Travis County Home Property Tax

All information contained herein is considered in the public domain and is distributed without warranty of any kind implied expressed or statutory. Property Tax Data by Property Type TAX RATE.

Property tax payment methods online You can pay your property tax online using an eCheck a credit or debit card or PayPal.

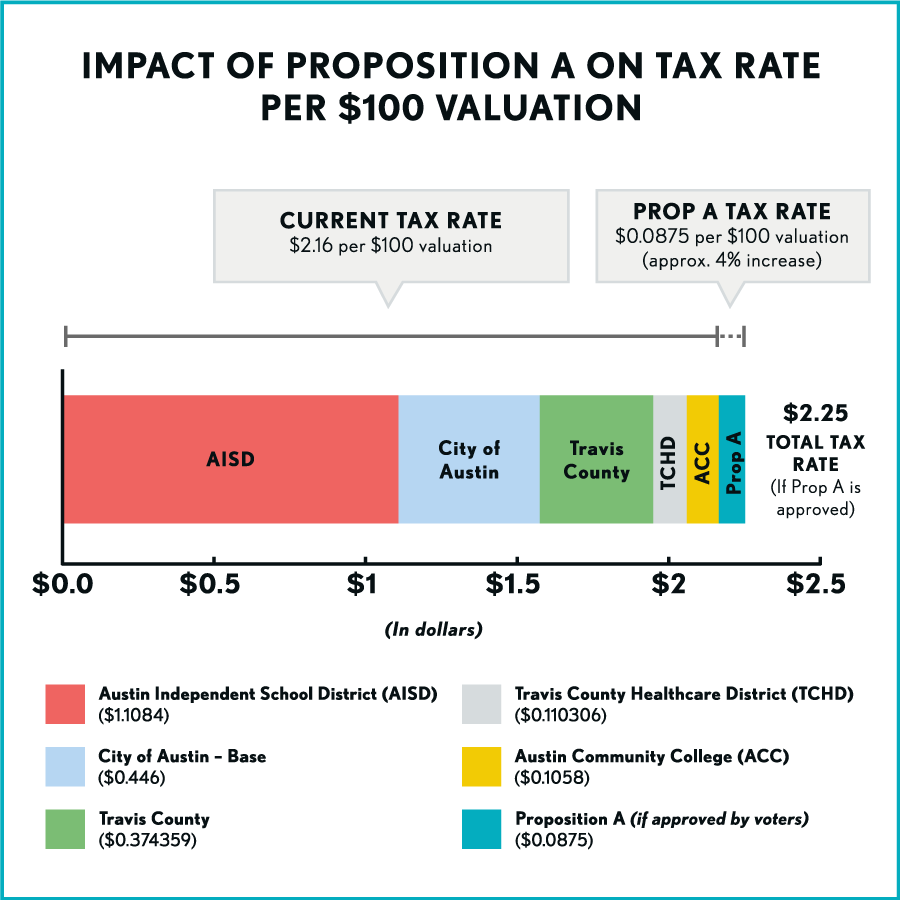

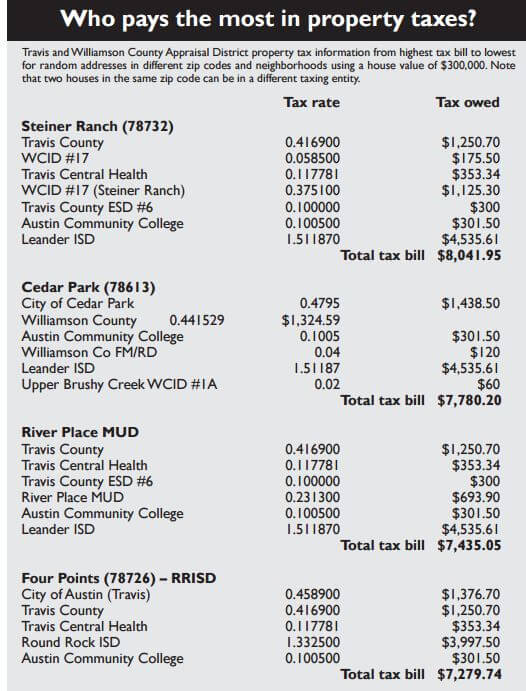

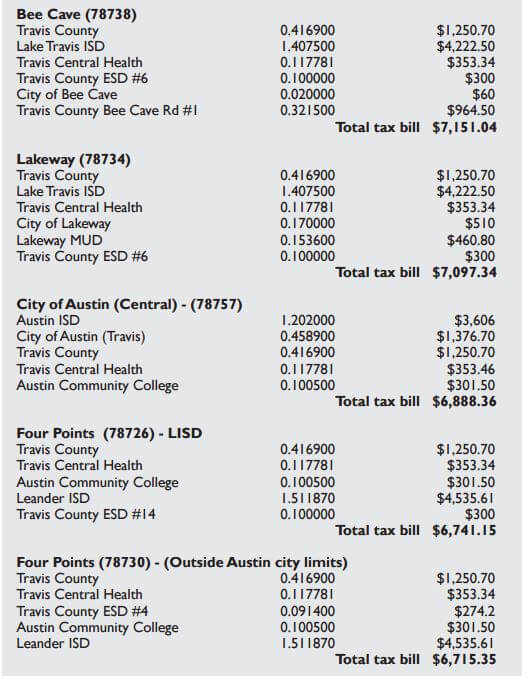

Travis county home property tax. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The numbers are important because theyre used to calculate property taxes. Austins property tax rates while not the highest are among the highest in Texas.

Easily look up your property tax account what you owe print a receipt and pay your property taxes online. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. 1 day agoAs Travis County homeowners get the 2021 property appraisal notices for their home over the coming weeks they will confront the double-edged sword that is Austins housing market.

Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

AUSTIN Texas Travis County property owners can expect to receive their 2021 appraisal notices from the Travis Central Appraisal District TCAD in the coming weeks. In 2020 Travis Countys median home value was 354622. If you know what service you need use the main menu on the left.

This year TCAD says it has reached 413403. The capitalization rate which the Travis Central Appraisal District will use in the valuation of properties with a Community Housing Development Organization designation is 775. TRAVIS COUNTY ADOPTED A TAX RATE THAT WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEARS TAX RATE.

Notices of Appraised Value are being mailed out to 389530 Travis County property owners this week. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

If you own and occupy your home as of January 1 st of the year you may be eligible for the general residential homestead exemption. You will be able to find. Travis Central Appraisal District is responsible for fairly determining the value of all real and business personal property within Travis County Texas.

The median property taxes paid in Austin come to around 6600 annually. In-depth Travis County TX Property Tax Information. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

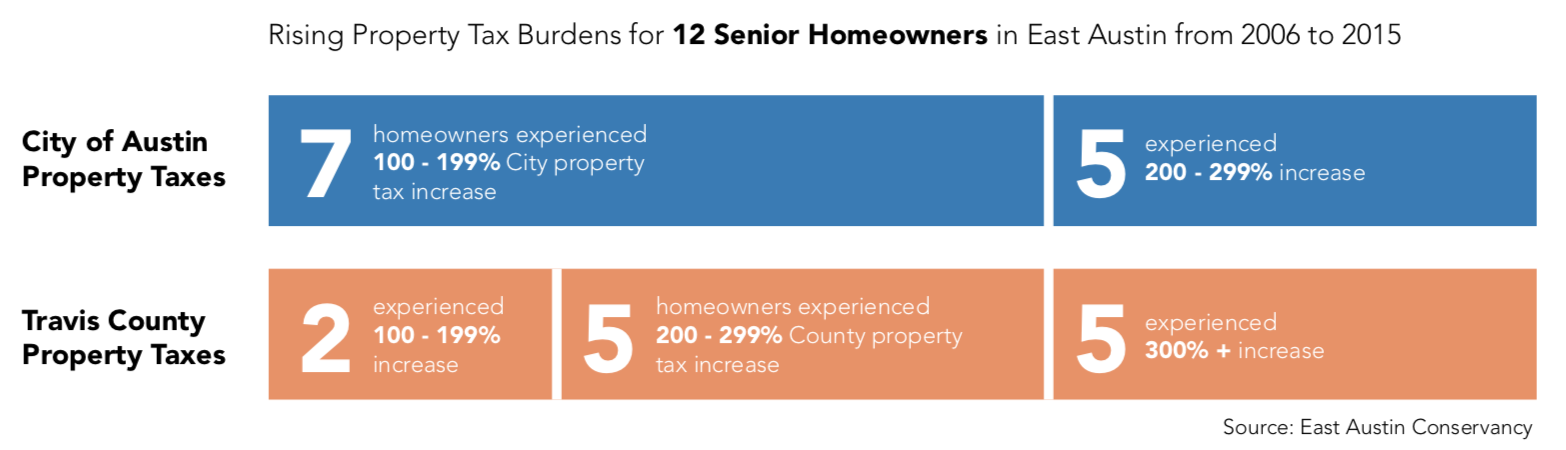

Austinites are charged around 223 per 100 of taxable value in Travis county and 234 per 100 of taxable value in Williamson county. Exemptions are also available for disabled veterans seniors over the age of 65 people with qualifying disabilities and some surviving spouses. THE TAX RATE WILL EFFECTIVELY BE RAISED BY 36 PERCENT AND WILL RAISE TAXES FOR MAINTENANCE AND OPERATIONS ON A 100000 HOME BY APPROXIMATELY 1100.

TRAVIS COUNTY ADOPTED A TAX RATE THAT WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEARS TAX RATE. The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. Keep reading to learn more about our services.

THE TAX RATE WILL EFFECTIVELY BE RAISED BY 36 PERCENT AND WILL RAISE TAXES FOR MAINTENANCE AND OPERATIONS ON A 100000 HOME BY APPROXIMATELY 1100. The Travis Central Appraisal District makes no claims promises or. Learn how you can pay your property taxes.

You will immediately receive an emailed receipt. A homestead exemption is a legal provision that can help you pay less taxes on your home. Meet Your Commissioners Court.

In Travis County property taxes support 127 local government agencies including 21 cities 16 emergency districts the county the hospital district the junior college 54 municipal utility districts 1 road district 15 school districts and 17 water control improvement districts. Pay property taxes by phone with a credit card.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home