Property Tax Receipt Travis County

These are local taxes based on the value of the property that help to pay for public schools city streets county roads police fire protection and many other services. The property tax account is being reviewed prior to billing.

Travis County Code Document Viewer

In-depth Travis County TX Property Tax Information.

Property tax receipt travis county. Travis county adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate. The tax rate will effectively be raised by 36 percent and will raise taxes for maintenance and operations on a 100000 home by approximately 1100. The Hays County Tax Office also collects property taxes for all other taxing jurisdictions school districts cities and special districts.

Property taxes are the primary source of government revenue in Texas. Travis County Tax Office. Learn how you can pay current property taxes.

The Williamson County Tax Assessor-Collectors office currently handles the following. In Travis County property taxes support 127 local government agencies including 21 cities 16 emergency districts the county the hospital district the junior college 54 municipal utility districts 1 road district 15 school districts and 17 water control improvement districts. Central Standard Time on January 31 are considered timely.

The 2020 property taxes are due January 31 2021. Buyers and sellers use tax certificates to show that there are no taxes due and property owners may be required to provide a tax certificate when applying for a permit. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP.

You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. All information contained herein is considered in the public domain and is distributed without warranty of any kind implied expressed or statutory. Jenifer OKane PCC Hays County Tax Assessor-Collector.

Many changes have been made to the property tax exemption and deferral programs for seniors people with disabilities and military veterans with a service-connected disability. Travis Central Appraisal District is responsible for fairly determining the value of all real and business personal property within Travis County Texas. Funds must be from a US.

The Tax Assessor-Collector is the constitutional office directed to assess and collect all ad valorem tax accounts as identified and valued by the Hays Central Appraisal District CAD. Learn how you can pay delinquent property taxes. Payments made online by 1159 pm.

Learn More Pay Property Taxeslaunch. A property owner may file a late application for a homestead exemption after the deadline for filing has passed if it is filed not later than two years after the delinquency date for the taxes on the homestead. For only 1 property taxes are paid by eCheck and those using the system are automatically emailed a receipt.

December 19 2018 Today is the last day to pay your property taxes online to receive a receipt for income tax purposes. Learn More Pay Property Taxeslaunch. Costs 1 to use.

The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. Credit and debit cards. This is the safe easy and fast way to pay said Bruce Elfant the Travis County tax assessor-collector.

The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. Instead of a fixed amount the annual income limit is now indexed at 65 of the median household income in King County which for 2019 was 58423. The tax rate will effectively be raised by 36 percent and will raise taxes for maintenance and operations on a 100000 home by approximately 1100.

The capitalization rate which the Travis Central Appraisal District will use in the valuation of properties with a Community Housing Development Organization designation is 775. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. A new online tax office feature allows property owners to schedule when they want their bill paid.

You will immediately receive an emailed receipt. You can pay your property tax online using an eCheck a credit or debit card or PayPal. Travis county adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate.

Travis County Code Document Viewer

Tx 188033 1 Travis County Complete Legal Document Online Us Legal Forms

Tx 188033 1 Travis County Complete Legal Document Online Us Legal Forms

Https Www Traviscad Org Wp Content Uploads 2019 09 Fy 2020 Adopted Budget Pdf Pdf

Travis County Texas Property Search And Interactive Gis Map

Travis County Texas Property Search And Interactive Gis Map

New Website Tracks How Much You Ll Pay In Travis Co Property Taxes Kvue Com

New Website Tracks How Much You Ll Pay In Travis Co Property Taxes Kvue Com

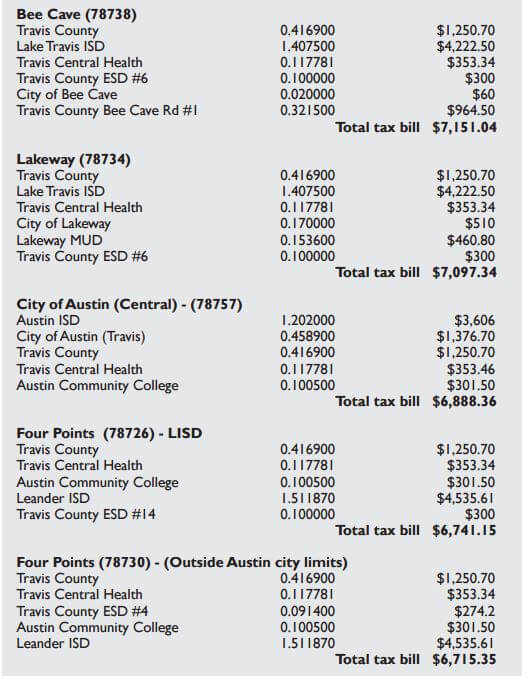

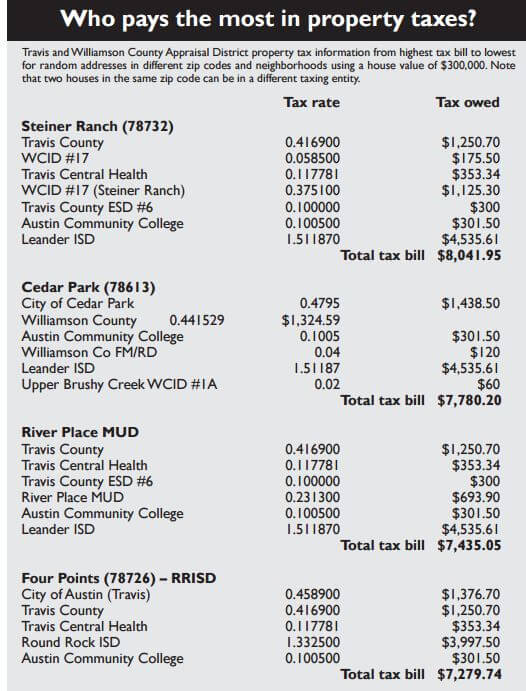

Steiner Residents Pay To More Property Taxable Entities Four Points News

Steiner Residents Pay To More Property Taxable Entities Four Points News

Https Theaustinbulldog Org Download 1348 Pablo Ornelas Jr And Ofilia Ornelas 2386 Travis County Tax Bills For The Ornelas Homes Pdf

Https Www Traviscad Org Wp Content Uploads 2019 04 2018 Annual Report 20190307 Pdf

Everything You Need To Know About Travis County Property Tax

Everything You Need To Know About Travis County Property Tax

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Property Tax Protests On The Rise As Home Values Increase Community Impact Newspaper

Property Tax Protests On The Rise As Home Values Increase Community Impact Newspaper

Data How Much Is Austin S Median Homeowner Paying In Property Taxes Community Impact Newspaper

Data How Much Is Austin S Median Homeowner Paying In Property Taxes Community Impact Newspaper

Steiner Residents Pay To More Property Taxable Entities Four Points News

Steiner Residents Pay To More Property Taxable Entities Four Points News

Funding Project Connect By Capital Metro Capital Metro Austin Public Transit

Funding Project Connect By Capital Metro Capital Metro Austin Public Transit

Austin Voters Ask How Much With Project Connect Raise My Taxes Austonia

Austin Voters Ask How Much With Project Connect Raise My Taxes Austonia

Travis County Code Document Viewer

Travis County Code Document Viewer

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Https Www Traviscad Org Wp Content Uploads 2018 10 Fy 2019 Budget Pdf Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home