Property Tax Bill El Paso Tx

Payments can be made online or by phone at 915-212-0106. Current tax payments for all property types may be made by debit or credit by phoning 719520-7900.

Breakdown Of El Paso County Property Tax Increase After 4 Entities Raise Tax Rates Kfox

Breakdown Of El Paso County Property Tax Increase After 4 Entities Raise Tax Rates Kfox

E-checks can be used or credit cards with a 198 percent convenience fee.

Property tax bill el paso tx. If an owners Business Personal Property filed in El Paso County exceeds a total value of 790000 all the property is taxable including the initial 790000. El Paso County has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. Only real estate and mobile home taxes may be paid online.

El Paso Central Appraisal District is responsible for appraising all real and business personal property within El Paso County. Our firm was structured to help maintain manage and coordinate property tax matters for our clients along with providing assurance of low fair and equitable values. Property owners have the right to appeal to the Appraisal Review Board ARB any actions taken by EPCAD concerning their property tax appraisals at no cost.

Property tax bills are mailed out every October and the payment is due by January 31st. Colorado State law requires the County to share its revenue for the Road and Bridge Fund with the city or town when the property is located within a city or town. Tax Lien Sale PLEASE NOTE.

This office will be located in West El Paso at 424 Executive Center Suite 120. We hope you find the information contained here to be useful and interesting. Tax bills are sent to the property owner unless the bill is requested by a tax agent or a mortgage company.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. There is a non-refundable fee of 25 of the tax amount for debit and credit card transactions. El Paso TX 79925 P.

The average homeowner in the county pays 2665 annually in property taxes almost 100 more than the. 915 780-2130 General. The El Paso County Tax Assessor-Collector Ruben P.

Was founded in 1983. A friendly reminder about the Property Tax Collection Season. Our companys sole aim is to reduce your property tax liability through aggressive negotiations with the local appraisal officer or assessor.

In-depth El Paso TX Property Tax Information. There are three ways to pay property taxes in El Paso County. Where are you sending the bills.

Effective October 1 2013 current year tax bills with an amount due less than 5 are not being mailed except by owner request per Property Tax Code 3101 f. 2066 that are located in the El Paso tax district. A property owner may file a written request with the collector that a tax bill not be sent until the total amount of taxes due on the property is 15 or more.

Gonzalez is proud to announce the opening of our brand new County Tax Office. 2066 then click Fiduciary No 907 then click Geo No. The only exception is that a property tax collector may wait to send a bill until the total taxes due for all taxing units the collector serves is 15 or more.

Credit or debit card payment for other property types may be made by phoning our office 719 520-7900. In the event additional assets are put into use which increases the total actual value of the personal property to an amount greater than 790000 the owner must file a Declaration Schedule. The current disclosure reflects the amount of the tax levy being shared with the city or town.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. The total tax rate for El Paso County Real Property is 0072. Cash personal checks cashiers checks and money orders.

El Paso County collects on average 209 of a propertys assessed fair market value as property tax. The hours of operation will be Monday through Friday 800 am. The median property tax in El Paso County Texas is 2126 per year for a home worth the median value of 101800.

We invite you to pay your Property Taxes at the El Paso County Tax Office We have seven tax offices conveniently located throughout El Paso County Payments accepted mid October through Monday February 1 2021. Typically these actions would be concerning the value of the property exemptions taxable status and ownership issues. Jackson then click Property Address all accounts with statements requested by fiduciary no.

Property Tax Associates Inc. El Paso County El Paso County is in western Texas bordering both Mexico and the state of New Mexico. Online payments may be made on Real Estate and Mobile Home current year taxes.

Where Can You Pay Your El Paso Property Taxes

Where Can You Pay Your El Paso Property Taxes

El Paso County Property Tax Records El Paso County Property Taxes Tx

El Paso County Property Tax Records El Paso County Property Taxes Tx

City Of El Paso Reminds Homeowner Of Property Tax Savings Kfox

City Of El Paso Reminds Homeowner Of Property Tax Savings Kfox

El Paso County Property Tax Records El Paso County Property Taxes Tx

El Paso County Property Tax Records El Paso County Property Taxes Tx

Council Approves El Paso City Budget That Cuts 62m Holds The Line On Property Tax Rate Kvia

Council Approves El Paso City Budget That Cuts 62m Holds The Line On Property Tax Rate Kvia

11660 Great Abaco Ct El Paso Tx 79936 Realtor Com

11660 Great Abaco Ct El Paso Tx 79936 Realtor Com

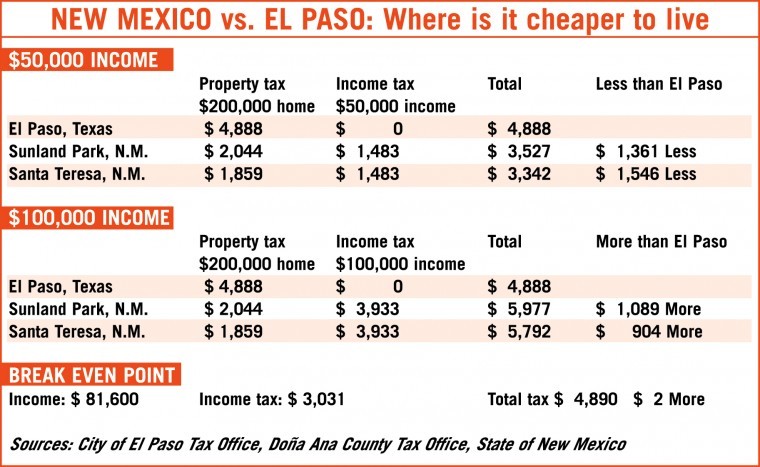

Where Is It Cheaper To Live Chart Elpasoinc Com

Where Is It Cheaper To Live Chart Elpasoinc Com

3710 Lee Blvd El Paso Tx 79936 Realtor Com

3710 Lee Blvd El Paso Tx 79936 Realtor Com

El Paso Tx Freeport Exemption Fill Online Printable Fillable Blank Pdffiller

El Paso Tx Freeport Exemption Fill Online Printable Fillable Blank Pdffiller

El Paso Central Appraisal District Protests And Appeals

El Paso Central Appraisal District Protests And Appeals

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Where To Pay Your Property Tax Bill In El Paso County Kfox

Where To Pay Your Property Tax Bill In El Paso County Kfox

11450 Napolske Ct El Paso Tx 79936 Realtor Com

11450 Napolske Ct El Paso Tx 79936 Realtor Com

El Paso County Property Tax Records El Paso County Property Taxes Tx

El Paso County Property Tax Records El Paso County Property Taxes Tx

El Paso County Property Tax Records El Paso County Property Taxes Tx

El Paso County Property Tax Records El Paso County Property Taxes Tx

Pay El Paso Property Taxes By January 31 Or Pay A Hefty Penalty

Pay El Paso Property Taxes By January 31 Or Pay A Hefty Penalty

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home