Travis County Property Tax History

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Travis County Property Records TX.

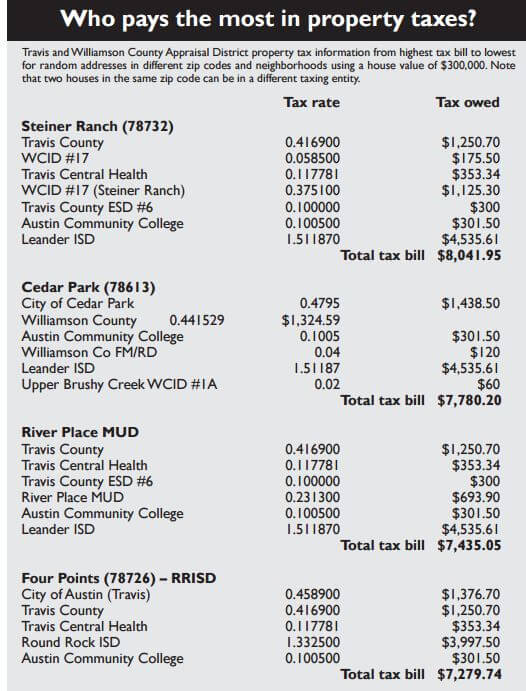

Steiner Residents Pay To More Property Taxable Entities Four Points News

Steiner Residents Pay To More Property Taxable Entities Four Points News

5 days ago.

Travis county property tax history. TRAVIS COUNTY ADOPTED A TAX RATE THAT WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEARS TAX RATE. The Travis Central Appraisal District makes no claims promises or guarantees about the accuracy completeness or adequacy of this information and expressly disclaims. The capitalization rate which the Travis Central Appraisal District will use in the valuation of properties with a Community Housing Development Organization designation is 775.

The Travis County Clerks Recording Division. The Travis County Tax Office makes no warranties or representations whatsoever regarding the quality content completeness accuracy or adequacy of such information and data. Learn More Pay Property Taxeslaunch.

Learn how you can pay delinquent property taxes. Go to Data Online. All information contained herein is considered in the public domain and is distributed without warranty of any kind implied expressed or statutory.

Learn More Pay Property Taxeslaunch. If you know what service you need use the main menu on the left. Learn more about property tax breaks and current and delinquent property.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. Learn how you can pay your property taxes. Propertyshark View All See.

The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. Preserves documents pertaining to real property records including deeds and tax liens Issues marriage licenses and. THE TAX RATE WILL EFFECTIVELY BE RAISED BY 36 PERCENT AND WILL RAISE TAXES FOR MAINTENANCE AND OPERATIONS ON A 100000 HOME BY APPROXIMATELY 1100.

Travis Clerk 512 854 - 9188. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. Travis County Tax Collector 15822 Foothill Farms Loop Pflugerville TX 78660 512-854-9473 Directions.

Go to Data Online. Travis County Property Records are real estate documents that contain information related to real property in Travis County Texas. Records assumed name certificates for new businessesThe Travis County Clerks permanent library contains millions of documents dating from the 1800s to the present.

Pay property taxes by phone with a credit card. This is a 685 increase from the FY2017 Adopted Budget of 701 million. Travis County adopted a General Fund Budget of 749 million.

Travis County Tax Collector 5501 Airport Boulevard Austin TX 78751 512-854-9473 Directions. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. A property owner may file a late application for a homestead exemption after the deadline for filing has passed if it is filed not later than two years after the delinquency date for the taxes on the homestead.

Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Property Tax Data by Property Type TAX RATE.

Pay property taxes by phone with a credit card. In-depth Travis County TX Property Tax Information. Travis Central Appraisal District is responsible for fairly determining the value of all real and business personal property within Travis County Texas.

In the past ten years Assessed Taxable Value increased 808 from 76752007737 to 138775986481 for the City of Austin and 80 from 95269235051 to 171000908622 for Travis County. Learn how you can pay current property taxes. Easily look up your property tax account what you owe print a receipt and pay your property taxes online.

Keep reading to learn more about our services. Go to Data Online. In Travis County property taxes support 127 local government agencies including 21 cities 16 emergency districts the county the hospital district the junior college 54 municipal utility districts 1 road district 15 school districts and 17 water control improvement districts.

Whether your taxes are paid or the balance that is due. Travis Appraisal District 512 834 - 9138. Travis County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps.

The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. Original records may differ from the information on these pages. Historic Aerials 480 967 - 6752.

Get Property Records from 4 Treasurer Tax Collector Offices in Travis County TX. You will be able to find. The Travis County Tax Office reserves the right to make changes at any time without notice.

Travis Tax Office 512 854 - 9473.

How To Find Out Who Owns A Property Or House Travis Cad

How To Find Out Who Owns A Property Or House Travis Cad

As Central Health Prepares Budget During Pandemic Eastern Travis County Residents Seek More Care Austin Monitoraustin Monitor

As Central Health Prepares Budget During Pandemic Eastern Travis County Residents Seek More Care Austin Monitoraustin Monitor

Property Taxes Austin Texas Travis County Property Walls

Property Taxes Austin Texas Travis County Property Walls

Travis Central Appraisal District Traviscentralad Twitter

Travis Central Appraisal District Traviscentralad Twitter

Https Www Traviscad Org Wp Content Uploads 2019 04 2018 Annual Report 20190307 Pdf

Protest Process Travis Central Appraisal District

Protest Process Travis Central Appraisal District

How To Find Out Who Owns A Property Or House Travis Cad

How To Find Out Who Owns A Property Or House Travis Cad

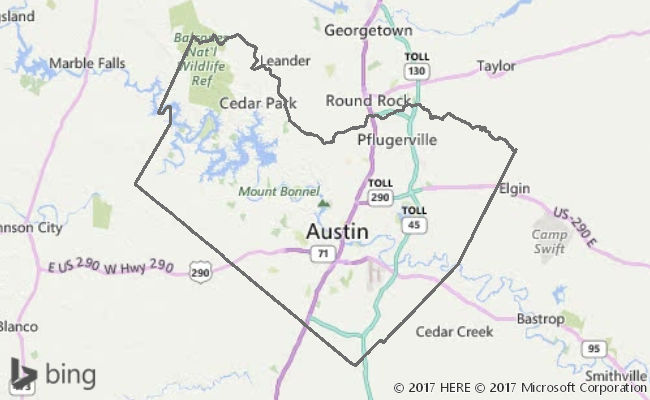

Travis County Texas Property Search And Interactive Gis Map

Travis County Texas Property Search And Interactive Gis Map

Property Taxes Austin Texas Travis County Property Walls

Property Taxes Austin Texas Travis County Property Walls

Http Www Austintexas Gov Edims Document Cfm Id 299922

Austin 2018 Property Tax Rate Map By Zip Code Emily Ross Austin Real Estate

Austin 2018 Property Tax Rate Map By Zip Code Emily Ross Austin Real Estate

Travis County Code Document Viewer

Https Www Traviscad Org Wp Content Uploads 2019 04 2018 Annual Report 20190307 Pdf

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Austin Property Tax Appraisal Map 2008 Crossland Team Austin Tx Real Estate

Map Of Property Tax Rate In Austin By Zip Code Area 2015 Emily Ross Austin Real Estate

Protesting Property Values During Covid 19 Emergency The Austin Bulldog

Protesting Property Values During Covid 19 Emergency The Austin Bulldog

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home