Property Tax History Alameda County

For more information refer to the Tax Defaulted Land FAQs below. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

You can even pay your property taxes right from the app.

Property tax history alameda county. Click here for Property Tax Look-up. Directions and Office Hours. Box 631 Martinez California 94553-0063 Office Hours 8AM - 5PM Except Holidays Call Center Hours 9AM - 4PM Except Holidays PHONE.

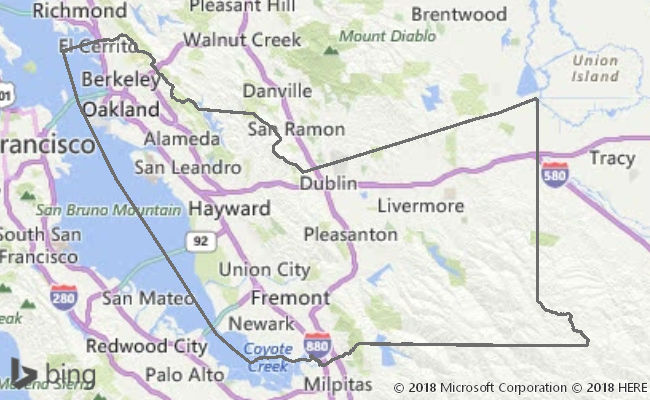

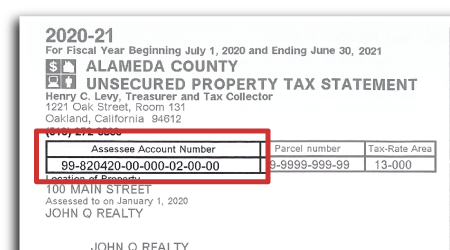

Alameda County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Alameda County California. No fee for an electronic check from your checking or savings account. Alameda County collects on average 068 of a propertys assessed fair market value as property tax.

The data presented on this website was gathered from a variety of government sources. Our records are available to the public during office hours. You can lookup your assessed value property taxes and parcel map.

These records can include Alameda County property tax assessments and. You can pay online by credit card or by electronic check from your checking or savings account. Press Release For past announcements click here.

Please let us know by using our on-line. 1221 Oak Street Room 249 Oakland CA 94612 5102726565 Links Agency Website. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose.

The Alameda County Assessor is pleased to announce that the AC Property App is now available on Android devices as well as Apple devices. Press Release The Alameda County Treasurer-Tax Collector Announces Policies and Procedures for COVID-19 Related Deliquent Property Tax Penalty Interest Waiver. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

Pay Your Property Taxes Online. Download it from Google Play or the iTunes store. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes.

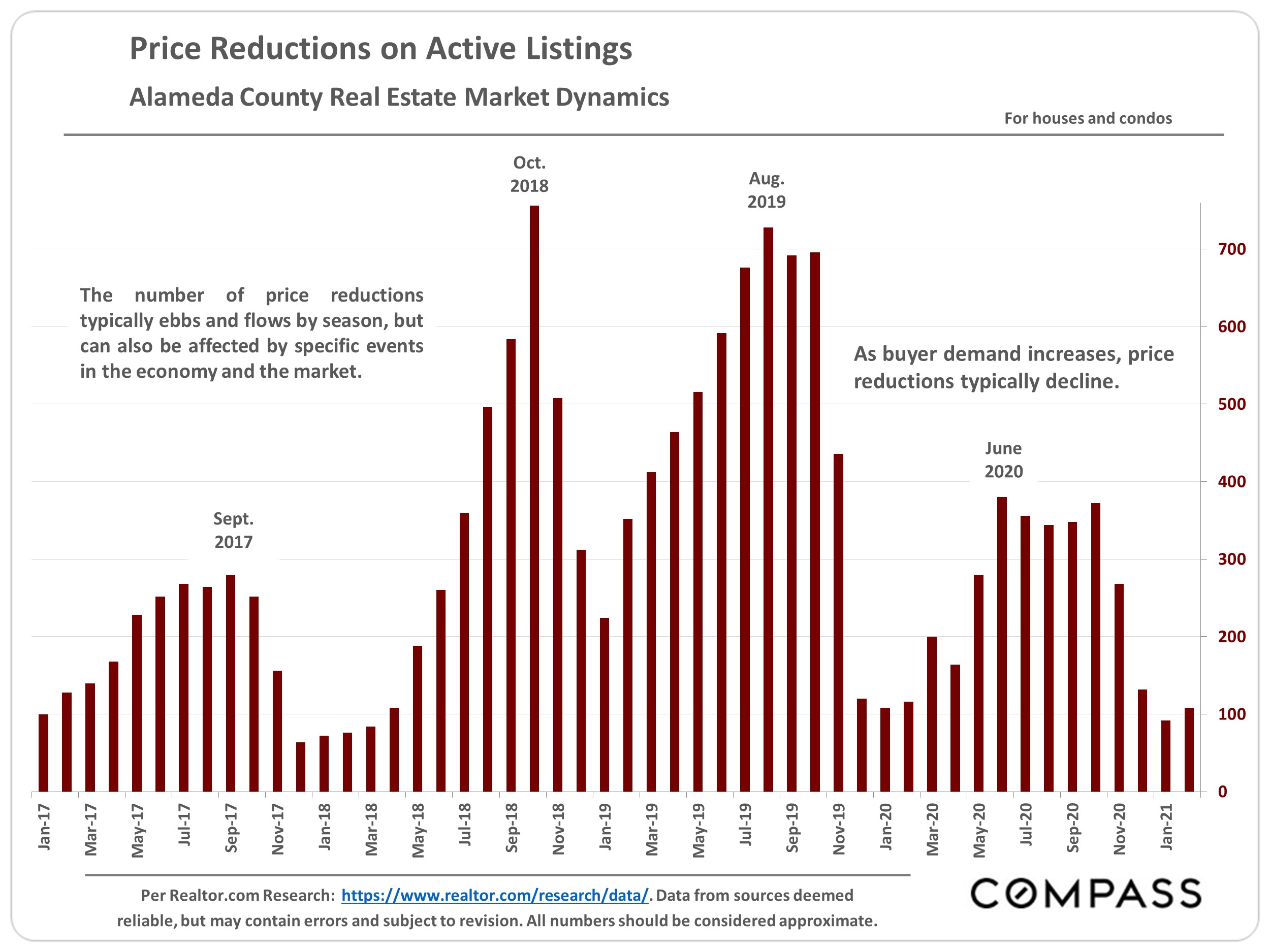

Proposition 13 enacted in 1978 forms the basis for the current property tax laws. Alameda County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps. To review property assessment information or Assessors map enter a parcel.

If the property is sold lienholders and the former owner may claim proceeds in excess of the taxes and cost of the sale. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County. A convenience fee of 25 will be charged for a credit card transaction.

2019 Contra Costa County Treasurer-Tax Collectors Office 625 Court Street Room 100 P. We accept Visa MasterCard Discover and American Express. Tax Defaulted Land FAQs.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Property taxes are levied on land improvements and business personal property. If you cannot come into the office you may send a representative or contact a title company for assistance.

Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes. Wwwcctaxus Comments or Suggestions. 925 957-5280 FAX925 957-2898 WEB.

City to County Converter Find Foreclosures by Zip Code. Check the yellow pages for listings. You also may pay your taxes online by ECheck or Credit Card.

1106 Madison Street Oakland CA 94607. Alameda County Treasurer-Tax Collector. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

NETR Online Alameda Alameda Public Records Search Alameda Records Alameda Property Tax California Property Search California Assessor. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of 068 of property value. Alameda County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Alameda County Alamedacounty Twitter

Alameda County Alamedacounty Twitter

Old City Hall Oakland California 879 195 Oakland City City Old City

Old City Hall Oakland California 879 195 Oakland City City Old City

Alameda County Assessor S Office Acassessor Twitter

Alameda County Assessor S Office Acassessor Twitter

Alameda County Assessor S Office Acassessor Twitter

Alameda County Assessor S Office Acassessor Twitter

California Public Records Public Records California Public

California Public Records Public Records California Public

Search Unsecured Property Taxes

Search Unsecured Property Taxes

Alameda County Assessor S Office Acassessor Twitter

Alameda County Assessor S Office Acassessor Twitter

Alameda County California Property Search Alameda County Property Title Search

Alameda County California Property Search Alameda County Property Title Search

Local Tax Information Union City Ca

Local Tax Information Union City Ca

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home