Property Tax Rate Franklin County Tn

Tennessee is ranked 1934th of the 3143 counties in the United States in order of the median amount of property taxes collected. Williamson County - TN disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data.

All property taxes real and personal are payable October 1 and shall become delinquent March 1 of each year.

Property tax rate franklin county tn. The median property tax on a 11070000 house is 75276 in Franklin County. 1320 West Main Street Suite 203 Franklin TN 37064 Phone. Property Taxes No Mortgage 7187900.

Property Record Cards. Data on this site exists for 84 of Tennessees 95 counties. The taxing jurisdictions that levy taxes on all Franklin citizens are Milwaukee County City of Franklin Milwaukee Metropolitan Sewerage District MMSD and Milwaukee Area Technical College MATC.

The information presented on this site is used by county Assessors of Property to assess the value of real estate for property tax purposes. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. As of April 16 Franklin County TN shows 11 tax liens.

You may now access historical property tax information for the cities of Brentwood Franklin Nolensville and Thompson Station HERE. Franklin County Property Tax Collections Total Franklin County Tennessee. 11 rows County Total.

Tennessee has some of the lowest property taxes in the US. The average effective property tax rate in Tennessee is 064. 550 Total Property Tax.

Delinquent tax refers to a tax that is unpaid after the payment due date. Property tax information last updated. View an Example Taxcard.

Comptroller of the Treasury Jason E. In October of each year tax notices for real and personal property are mailed out to property owners as recorded by deed on January 1 of that taxing year. Pay Property Taxes Online in Franklin County Tennessee using this service.

This website gives you the ability to view search and pay taxes online and is beneficial for all taxpayers locally and worldwide. Links are provided at the bottom of this page for the counties not included here which are Bradley Chester Davidson Hamilton Hickman Knox. City of Franklin Property Tax.

Interested in a tax lien in Franklin County TN. The median property tax also known as real estate tax in Franklin County is 75300 per year based on a median home value of 11070000 and a median effective property tax rate of 068 of property value. Property Taxes Mortgage 7142700.

When a Franklin County TN tax lien is issued for unpaid past due balances Franklin County TN creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. Other governmental bodies that can levy taxes on some of Franklin citizens are the Franklin School District Oak Creek-Franklin Joint School. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Franklin County Tax Appraisers office.

Get information on a Franklin County property and view your. 10440 Williamson County Rate. Please call 615 790-5709 if you need additional information.

This service gives you the freedom to pay and search 24 hours a day 7 days a. The median annual property tax paid by homeowners in Tennessee is 1220 about half the national average. Franklin Only not in FSSD 04176.

Submit a report online here or. The Assessor creates and maintains an individual property record card on every parcel of property in the county approximately 25000. Franklin County collects on average 068 of a propertys assessed fair market value as property tax.

The median property tax on. 615-790-5463 Monday - Friday. 22000 Williamson County Tax.

These records are updated weekly by the State of Tennessee Local Assessor System for web viewing. The median property tax in Franklin County Tennessee is 753 per year for a home worth the median value of 110700. PaySearch Property Taxes Welcome to the Tennessee Trustee Tax Payment Solution Service.

How does a tax lien sale work. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. April 16 2021 You may begin by choosing a search method below.

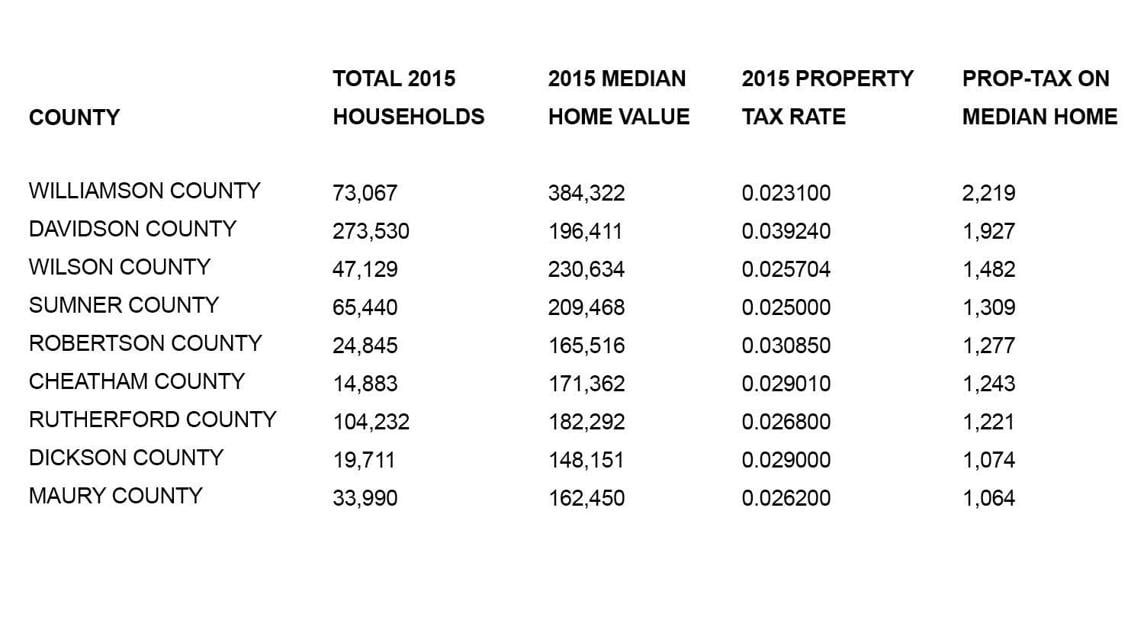

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Real Estate Property Taxes In Brentwood Tn David Wright

Real Estate Property Taxes In Brentwood Tn David Wright

Letter To The Editor A Word About Relative Taxes Franklin Williamsonherald Com

Letter To The Editor A Word About Relative Taxes Franklin Williamsonherald Com

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Free Tennessee Property Surveys Online Bryant Fence Company

Free Tennessee Property Surveys Online Bryant Fence Company

Best States For Retirement 2021 Moneyrates Com Retirement South Dakota States

Best States For Retirement 2021 Moneyrates Com Retirement South Dakota States

15 Best Places To Live In Wyoming The Crazy Tourist Best Places To Live Cool Places To Visit Tourist

15 Best Places To Live In Wyoming The Crazy Tourist Best Places To Live Cool Places To Visit Tourist

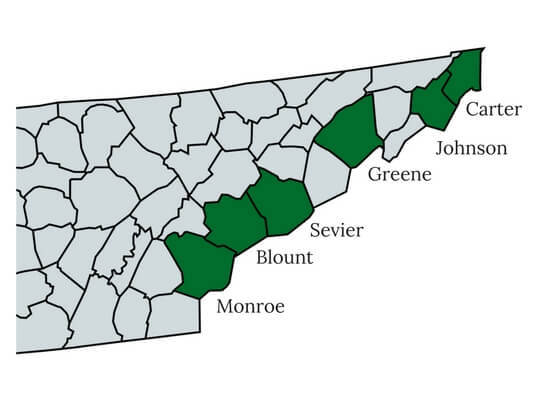

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Increased Property Values Mean Different Things For Property Taxes

Increased Property Values Mean Different Things For Property Taxes

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Tidence Lane Home Tidence Was The First Pastor Of The Buffalo Ridge Baptist Church In Washington County In 1778 He Also Org Whitesburg Old Houses House Styles

Tidence Lane Home Tidence Was The First Pastor Of The Buffalo Ridge Baptist Church In Washington County In 1778 He Also Org Whitesburg Old Houses House Styles

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home