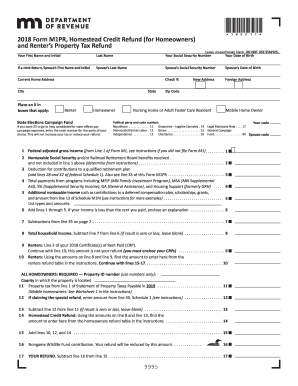

Income Tax Relief On House Rent Paid

However the deduction is restricted to 25 of the total income or excess of rent actually paid over 10 of the total income. The value of HRA actually received by you.

Know About Hra Generator Income Tax Return Income Tax Filing Taxes

Know About Hra Generator Income Tax Return Income Tax Filing Taxes

Yes you can claim an income tax exemption on both house rent allowance HRA and repayment of home loan.

Income tax relief on house rent paid. Find out if you qualify and take a little off the top of this years taxes. If you rent out a room or flat in your home you are exempt from income tax on the amount that your tenant pays you for rent and other services up to 14000 in a tax year. Where rental income is received by the partnership in the business of investment holding or operating coffeeshopseating housesfood courts the rental income is to be reported as business income of the partnership in the partnership income tax form.

The first 1000 of your income from property rental is tax-free. If rental income is derived by a partnership from its partnership property the rental income is to be reported in the partnership income tax form Form P. Publication 527 includes information on the expenses you can deduct if you rent a condominium or cooperative apartment if you rent part of your property or if you change your property to rental use.

Less than the basic rate threshold of 12500 youll pay 0 in tax on rental income Above 12500 and below the higher rate threshold of 50000 - youll pay 20 in tax on rental income Above 50000 and below the additional rate threshold of 150000 youll pay 40 in tax on rental income. 50 of your basic salary if you live in a metro or 40 of your basic salary if you live in a non-metro This minimum of above is allowed as income tax exemption on house rent allowance. From 6 April 2020 Income Tax relief on all residential property finance costs is restricted to the basic rate of income tax.

Contact HMRC if your income from property rental. The tax rate applicable to the individual is 20 percent of his income. If your income is.

You can claim the HRA exemption on the lowest of the following three items. 50 of the basic salary in case you are residing in any of the four metro cities. The benefit is allowed as a deduction from ones total income.

If you provide substantial services that are primarily for your tenants convenience report your income and expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship. If your propertys expenses are larger than the Schedule E rental income you accrued you can deduct any losses from your taxable income if your non-property based income is less than 150000 in the tax year. Under the Section 80 GG the self-employed or the salaried person can claim a HRA tax exemption or the rent paid by him or her in excess of 10 of hisher income or salary respectively.

Lets say an individual with a monthly basic salary of Rs 15000 receives HRA of Rs 7000 and pays Rs 8400 rent for an accommodation in a metro city. If you are living in a house on rent and servicing home loan on another property - even if both the properties are located in the same city. When to Report Income.

If you are a higher rate taxpayer you pay 40 on your rental profits. This is your property allowance. You can generally use Schedule E Form 1040 Supplemental Income and Loss to report income and expenses related to real estate rentals.

Actual house rent paid by you minus 10 of your basic salary 3. For tenants the income tax deduction on their rent is only available for contracts signed before 1st January 2015. Report rental income on your return for the year you actually or constructively receive it if you are a cash basis taxpayer.

The main reason landlords use a company to invest in property is the benefit of taking advantage of corporation tax rates and dividend tax rates which are lower than income tax. The amount of rent paid by you which exceeds 10 of salary. If your rental income from your property exceeds the expenses that the property incurred that income is taxable.

For tenants who meet this condition the applicable deduction is 1005 of the amount paid provided that their taxable income is less than 2410720 euro. Additional rate taxpayers even more. The upper ceiling is 25 which means that rent paid in between 10 and 25 of the salaryincome is only available for deduction HRA exemption.

Do you live in a state with a renters tax credit. To avail HRA benefit the least of the following amount yearly is exempted rest is taxable. The relief applies only to residential tenancies not to short-term guest arrangements.

10 hours agoA salaried person filing Income Tax Return ITR often finds it confusing whether they can claim income tax benefit on both House Rent Allowance HRA and home loan. Moreover the maximum deduction that can be claimed in a year is Rs 60000 and Rs 5000 per month.

Read more »

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)