 business days for mail time and for updating of the state.

Second Street in St. Only the Assessors Office can change the vehicles or addresses on a personal property tax bill. Box 1498 Columbia SC.

If you have not received a bill by December 1st please contact the Collectors office at 636-797-5406 to check the status of your tax record and verify the mailing address. Collector - Personal Property Tax and Real Estate Tax Department 314 622-4105 1200 Market Room 109 St. Division of Motor Vehicles PO.

The Personal Property Tax Department can print duplicate personal property tax bills and duplicate tax receipts and assists taxpayers with their inquiries pertaining to personal property tax bills. Louis City in which the property is located and taxes paid. If you did not file a Personal Property Declaration with your local assessor and did not receive a Personal Property bill you will need to file with your assessors.

The Homestead Tax credit application is required to be completed by all homeowners. The Collectors office then sends out the bills. Use your account number and access code located on your assessment form and follow the prompts.

Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Please note that personal property account numbers begin with the letter I like in. A Homeowners Tax credit application is available to residential homeowners who meet certain income requirements.

The official Paid Personal Property Tax Receipt needed for license renewal will be mailed from the Collectors Office. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. To receive a receipt via email within two days print the email address clearly on the bill or envelope.

Nassau County Tax Lien Sale Annual Tax Lien Sale Public Notice. If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232. Property Taxes-Assessment How is My Property Tax Determined.

Personal Property Tax is due on December 31st of the year and become delinquent on January 1st of the proceeding year. 2020 Tax Sale Property Map. Obtaining Copies of Tax Receipts.

Once your account is displayed you can select the year you are interested in. If you do not receive a form by mid-February please contact Personal Property at 636-949-7420 or by email.

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

How To Title A Vehicle In Missouri Blue Maven Law

Personal Property Taxes Page 1 Line 17qq Com

Personal Property Taxes Page 1 Line 17qq Com

Online No Tax Due System Information

Online No Tax Due System Information

Https Www Sccad Com Pdfs 6 8 2017boardpacket Pdf

Personal Property Tax Receipt St Charles Missouri Property Walls

Copy Of California Property Tax Bill Sample Page 1 Line 17qq Com

Copy Of California Property Tax Bill Sample Page 1 Line 17qq Com

St Louis County Mo Real Estate Tax Lookup Msu Program Evaluation

St Louis County Mo Real Estate Tax Lookup Msu Program Evaluation

Https Www Sccmo Org Documentcenter View 14943 April 2020 Candidates And Issues Bidid

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Tax Receipt St Charles Missouri Property Walls

Personal Property Receipt St Louis County Property Walls

Personal Property Receipt St Louis County Property Walls

Https Www Efis Psc Mo Gov Mpsc Commoncomponents Viewdocument Asp Docid 935455060

Personal Property Taxes Page 1 Line 17qq Com

Personal Property Taxes Page 1 Line 17qq Com

Personal Property Receipt St Louis County Property Walls

Personal Property Receipt St Louis County Property Walls

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home