How To Get Receipt Of Property Tax Paid Online

The 24-digit tax bill number is required. Click on the button for Online Tax Payment Step 3.

How To Pay Property Tax For The Year 2016 17

How To Pay Property Tax For The Year 2016 17

Obtaining a property tax receipt Property Tax Receipts are obtained from the county Collector or City Collector if you live in St.

How to get receipt of property tax paid online. For your convenience the Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check eCheck. Enter your PPSN property ID and property PIN and click Login. To obtain your property tax receipt visit the Online Payment Program.

Pay your Tarrant County tax bill search for an account. Louis City in which the property is located and taxes paid. The Tax Office accepts full and partial payment of property taxes online.

Click on the button Online Payment Step 4. Online Property Tax Payment Fees. The 24-digit tax bill number is required.

Personal Property Tax Lookup And Print Receipt. Visit the Chennai Corporation website Step 2. You may click on this collectors link to access their contact information.

You can download Receipt Online. Select Yes I accept. You can download your property tax bill online.

Tarrant County has the highest number of property tax accounts in the State of Texas. You will be able to check your tax balance and make a payment through the address lookup tool. Use the information from your current paid property tax receipt such as your account numbers property legal description and county information to access the website for your county tax office.

Click on the link for Personal PropertyMVLT and Real Estate. There is a chance that you may have misplaced the receipt or you may have not received the same on your e-mail id. But you know the importance of LIC receipt.

Enter your property tax bill details. Click on the Online Services tab at the top of the website. There may be a charge for this duplicate property tax receipt.

Inquiresearch property tax information. View all statements and receipts. Property taxpayers may use credit cards debit cards or e-Checks to pay their taxes.

You may also obtain a duplicate of your original property tax receipt from our offices. ClayCountyMotax is a joint resource provided and maintained by Lydia McEvoy Clay County Collector and Cathy Rinehart Clay County Assessor. Select the information requested from the pull down menus Tax Year - individual year or ALL.

Electronic payments will be pending until it clears from your bank account. Tax Receipts can be found on the current statement page or by clicking on the Property Tax Receipts button. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Select the Tax Bill Payment option which is the 6 th option. If a bank or mortgage company pays your property taxes they will receive your property tax bill. Search here for the property by owner name property address or account number to make a payment get a copy of the statement or receipt.

Heres what you need to do to pay Chennai property tax online. You can download Property related other. Final processing may take several days.

Register to Receive Certified Tax Statements by email. Paying property tax in Chennai Corporation online is pretty easy. Receipt available for current or past two years.

If taxes are due you may pay online using the button below. There is a 1 fee for each duplicate receipt. You can pay your Property Tax bill Online.

There should be an option on their web page where you can request a duplicate tax receipt. Bills are generally mailed and posted on our website about a month before your taxes are due. CREDITDEBIT CARD CONVENIENCE FEES APPLY.

You will need your Account Number to proceed with payment. Ie your zone number ward number bill no. Personal banking online bill pay.

If the entire tax bill number 24 digits is not entered in the online bill pay account number field the payment will be rejected and sent back to the taxpayers bank. Steps to viewprint property tax payment information. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

On the home screen click the View Property History button. Property Tax Payments can be made at all locations by cash check and most major credit cards. You may obtain a duplicate of your original property tax receipt for free online.

In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. Pay online Pay online through the Citys Real Estate Tax portal by entering your physical address or Office of Property Assessment OPA number. 209 of total minimum fee of 100.

You can access the service through LPT online by following these steps.

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

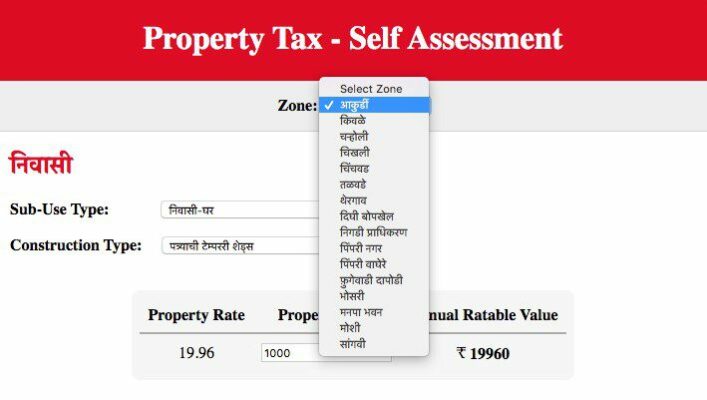

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Property Tax Payment In Delhi Some Simple And Helpful Steps

Property Tax Payment In Delhi Some Simple And Helpful Steps

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

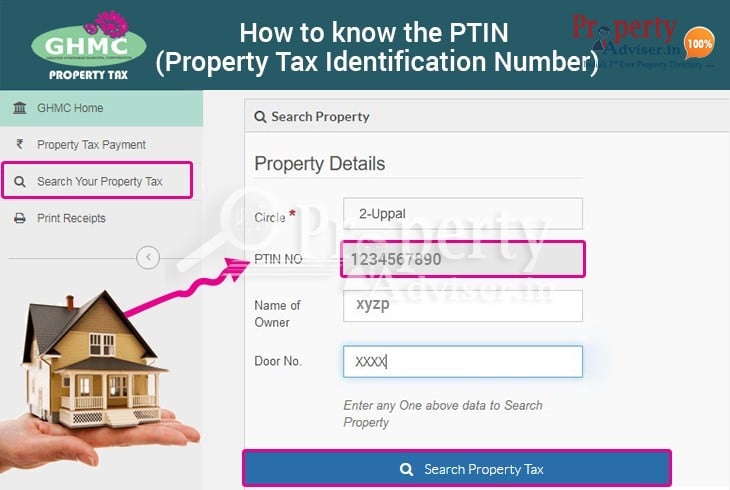

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

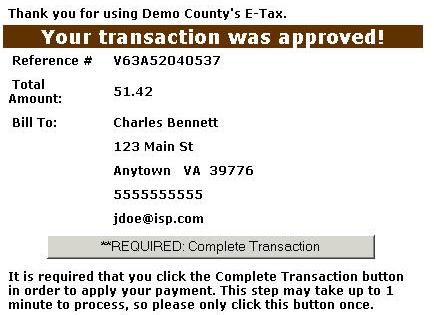

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

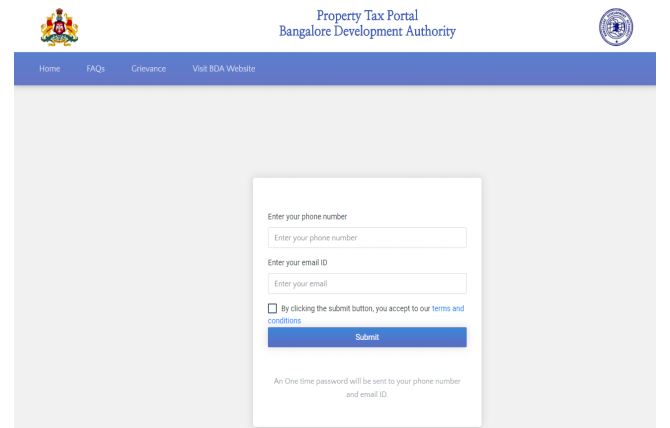

Bbmp Bangalore Property Tax Online Payment Calculator Forms Rebate Dates

Bbmp Bangalore Property Tax Online Payment Calculator Forms Rebate Dates

How To Change The Name In The Bangalore Bbmp Property Tax Records Receipts Quora

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

How To Change The Name In The Bangalore Bbmp Property Tax Records Receipts Quora

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home