Alameda County Property Tax Questions

Status Check and enter your Assessors Parcel Number APN from your Alameda County Property Tax Statement. Look Up Supplemental Property Tax.

Https Www Ebmud Com Index Php Download File Force 7556 0 072319 Regular Meeting Staff Reports Pdf

Exemptions will remove the Special Assessments from the upcoming property tax statement so that you do not have to pay it.

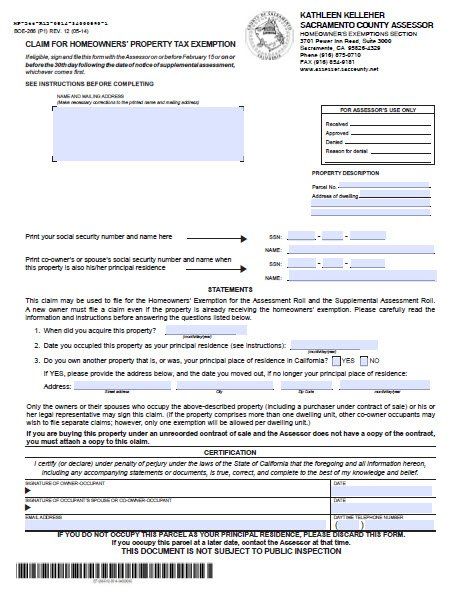

Alameda county property tax questions. No fee for an electronic check from your checking or savings account. Order a current secured property tax bill. The exemption is available to an eligible owner of a dwelling which is occupied as the owners principal place of residence as of 1201 am January 1 each year.

The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. Pay Your Property Taxes Online. Press Release The Alameda County Treasurer-Tax Collector Announces Policies and Procedures for COVID-19 Related Deliquent Property Tax Penalty Interest Waiver.

You can pay online by credit card or by electronic check from your checking or savings account. Bids start as low as 108400. The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years.

In our previous counties we always pay property tax twice a year once in November and once in April. Alameda County Property Records are real estate documents that contain information related to real property in Alameda County California. This form constitutes an official request that you declare all assessable business property situated in this county which you owned claimed possessed controlled or managed on the tax lien date and that you sign under penalty of perjury and return the statement to.

Why does the county sell tax defaulted property. On January 1 tax lien date. There are several ways to pay your property taxes in Alameda County.

Watch Video Messages from the Alameda County Treasurer. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County. This is especially true in an area with high rates of taxation like many of the areas in the county of Alameda.

What is the Difference Between an Exemption and a Refund. Office hours location and directions. Understanding the ins and outs of real estate taxes is crucial for minimizing your losses in real estate whether youre renting properties or flipping them.

The tax type should appear in the upper left corner of your bill. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes. Alameda County Property Tax.

We accept Visa MasterCard Discover and American Express. The following information and services can be accessed with any touch-tone telephone 24-hours a day seven days a week by calling 510 272-6800. 1221 Oak Street Room 249 Oakland CA 94612 5102726565 Links Agency Website.

Assessed value exemption and tax payment information. The system may be temporarily unavailable due to system maintenance and nightly processing. 19 rows Measure Z VIOLENCE PREV TAX Exemption - Approved Measure D and Z.

A convenience fee of 25 will be charged for a credit card transaction. Alameda County CA is offering 191 parcels for auction online. Pay current year and supplemental secured and unsecured tax bill.

Select from one of the tax types below to research a payment. I have a question for Alameda County property owner. We just moved here so we are not sure how this works.

Note that both current and prior year bills will be displayed after searching by a parcel number. 7 rows Search Secured Supplemental and Prior Year Delinquent Property Taxes. Look Up Prior Year Delinquent Tax.

Look Up Unsecured Property Tax. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Frequently Asked Questions about Public Internet Auction of Tax Defaulted Land PROPERTY IS SOLD AS IS INSPECT THOROUGHLY BEFORE YOU BUY.

Are these the standard payment dates. Residents of Alameda County where the median home value is 707800 pay an average effective property tax rate of 078 for a median tax bill of 5539. A single 5000 deposit plus a non-refundable 35 processing fee is required to participate in the County of Alameda Tax Sale.

How do I Check the Status of my Exemption or Refund Application. You can go online to the website. These are all NO RESERVE auctions.

How to change your mailing address. California property tax laws provide two alternatives by which the Homeowners Exemption up to a maximum of 7000 of assessed value may be granted. Now I am receiving two bills for payments due on Feb 28 and June 30.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. California law prescribes a yearly ad valorem tax based on property as it exists at 1201 am.

Read more »