Property Tax Exemptions Travis County

1 day agoMoving past Travis County data dispute. In-depth Travis County TX Property Tax Information.

Horse Property For Sale In Fort Bend County Texas Rare Ag Exempt Unrestricted 5 Acre Horse Ranch In Fort Bend Count Horse Ranch Horse Facility Horse Property

Horse Property For Sale In Fort Bend County Texas Rare Ag Exempt Unrestricted 5 Acre Horse Ranch In Fort Bend Count Horse Ranch Horse Facility Horse Property

Other taxing units may adopt this exemption and determine its amount.

Property tax exemptions travis county. Theater School Property Tax Exemption. Learn how you can pay delinquent property taxes. Person Age 65 or Older or Surviving Spouse Exemption.

A veteran who was disabled while serving with the US. Learn More Pay Property Taxeslaunch. Tax Code Section 1113b requires school districts to offer a 25000 exemption on residence homesteads and Tax Code Section 1113n allows any taxing unit the option to decide locally to offer a separate residence homestead exemption of up to 20 percent of a propertys appraised value.

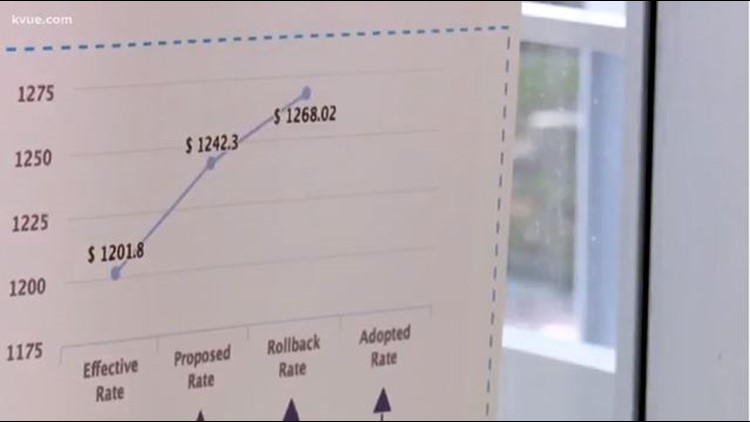

If the county grants an optional exemption for homeowners age 65 or older or disabled the. Travis county adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate. Surviving Spouse of a Disabled Veteran of Member of the Armed Service who was Killed in Action.

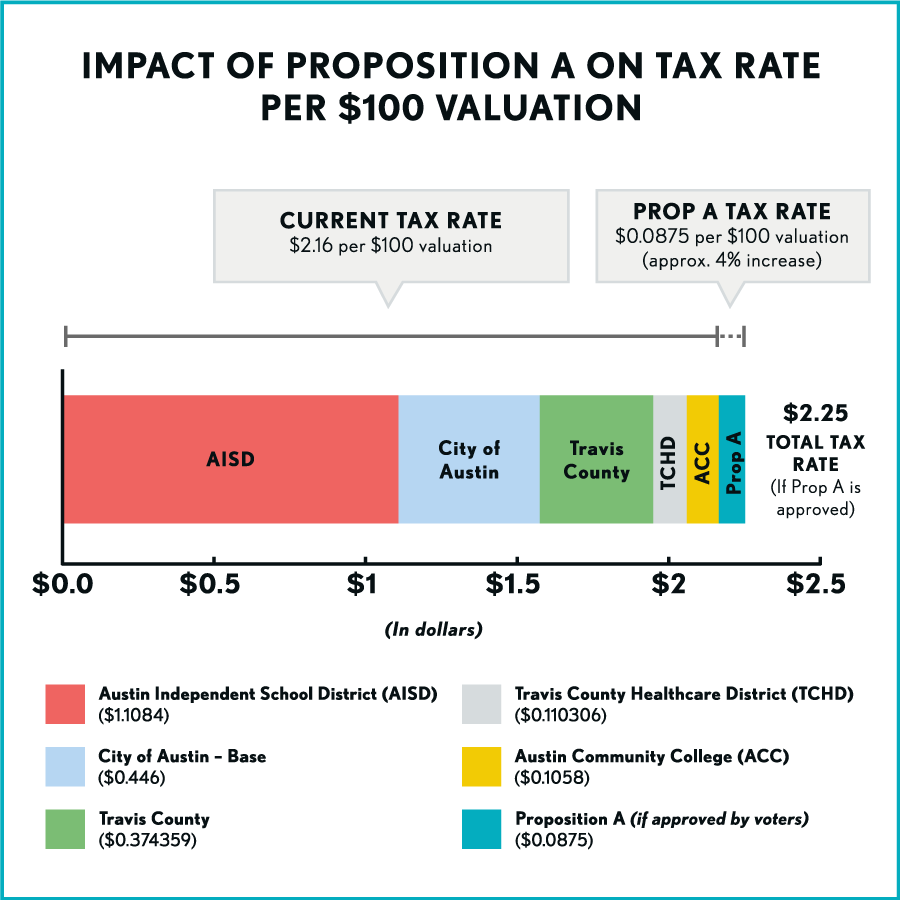

The numbers are important because theyre used to calculate property taxes. Private School Property Tax Exemption. The tax rate will effectively be raised by 36 percent and will raise taxes for maintenance and operations on a 100000 home by approximately 1100.

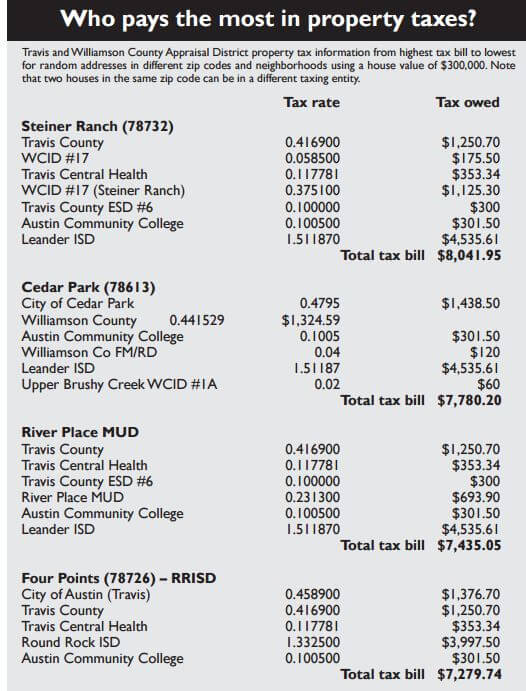

Property Tax in Williamson County. For Williamson County the property tax rate is 0418719 per 100 valuation for the 2020-21 year. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County.

Notices of Appraised Value are being mailed out to 389530 Travis County property owners this week. The homestead exemption is just one way to lower your property taxes as a Travis County homeowner. You may qualify for a property tax deduction if you are either.

Learn More Pay Property Taxeslaunch. Travis County Property Tax Exemptions Help Save Money in Texas Travis County suffers from the same property tax woes that beset the rest of the state of Texas. Travis Countys median home value was 354622.

If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax. Travis County offers a 20 homestead exemption the maximum allowed by law. By state law this exemption is 25000 for school districts.

The Commissioners Court also offers an additional 85500 exemption for homesteads of those 65 years and older or are disabled. If a property is valued at 400000 property taxes will cost the owner 167488. Learn how you can pay current property taxes.

All residence homestead owners are allowed a 25000 homestead exemption from their homes value for school district taxes. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP.

An over 65 exemption is available to property owners the year they become 65 years old. The tax examples below are based on Leander tax rates. Fill out our quick three-minute form to get.

For some Travis County residents the 2021 property appraisals also will end a one-year respite in hikes to. You can use this equation to estimate property taxes. Armed forces or the surviving spouse or child under 18 years of age or unmarried of a disabled veteran.

Youth Development Organization Property Tax Exemption. With no state property tax each county is responsible for raising enough funds to pay for the services and amenities it needs resulting in the seventh-highest average property tax rate in the US. Travis Central Appraisal District is responsible for fairly determining the value of all real and business personal property within Travis County Texas.

AUSTIN Texas Travis County property owners can expect to receive their 2021 appraisal notices from the Travis Central Appraisal District TCAD in the coming weeks. Filing a tax protest something we specialize in here at Five Stone can also significantly lower your tax burden as well. Texas law caps increases of tax-assessed value to.

Read more »Labels: county, exemptions, property, travis

.png)