View Property Tax Bill Travis County

Using this service to simply view properties will not incur a fee. If you know what service you need use the main menu on the left.

Why Texas Property Taxes Are Expected To Skyrocket Again This Year San Antonio Business Journal

Why Texas Property Taxes Are Expected To Skyrocket Again This Year San Antonio Business Journal

However if you dont want to wait to receive your bill in the mail or you are ready to pay now you can view your bill on the Travis County Tax Office website here.

View property tax bill travis county. Search for your account using your name street address or account number or six-digit billing number found on your bill. Over the phone at 855-335-3132. At this time of year we receive numerous calls from property owners wanting to know when they will receive their tax bill said Bruce Elfant the Travis County tax.

See what the tax bill is for any Travis County TX property by simply typing its address into a search bar. As Travis County homeowners get the 2021 property appraisal notices for their home over the coming weeks they will confront the double-edged sword that is. 31 deadline whether or not they received a bill.

The tax office said property. Learn More Pay Property Taxeslaunch. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County.

Click Add to Cart Click View Cart Select your payment type. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. You may also print a copy of your Current Secured or Supplemental tax bill by selecting View Tax Info from the Search Results screen and clicking the ViewPrint Bill button.

The tax office said property. State law says property owners are responsible for paying their tax bill by the Jan. Taking into account various assets Williams net worth is greater than 100000 - 249999.

Learn how you can pay current property taxes. Learn how you can pay your property taxes. The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

Property Tax Bill Payment Options. Learn how you can pay delinquent property taxes. Learn More Pay Property Taxeslaunch.

Select your payment method and enter your account information and submit your payment. You will be able to find. Calendar_today Make an appointment.

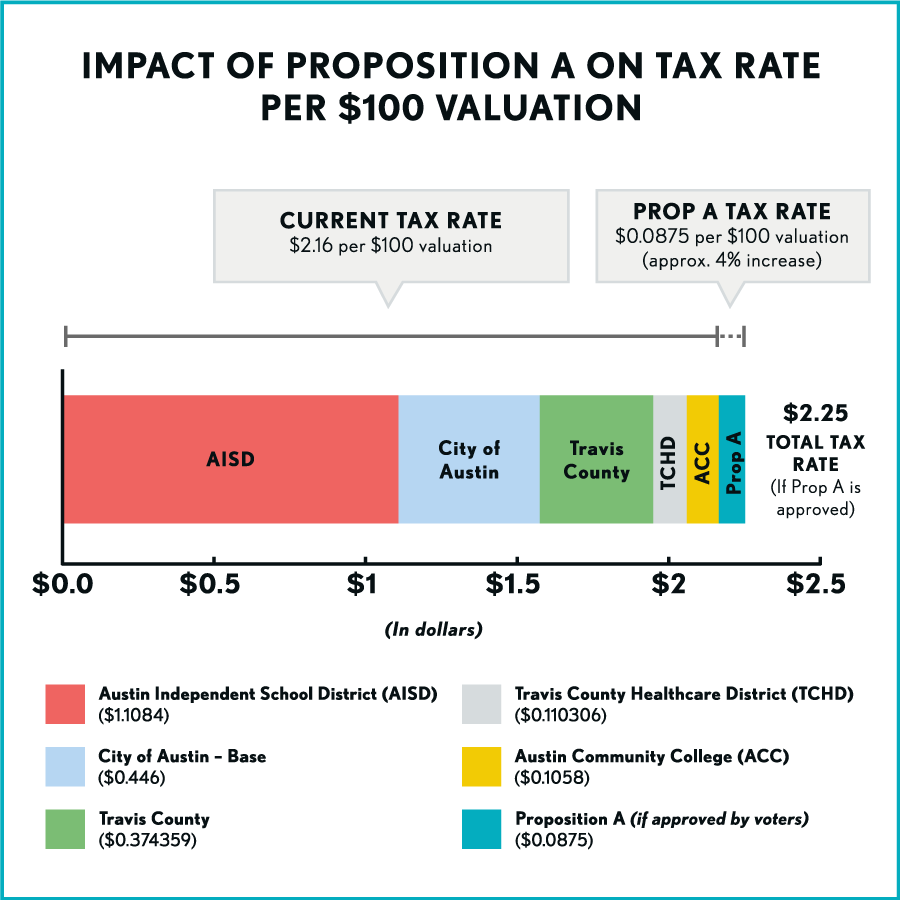

Pay property taxes by phone with a credit card. In Travis County property taxes support 127 local government agencies including 21 cities 16 emergency districts the county the hospital district the junior college 54 municipal utility districts 1 road district 15 school districts and 17 water control improvement districts. Keep reading to learn more about our services.

The accepted payment methods are e-check debit card or credit card. Travis Central Appraisal District is responsible for fairly determining the value of all real and business personal property within Travis County Texas. View and download property tax reports and data.

Go to the Travis County Tax Office shopping cart. It will only be charged when making payments online or over the phone. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. AUSTIN Texas Travis County property owners can now review proposed tax rates and the impact they could have on their property tax bill. And makes between 60 - 69999 a year.

See Travis County TX tax rates tax exemptions for any property the tax assessment history for the past years and more. Travis County TX Property Tax information. 1 day agoView Comments.

Those who have not seen their tax bill may view and print it from the Travis County website. Travis Central Appraisal District. PROPOSED TAX RATES NOW AVAILABLE ONLINE FOR TRAVIS COUNTY PROPERTY OWNERS.

However if you dont want to wait to receive your bill in the mail or you are ready to pay now you can view your bill on the Travis County Tax Office website here. You may pay your property tax bills. Easily look up your property tax account what you owe print a receipt and pay your property taxes online.

Williams personal network of family friends associates neighbors include Kimberly Travis Bill Travis Barbara Travis Leesa Travis and William Rock. Access_time Check wait times. Print a copy of your receipt for your records.

The capitalization rate which the Travis Central Appraisal District will use in the valuation of properties with a Community Housing Development Organization designation is 775. For questions about property tax bills and collections call the Property Tax Assistance Divisions Information Services Team at 512-305-9999 or 1-800-252-9121 press 2. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County.

All information contained herein is considered in the public domain and is distributed without warranty of any kind implied expressed or statutory.

Read more ».png)