Travis County Property Tax Liens

Travis county adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate. 800 AM - 500 PM Monday - Friday 512 854-9188 Divisions at this Location.

Horse Property For Sale In Fort Bend County Texas Rare Ag Exempt Unrestricted 5 Acre Horse Ranch In Fort Bend Count Horse Ranch Horse Facility Horse Property

Horse Property For Sale In Fort Bend County Texas Rare Ag Exempt Unrestricted 5 Acre Horse Ranch In Fort Bend Count Horse Ranch Horse Facility Horse Property

Texas law authorizes the sale of tax deed properties at the Travis County tax deed sale auction on the first Tuesday of each month.

Travis county property tax liens. Bidders should research each property carefully as they may find other liens against the property besides the tax debt. Keep reading to learn more about our services. Travis County Property Records are real estate documents that contain information related to real property in Travis County Texas.

The certificate is then auctioned off in Travis County TX. The Travis County Clerks permanent library contains millions of documents dating from the 1800s to the present. When a Travis County TX tax lien is issued for unpaid past due balances Travis County TX creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties.

Travis County Texas relies on the revenue generated from real estate property taxes to fund daily services. Easily look up your property tax account what you owe print a receipt and pay your property taxes online. If you know what service you need use the main menu on the left.

Currently Texas law does not permit the sale of tax lien certificates in Travis County. Travis county adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate. To calculate property taxes in Travis County property value must first be assessed by the county.

Truth in taxation summary. Civil Probate Misdemeanor Records Management Texas Public Information Act Requests. The buyer of the tax lien has the right to collect the lien plus interest based on the official specified interest rate from the property owner.

Travis county adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate. Learn how you can get a property tax break. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

The annual interest rate during the deferral or abatement period is eight percent instead of the rate provided by Section 3301. Travis County Texas Tax Sale. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

It includes the amount of delinquent taxes penalties interests and any known costs and expenses due if the taxes are delinquent. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Buyers and sellers use tax certificates to show that there are no taxes due and property owners may be required to provide a tax certificate when applying for a permit.

512 238-VOTE 8683 Election Division. The tax rate will effectively be raised by 36 percent and will raise taxes for maintenance and operations on a 100000 home by approximately 1100. The tax rate will effectively be raised by 36 percent and will raise taxes for maintenance and operations on a 100000 home by approximately 1100.

Learn about taxation rates and laws. Learn more about tax certificates. The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

Travis Central Appraisal District is responsible for fairly determining the value of all real and business personal property within Travis County Texas. Preserves documents pertaining to real property records including deeds and tax liens Issues marriage licenses and. 512 854-9188 24 Hour Voter Hotline.

Each property sold as is with no expressed or implied warranties of any kind including merchantability and fitness for a particular use. Each county has a central authority that is responsible for appraising the value of property. The tax rate will effectively be raised by 36 percent and will raise taxes for maintenance and operations on a 100000 home by approximately 1100.

Travis County Courthouse 1000 Guadalupe Street Austin TX Dana DeBeauvoir Travis County Clerk PO. The Travis County Clerks Recording Division. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP.

Foreclosure is a legal action the county takes as its final effort to collect delinquent property taxes. You can bid on these properties at public sales. The tax is based on the taxable value of the property which is the assessed value minus any deductions or exemptions.

512 854-4996 Misdemeanor Division. Anyone can request a tax certificate. Box 149325 Austin TX 78714 Hours.

In-depth Travis County TX Property Tax Information. You will be able to find. Records assumed name certificates DBAs for new businesses.

G A tax lien remains on the property and interest continues to accrue during the period collection of delinquent taxes is deferred or abated under this section. The Travis County Clerk maintains the countys records administers elections and oversees legal documentation such as property deeds marriage licenses and assumed name certificates. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

Payment Options Payment Options Peanut Butter Fudge

Payment Options Payment Options Peanut Butter Fudge

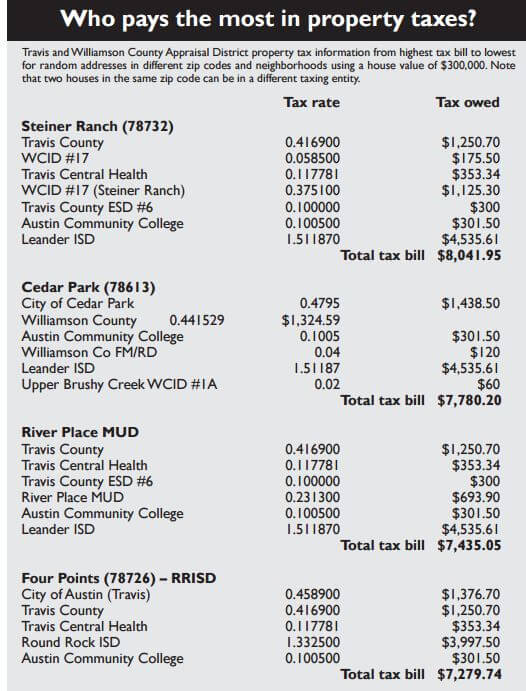

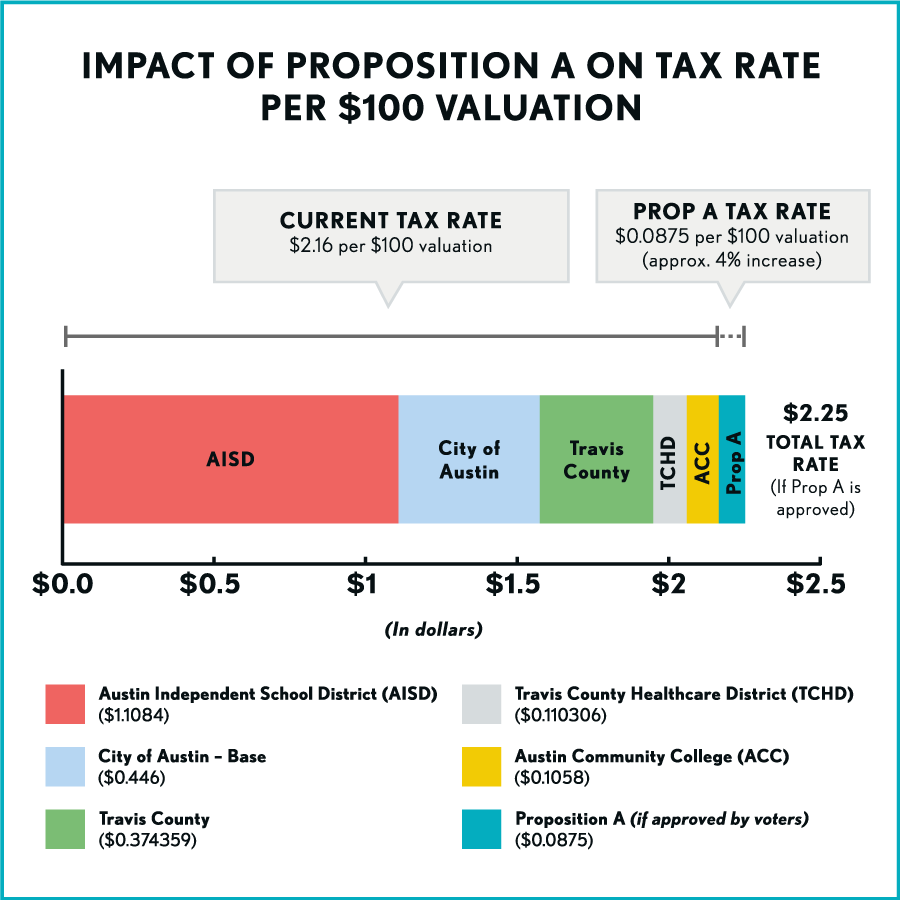

Steiner Residents Pay To More Property Taxable Entities Four Points News

Steiner Residents Pay To More Property Taxable Entities Four Points News

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Travis Central Appraisal District Appraisal Property Search Informative

Travis Central Appraisal District Appraisal Property Search Informative

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Land For Sale Vacant Land For Sale

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Land For Sale Vacant Land For Sale

The Austin Region Has Over 163 549 Apartments In 60 Cities Towns 94 Different Zip Codes 16 Public Scho Austin Apartment Finding Apartments Austin Real Estate

The Austin Region Has Over 163 549 Apartments In 60 Cities Towns 94 Different Zip Codes 16 Public Scho Austin Apartment Finding Apartments Austin Real Estate

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Texas Land Rural Land

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Texas Land Rural Land

How Healthy Are Williamson And Travis Counties Community Impact Newspaper Https Communityimpact Com Community Austin Roun Travis County Health Care County

How Healthy Are Williamson And Travis Counties Community Impact Newspaper Https Communityimpact Com Community Austin Roun Travis County Health Care County

Map Of Property Tax Rate In Austin By Zip Code Area 2015 Emily Ross Austin Real Estate

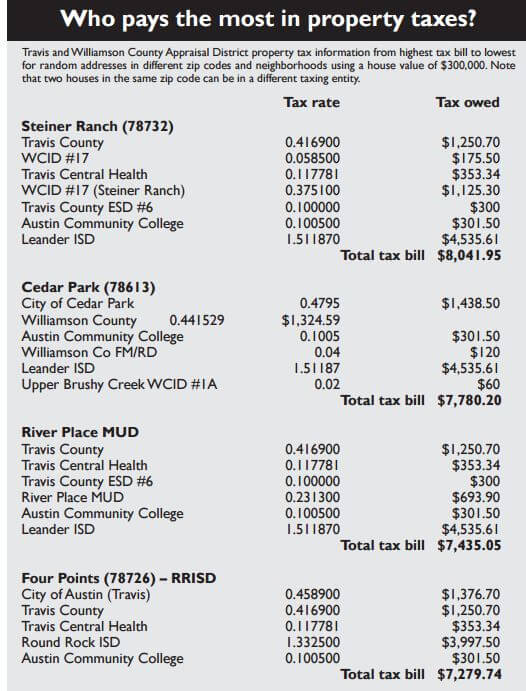

2020 Mobility Elections Proposition A Austintexas Gov

2020 Mobility Elections Proposition A Austintexas Gov

Austin 2018 Property Tax Rate Map By Zip Code Emily Ross Austin Real Estate

Austin 2018 Property Tax Rate Map By Zip Code Emily Ross Austin Real Estate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Wood County Texas Land

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land For Sale Wood County Texas Land

Steiner Residents Pay To More Property Taxable Entities Four Points News

Steiner Residents Pay To More Property Taxable Entities Four Points News

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Undeveloped Land Texas Land For Sale Acre

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Undeveloped Land Texas Land For Sale Acre

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land Texas Land For Sale Real Estate Investing

Texas Land For Sale Real Estate Investment Property In Tx High Value Wholesale Texas Land Texas Land For Sale Real Estate Investing

Commercial Real Estate Sales And Property Management Commercial Real Estate Property Management Real Estate Sales

Commercial Real Estate Sales And Property Management Commercial Real Estate Property Management Real Estate Sales

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home