2018 Michigan Homestead Property Tax Credit Claim Mi-1040cr Instructions

Michigan taxpayers who wish to claim a homestead property tax credit must complete form MI-1040CR. Filers First Name MI.

Https Www Michigan Gov Documents Taxes 5603 692762 7 Pdf

File the form that gives you the larger credit.

2018 michigan homestead property tax credit claim mi-1040cr instructions. Type or print in blue or black ink. M Claim your credit on the MI-1040CR and checkox b 5b if you are age 65 or younger. 1 4 Attachment 05 1.

0123456789 - NOT like this. When to File If you are not required to file an MI-1040 you may file your credit claim as soon as you know your 2018. If you are a filer that is claimed as a dependent on someone elses return please refer to the instructions for Form MI-1040CR.

0123456789 - NOT like this. 27 rows MI-1040 Book Instructions only no forms MI-1040CR. The information contained in this booklet may ease the burden of filling out state tax forms and may even save some taxpayers money.

05-18 Page 1 of 3 Amended Return 2018 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Issued under authority of Public Act 281 of 1967 as amended. If you are blind and own your own home complete the MI-1040CR and the MI-1040CR-2. 0123456789 - NOT like this.

As well you cannot claim a property tax credit if your taxable value exceeds 135000 this excludes vacant farmland classified as agricultural. Filers First Name MI. Form MI-1040CR requires you to list multiple forms of.

Line-by-Line Instructions for Homestead Property Tax Credit MI-1040CR Lines not listed are explained on the form. Available for PC iOS and Android. 2018 MICHIGAN Homestead Property Tax Credit Claim for Veterans and Blind People MI-1040CR-2 Amended Return Type or print in blue or black ink.

The credit is not available if your total. Ifoure y a blind and rent your homestead you cannot use theI-1040CR-2. Type or print in blue or black ink.

Multiply amount on line 42 by percentage on line 43. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Enter your name s address and Social Security number s.

How to Instructions for the MI-1040CR Form. If you are blind and rent your homestead you cannot use the MI-1040CR-2. The Michigan Tax Tribunal within 35 days from date of notice.

When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes. Michigan Department of Treasury Rev. Spouseomplete c forms MI-1040CR and MI-1040CR-2 availablen o Treasurys Web site Use the form that gives.

If you are married filing separate claims enter both Social Security numbers but. Claim your credit on the MI-1040CR and check box 5b if you are age 65 or younger. You a larger credit.

To request direct deposit fill out the direct deposit portion of the MI-1040 MI-1040CR or MI-1040CR-2 or file Form 3174 and attach it to the state income tax form. 1 4 Attachment 05 1. If your total household resources are over 60000 you may not claim a property tax credit.

See the income tax section later in this booklet for more details. 1 4 Attachment 06 1. 05-18 Page 1 of 3 Issued under authority of Public Act 281 of 1967 as amended.

Fill out securely sign print or email your 2017 Michigan Homestead Property Tax Credit Claim MI-1040CR instantly with SignNow. Seniors who pay rent including rent paid to adult care facilities. Michigan Department of Treasury Rev.

HOMESTEAD PROPERTY TAX CREDIT Eligible homeowners or renters who pay more than 3 5 percent of their household income in property taxes or in rent for renters can receive a credit or rebate on their state income tax. Michigan Department of Treasury Rev. If you are active military an eligible veteran or the surviving spouse of a veteran complete the MI-1040CR and the MI-1040CR-2 Michigan Homestead Property Tax Credit Claim for Veterans and Blind People.

Print numbers like this. Eligible filers had a homestead in Michigan lived there for at least six months during the tax year and either own the home and pay property taxes or have a rental contract and pay rent. Enter amount here and if you file an MI-1040 carry this amount to MI-1040 line 25.

Lines 1 2 and 3. Print numbers like this. Michigan Homestead Property Tax Credit 2018 Form.

05-18 Page 1 of 3 Amended Return 2018 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Issued under authority of Public Act 281 of 1967 as amended. Homestead Property Tax Credit. Print numbers like this.

Check boxes 5a and 5b if you are blind and age 65 or older.

Michigan 1040 Page 1 Line 17qq Com

Michigan 1040 Page 1 Line 17qq Com

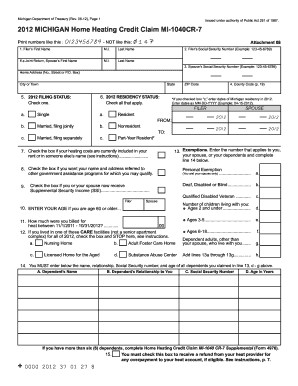

Michigan Home Heating Credit Instructions

Michigan Home Heating Credit Instructions

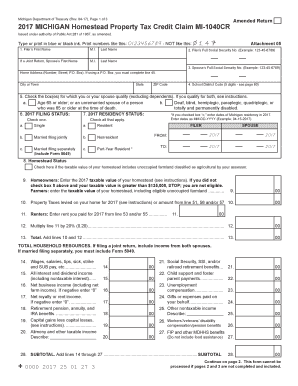

Michigan Homestead Property Tax Credit Form 2017 Property Walls

Michigan Homestead Property Tax Credit Form 2017 Property Walls

2018 2021 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank Pdffiller

2018 2021 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank Pdffiller

Michigan Homestead Property Tax Credit 2019 Instructions Fill Out And Sign Printable Pdf Template Signnow

Michigan Homestead Property Tax Credit 2019 Instructions Fill Out And Sign Printable Pdf Template Signnow

Https Www Uwwashtenaw Org Sites Uwwashtenaw Org Files Mi 204012 20v2 1 20 Pdf

Https Www Michigan Gov Documents Taxes Book Mi 1040cr 5 674637 7 Pdf

2018 2021 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank Pdffiller

2018 2021 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank Pdffiller

Homestead Credit Michigan Fill Out And Sign Printable Pdf Template Signnow

Homestead Credit Michigan Fill Out And Sign Printable Pdf Template Signnow

Https Www Efile Com State Tax Form Michigan Mi State Tax Home Heating Credit Claim Form Mi 1040cr 7 2019 Pdf

Https Www Michigan Gov Documents Taxes Taxpayer Assistance Manual Supplement 551586 7 Pdf

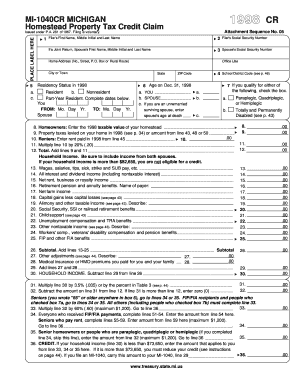

State Of Michigan Tax Form 1040 Cr Page 1 Line 17qq Com

State Of Michigan Tax Form 1040 Cr Page 1 Line 17qq Com

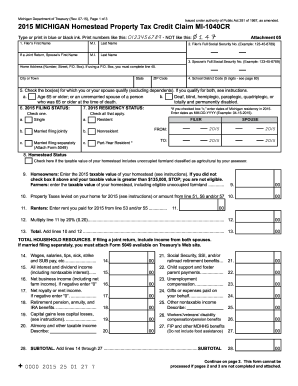

Fillable Online Michigan 2015 1040cr Forms Fax Email Print Pdffiller

Fillable Online Michigan 2015 1040cr Forms Fax Email Print Pdffiller

Fill Free Fillable Mi 1040cr 508843 7 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Pdf Form

Fill Free Fillable Mi 1040cr 508843 7 2015 Michigan Homestead Property Tax Credit Claim Mi 1040cr Pdf Form

2018 Form Wi Dor Schedule H Ez Fill Online Printable Fillable Blank Pdffiller

2018 Form Wi Dor Schedule H Ez Fill Online Printable Fillable Blank Pdffiller

Https Www Uwwashtenaw Org Sites Uwwashtenaw Org Files Mi 204012 20v2 1 20 Pdf

Michigan Homestead Property Tax Credit Form 2018 Property Walls

Michigan Homestead Property Tax Credit Form 2018 Property Walls

Michigan 1040 Page 1 Line 17qq Com

Michigan 1040 Page 1 Line 17qq Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home