Property Tax Rate Rochester Ny

Rochester NY 14623. The city has four classes of property.

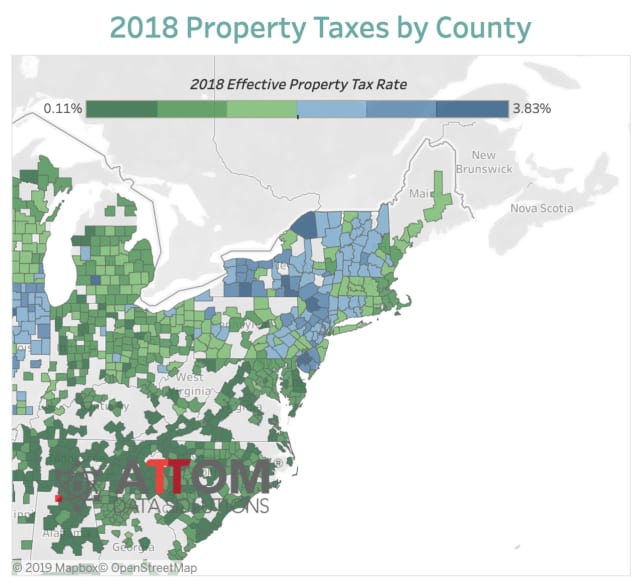

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Please be careful when entering.

Property tax rate rochester ny. 304 County Office Building 39 W. 2021 Town County Tax Rates. Property and tax information is available for the towns in Monroe County New York.

The City of Rochester assesses property taxes based on the market value of the property. 800am - Noon 100pm - 400pm The information and documents contained on this website are for informational purposes only and should not be considered as certified copies or as posted legal notice as required by law. Nuisances Tax Exemptions.

Residential one-family and three-family homes are class one The assessment ratio for class one property is 6. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. This convenient site allows you to pay tax bills water bills parking tickets or alarm permit renewals online.

2020-2021 School Tax Rates. Since then the average increase has been 17. You can also sign up for Direct Pay which allows you to set up automatic recurring payments of tax andor water bills from a checking or savings account.

Property assessment information may change during the year but does not become final for taxing purposes until the official filing of the Town Final Assessment. Property taxes in New York rose on average 42 between 2005 and 2012 a report this month by Comptroller Thomas DiNapoli found. In-depth Monroe County NY Property Tax Information.

The property and owner information is the most current information as provided by the Town Assessors. A non-negotiable 20 fee will be assessed by the City if an electronic check payment bounces for any reason. Property Assessment Tax Details Photos Water Last Sale Zoning Code Enforcement.

The median property tax in New York is 375500 per year for a home worth the median value of 30600000. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

City property owners receive a combined City and School Tax Bill issued around July 1st with the first payment due July 31st. In the City of Rochester properties are assessed at Full Market Value resulting in an Equalization Rate of 100. Look up Monroe County School taxes outside City of Rochester.

That means that homeowners pay far lower property taxes in New York City than other types of property owners. Rochester Town Hall - 50 Scenic Road PO Box 65 Accord NY 12404 Phone. Home buyers and Investors buy the liens in Rochester NY at a tax lien auction or online auction.

The City administers multiple exemption programs that can reduce the property tax. 64 rows City of Rochester. 2020 Tax Rates For Monroe County Villages.

The ratio for other classes of property commercial and apartment buildings is 45. 2021 Town and County Special District Rates print this page email this page back to top. Main Street Rochester NY 14614 Phone.

Look up Rochester City. Installment payments are available.

First Time Home Buyer Programs In Rochester Ny First Time Home Buyers Home Improvement Loans Home Loans

First Time Home Buyer Programs In Rochester Ny First Time Home Buyers Home Improvement Loans Home Loans

Real Estate Agent In Rochester Ny Estate Lawyer Things To Sell Real Estate

Real Estate Agent In Rochester Ny Estate Lawyer Things To Sell Real Estate

Property Tax Assessment Rochester Ny The Tax Opposer

Property Tax Assessment Rochester Ny The Tax Opposer

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

30 32 32 Sheldon Ter Rochester Ny 14619 Zillow

30 32 32 Sheldon Ter Rochester Ny 14619 Zillow

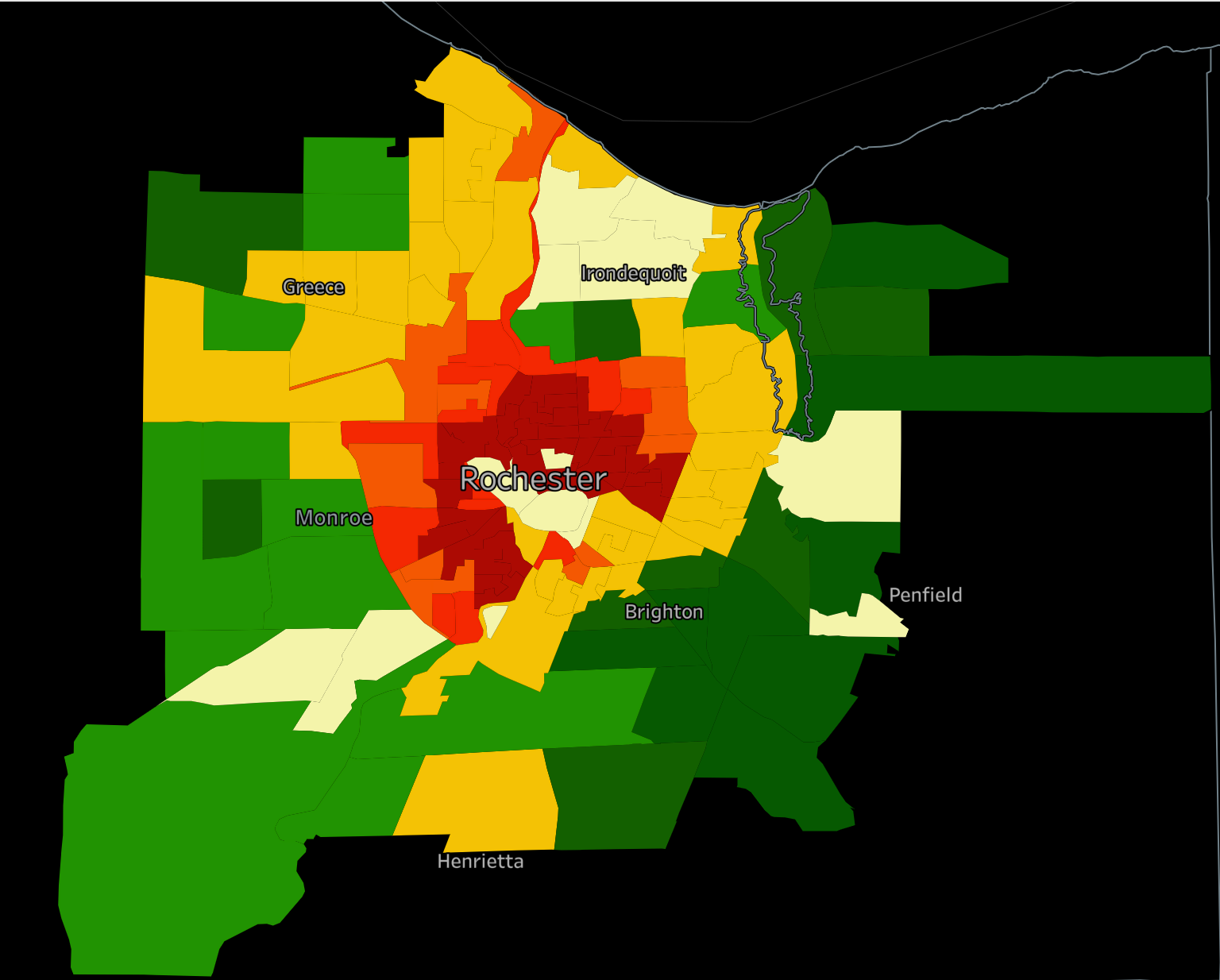

Home Assessments Up 19 Across Rochester News City News Arts Life

Home Assessments Up 19 Across Rochester News City News Arts Life

Homestead Tax Exemption Florida Orange County Erica Diaz Team Real Estate Tips Tax Exemption Home Buying

Homestead Tax Exemption Florida Orange County Erica Diaz Team Real Estate Tips Tax Exemption Home Buying

Rochester New York Ny Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

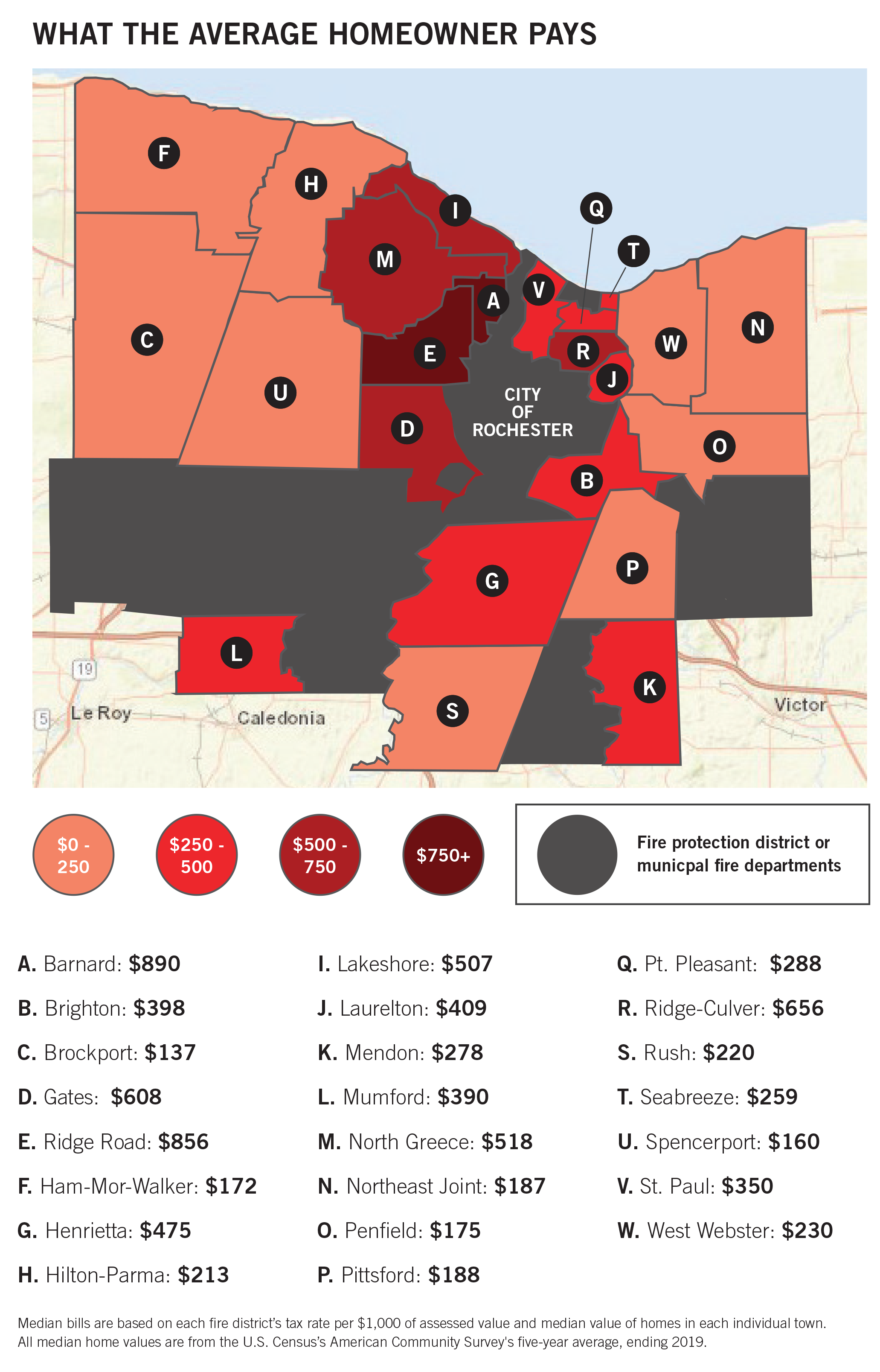

Voter Burnout Overlooked Fire District Elections Come With A Price News City News Arts Life

Voter Burnout Overlooked Fire District Elections Come With A Price News City News Arts Life

725 Arnett Blvd Rochester Ny 14619 Realtor Com

725 Arnett Blvd Rochester Ny 14619 Realtor Com

Rochester New York Ny Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The Rochester Real Estate Market An Attractive Investment In 2021

The Rochester Real Estate Market An Attractive Investment In 2021

County Tax Rates Grar Greater Rochester Association Of Realtors

County Tax Rates Grar Greater Rochester Association Of Realtors

2910 Brighton Henrietta Town Line Rd Rochester Ny 14623 Zillow

2910 Brighton Henrietta Town Line Rd Rochester Ny 14623 Zillow

106 Comfort St Rochester Ny 14620 Realtor Com

106 Comfort St Rochester Ny 14620 Realtor Com

Robbie Jm Allen Homes New Home Builders Home Insurance Robbie

Robbie Jm Allen Homes New Home Builders Home Insurance Robbie

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Property Management Company Rochester Ny In 2021 Property Management Investment Property For Sale Real Estate Management

Property Management Company Rochester Ny In 2021 Property Management Investment Property For Sale Real Estate Management

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home