How To File Taxes For Llc In Dc

District of Columbia corporations are subject to DCs corporate franchise tax. Your choice will directly influence the tax filing rules you are subject to.

Income Tax Return Filing Consultants In Mumbai Income Tax Return Income Tax Income Tax Return Filing

Income Tax Return Filing Consultants In Mumbai Income Tax Return Income Tax Income Tax Return Filing

1000 if they exceed 1 million.

How to file taxes for llc in dc. Important District of Columbia Real Property Tax Filing Deadline Extensions - Learn more here. Certificate of Organization will be issued upon successful filing of articles of organization. Walk-in Customers will be charged expedited fee for one day service in the amount of 100 in addition to regular filing fees.

To register domestic limited liability company in the District customer shall deliver articles of organization form DLC-1 to the Superintendent for filing either by web or by mail walk-in. Must file Form D-20 with the DC. Or otherwise receive income from sources within DC.

Certified copy of filing. District of Columbia LLCs and foreign LLCs registered in the District must submit a report biannually with the Department of Consumer and Regulatory Affairs along with a registration fee of 300. A District of Columbia LLC with 2 or more Members is taxed like a Partnership by the IRS.

If you are a sole proprietorship you must file Self-Employment Tax Form 1040 Schedule SE. You only pay federal income tax on your Washington DC LLC profits that you take out of the business less certain deductions and allowances. Tax reporting for DC LLCs Partnerships Corporations LLCs Partnerships and Sole Proprietorships subject to DC Franchise tax file an unincorporated franchise tax return form D-30.

Filing Federal Employment Taxes. 30 rows Domestic Foreign Limited Liability Company. If your LLC owns or holds personal property in the District of Columbia you must file a Personal Property Tax return.

A Limited Liability Company LLC is a business structure allowed by state statute. You will need to file articles of organization form DLC-1 to form a new LLC. For faster service please use our online portal MyTaxDCgov.

Other things being equal your corporation will owe District of Columbia corporate franchise tax in the amount of 41250 825 of 500000. This can be filed online and the cost is 220 one-time filing fee. We are currently experiencing higher than normal wait times and apologize for any inconvenience.

Owners of an LLC are called members. Articles of Organization and filing fee. Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company.

If you operate your business using a limited liability company LLC then you have more flexibility in choosing how the IRS taxes your business earnings. Forming an LLC in DC requires filing an Articles of Organization. Forming an LLC is the optional step in regulatory compliance.

The amount of income tax you pay depends on your earnings current income tax brackets deductions and how you file. The K-1 is then attached to the owners personal income tax return Form 1040. The minimum payable tax is 250 if gross DC.

Please consult a corporate attorney or CPA to get legal advice. There is no set of tax rules that specifically apply to LLCs. You need to file your LLC taxes when your business brings in money either through revenue or a loan or when it is eligible for a deduction or tax credit.

Check your state laws to determine. The Corporate Franchise Tax Corporations that carry on or engage in a business or trade in DC. Receipts are 1 million or less.

By filing annual. For more information on state LLC tax registration check Nolos article District of Columbia LLC Annual Filing Requirements. While you must file you are exempt from paying the tax if your personal property value is less than 225000.

DC resident owners partners or members can subtract on their personal DC returns any income that is also taxed on a DC franchise tax return. We recommend filing this online since its much easier and has a faster approval time than filing your Articles of Organization by mail. Office of Tax and Revenue.

The IRS allows the LLC to use partnership corporate or sole proprietor tax rules. This includes your tax-free amount plus LLC. Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities.

You can file articles of organization online at httpscorpdcradcgov. For the 2018 tax year your District of Columbia corporation had taxable income of 500000. Heres some of filing requirements as listed in the DC tax instructions.

Are there exemptions to paying DCs Personal Property Tax. If your LLC has employees file Employers Annual Federal Unemployment FUTA Tax Return and either Employers QUARTERLY Federal Tax Return or Employers ANNUAL Federal Tax Return. You must also pay regular federal income tax on any earnings you take out of your Washington DC LLC.

In LLCPartnership taxation the LLC is a tax-reporting entity and has to file its own federal informational return Form 1065 and issue K-1s to each Member reporting their share of the profits.

District Of Columbia Sales Tax Small Business Guide How To Start An Llc

District Of Columbia Sales Tax Small Business Guide How To Start An Llc

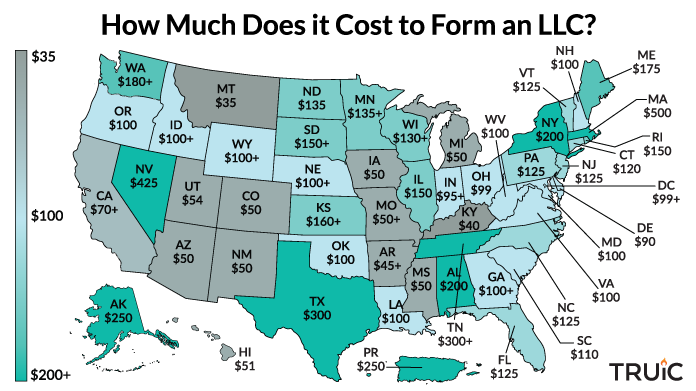

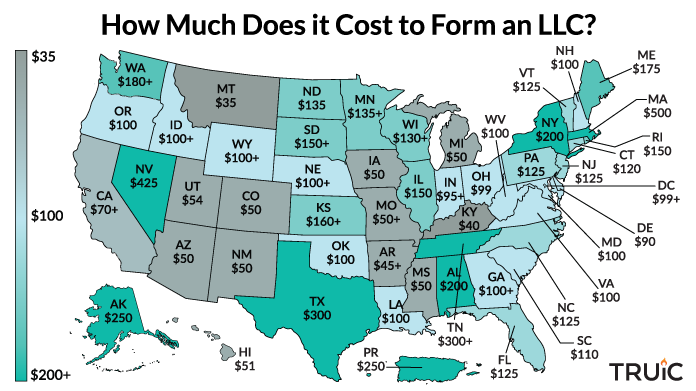

Llc Cost How Much Does It Cost To Start An Llc Truic

Llc Cost How Much Does It Cost To Start An Llc Truic

Ohio Llc Steps To Form An Llc In Ohio

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Free Federal State Tax Prep And Filing For Active Duty Military Win A Trip For 2 To Wash D C On Memorial Day Www Afbn Us Win A Trip Active Duty Washing Dc

Free Federal State Tax Prep And Filing For Active Duty Military Win A Trip For 2 To Wash D C On Memorial Day Www Afbn Us Win A Trip Active Duty Washing Dc

Pt Money S Income Tax Preparation Checklist Download Pt Money Tax Preparation Income Tax Preparation Tax Prep Checklist

Pt Money S Income Tax Preparation Checklist Download Pt Money Tax Preparation Income Tax Preparation Tax Prep Checklist

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Llc Tax Filing What You Need To Know As A Solo Entrepreneur Llc Taxes Filing Taxes Tax

Llc Tax Filing What You Need To Know As A Solo Entrepreneur Llc Taxes Filing Taxes Tax

Stumped How To Form A Virginia Llc The Easy Way

An Extension To File Your Taxes Is Not An Extension To Pay Tax Attorney Nick Nemeth Tax Attorney Filing Taxes Irs Taxes

An Extension To File Your Taxes Is Not An Extension To Pay Tax Attorney Nick Nemeth Tax Attorney Filing Taxes Irs Taxes

Llc Vs S Corp What S The Difference Truic

Llc Vs S Corp What S The Difference Truic

Get To Know How To Set Up An Llc Start Your Successful Business In The Us Http Blog Invoiceber Small Business Organization Llc Business Business Checklist

Get To Know How To Set Up An Llc Start Your Successful Business In The Us Http Blog Invoiceber Small Business Organization Llc Business Business Checklist

New Tax Laws 2020 Tax Consulting Income Tax Business Tax

New Tax Laws 2020 Tax Consulting Income Tax Business Tax

Does My Llc Need To File A Tax Return Even If It Had No Activity Small Business Tax Small Business Finance Business Tax

Does My Llc Need To File A Tax Return Even If It Had No Activity Small Business Tax Small Business Finance Business Tax

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

How To File Your Monthly Taxes Taxtime Bookkeeping Business Small Business Bookkeeping Business Tax

How To File Your Monthly Taxes Taxtime Bookkeeping Business Small Business Bookkeeping Business Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home