Leave unused boxes blank. This means that we dont yet have the updated form for the current tax yearPlease check this page regularly as we will post the updated form as soon as it is released by the Minnesota Department of Revenue.

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

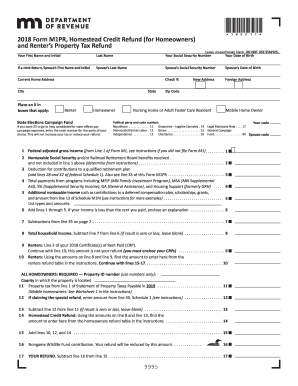

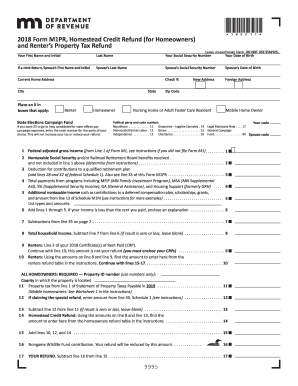

Minnesota Revenue Property Tax Refund Instructions 2018.

Property tax form mn 2018. 2018 Form M1PR Homestead Credit Refund for Homeowners and Renters Property Tax Refund. Keep in mind that some states will not update their tax forms for 2021 until January 2022. High quality example sentences with informations Minnesota 2015 M1pr Form PDF 7c fab52b902cf61c f minnesota revenue property tax refund instructions 2018 Hornig panies 16 Reviews Property Management 1000 W 22nd St Sales taxes in the United States state property tax refund 4K the minnesota department of revenue reminds.

If a Joint Return Spouses First Name and Initial Spouses. This form is for income earned in tax year 2020 with tax returns due in April 2021We will update this page with a new version of the form for 2022 as soon as it is made available by the Minnesota. Print and mail the voucher with Form M1PRX along with a check made payable to Minnesota Revenue.

Obsolete We last updated the Business and Investment Credits in April 2021 and the latest form we have available is for tax year 2018. This refund does not transfer to your Minnesota Form M1. High quality example sentences with informations Minnesota 2015 M1pr Form PDF 7c fab52b902cf61c f minnesota revenue property tax refund instructions 2018 Hornig panies 16 Reviews Property Management 1000 W 22nd St Sales taxes in the United States state property tax refund 4K the minnesota department of revenue reminds homeowners and renters to file for their 2016 property tax.

2018 Tax Year Minnesota Tax Forms. List types and amounts. Your Date of Birth.

Policy statements that provide added interpretation details or information about Minnesota tax laws or rules. File by August 15 2019. There is no income limit for the special property tax refund and the maximum refund is 1000.

Your total household income is less than 61320. OFFICE OF PROPERTY VALUATION DIVISION OF STATE VALUATION FOURTH FLOOR STATION 32 501 HIGH STREET FRANKFORT KENTUCKY 40601-2103 2018 PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2018 tangible personal property tax return. You can also now declare additional nontaxable income using Form M1PR-AI.

Your First Name and Initial Last Name Your Social Security Number. You will not receive a refund if your return is filed or the postmark date is after August 15. DO NOT USE STAPLES.

We last updated Minnesota Form M1PR in February 2021 from the Minnesota Department of Revenue. Hennepin County is committed to managing that share wisely and transparently. The advanced tools of the editor will direct you through the editable PDF template.

The due date is August 15. How to complete the Get And Sign M1pr 2018-2019 Form on the internet. The MN Tax Forms and Mailing Address are below - click for the IRS Federal Income Tax Forms for Tax Year 2018.

Can I still file. To file for the Renters refund you need to fill out Form M1PR and submit along with a Certificate of Rent Paid CRP that you should have received from your landlord in January. 31 2018 can no longer be prepared and e-filed.

Complete and file your Minnesota Property Tax Return. You may file up to one year after the due date. You cannot be claimed as a dependent on someone elses 2018 federal income tax return.

To start the blank use the Fill Sign Online button or tick the preview image of the form. There are different ways to file your Property Tax Refund. Be sure to verify that the form you are downloading is for the correct year.

Minneapolis 2020 disaster reassessment for property tax relief. Your net property tax on your homestead must have increased more than 12 percent from 2018 to 2019. If this is related to Form M1PR - You may file and claim a refund for up to one year after the original due date of August 15th.

Your 2018 Form M1PR should be mailed delivered or electronically filed with the department by August 15 2019. Enter your official identification and contact details. Forgot to file for a property tax refund last year.

You may qualify for the property tax refund if all of the following conditions are true for 2018. The example families in Greater Minnesota have homes valued at 165000 and payable 2020 property taxes of 1 900 typical amounts for Greater Minnesota. The deadline for filing 2018 Minnesota Property Tax Refunds is August 15.

Property taxes are your share of the total cost of local government and they are used to help support a variety of valuable resources in the county cities and schools. Complete the respective Forms below sign and mail them to the Minnesota Department of Revenue. The Minnesota Department of Revenue asks you to supply this information on the contact form.

Get And Sign Minnesota Property Tax Form M1prx 2018-2021 Or audit report see Form M1PRX instructions. The current tax year is 2020 with tax returns due in April 2021. According to the Minnesota Department of Revenue if you file a Special property tax.

The net property tax increase must be at least 100 and the increase must not be due to new improvements. You were a full-year or part-year resident of Minnesota. The example metro area families have homes valued at 265000 and payable 2020 property taxes of 3 600 typical amounts for the metro area.

Minnesota has a state income tax that ranges between 5350 and 9850. Minnesota State Income Tax Forms for Tax Year 2018 Jan.

Read more »Labels: 2018, property

Maria Bartiromo Net Worth Celebrity Net Worth

Maria Bartiromo Net Worth Celebrity Net Worth

.jpeg?width=600&height=424)