Does Tennessee Have A Homestead Tax Exemption

For more information on the changes to the Property Tax Relief Program read Public Chapter No. Tax Relief is not an exemption.

6 Things To Know About Homestead Exemptions Newhomesource

5000 plus 500 per.

Does tennessee have a homestead tax exemption. A homestead tax exemption is the amount of tax the state excludes from your real property tax assessment on your principal place of residence your homestead. Under the Tennessee exemption system homeowners may exempt up to 5000 of their home or other property covered by the homestead exemption which is a principal place of residence. The assessed valuation of a property is based on 25 of its fair market value.

The maximum market value on which tax relief is calculated is 175000. To apply for this benefit please contact the County Trustees office in your county. Applicants must comply with the applicable requirements of Tenn.

A homestead exemption is granted as an automatic benefit in Tennessee. States offer the exemptions or. The Homestead Exemption Program delays the payment of property taxes for single members earning less than 16000 and joint members earning less than 20000.

The Tennessee Homestead Exemption Amount. With limited exception no organization is automatically exempt from the payment of property taxes but rather must apply to and be approved by the Tennessee State Board of Equalization. Homestead Exemption A Background.

Tennessee Exemption Amount Tennessee allows a basic 5000 for homestead exemption of real property. The homestead exemption amounts in Tennessee for. The individual filing for homestead exemption does not have to be the head of the family.

This means that homeowners dont have to file a homestead claim at all. A variety of tax exemptions are available for the elderly disabled and veterans. The individual filing the individuals spouse or the individuals child must occupy the home.

Tennessees homestead exemption allows homeowners to deduct up to 5000 off their upcoming tax return for their principal place of residence. According to data from the Center on Budget Policy Priorities 21 US. However there is a property tax relief program for the elderly disabled and veterans.

Homestead exemptions dont exist in every US. The elderly 65 or older and the disabled can get an exemption on up to 29000 of their homes value if they earn 30700 or less. PROS and CONS of Homesteading in Tennessee.

Tennessee has the lowest homestead exemption of the states that do not allow the use of the federal homestead exemption and has the third lowest combined dollar value of all property exemptions after Missouri and Alabama. Twenty-three counties and thirty cities in Tennessee have adopted property tax freeze and property tax relief programs which ensure low-income elderly or disabled homeowners are able to age in place when living in a part of town with higher than average growth in property values. 66 rows Must file homestead declaration before filing for bankruptcy.

51 rows Homestead exemption is a great option for those facing financial hardship such as people. If you need to file for bankruptcy you can claim the homestead exemption. Understanding your property taxes as a citizen of Tennessee is the jumping-off point to lowering themEven though Tennessee is one of the states with low property taxes that doesnt mean you dont need help paying themOne strategy you can try out is checking whether you are eligible for property tax exemptions.

You still receive your tax bill s and are responsible for paying your property taxes each year. Joint owners of property such as married couples may claim up to 7500 on property used as their principal place of residence. Tennessee offers additional protections for unmarried homeowners over the age of 62 who are entitled to a homestead exemption of up to 12500.

Use the Tennessee Trustee website to find your County Trustee contact information. To qualify the individual must use the property as his or her principle place of residence. Tennessee Property Taxes Tennessee does not have a homestead exemption.

Property Tax Freeze Program. Function of the Homestead Exemption The primary purpose of the homestead exemption is to protect your home from creditors who may seek to place a lien on your property in order to recover a debt. A Breakdown of the Tennessee Property Tax Homestead Exemption.

Tax relief is payment by the State of Tennessee to reimburse homeowners meeting certain eligibility requirements for a part or all of paid property taxes.

How To Apply For A Homestead Exemption Howstuffworks

How To Apply For A Homestead Exemption Howstuffworks

Https Www Tnfarmbureau Org Wp Content Uploads 2010 10 Homestead Exemption Pd Paper 2019 Pdf

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

/GettyImages-1254784260-b0ee3e20ca46463493b2682a26f133cd.jpg) What Is A Homestead Tax Exemption

What Is A Homestead Tax Exemption

What Is A Homestead Tax Exemption Smartasset

What Is A Homestead Tax Exemption Smartasset

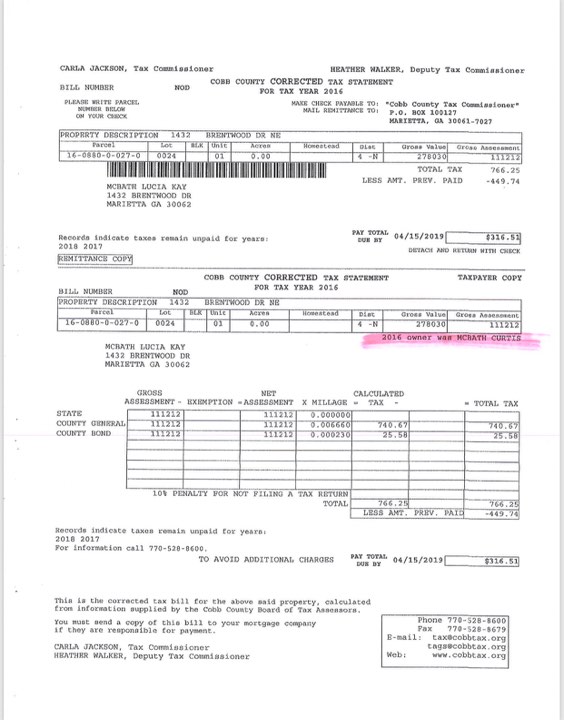

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Austin Real Estate Secrets Texas 2014 Homestead Exemption How To File Tips From Tim In 2019 Texas Logo Texas Tattoos Texas

Austin Real Estate Secrets Texas 2014 Homestead Exemption How To File Tips From Tim In 2019 Texas Logo Texas Tattoos Texas

Why Tennessee Is The Best Eastern State For A Homestead Country Homestead Living Living The Homestead Life

Why Tennessee Is The Best Eastern State For A Homestead Country Homestead Living Living The Homestead Life

What Is The Homestead Exemption In Bankruptcy Memphis Bankruptcy Lawyer Debt Forgiveness Hurst Law Firm

What Is The Homestead Exemption In Bankruptcy Memphis Bankruptcy Lawyer Debt Forgiveness Hurst Law Firm

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

Relocating To Florida Check Out These Relocation Tips And Resources Real Estate Buying Florida Relocation

Relocating To Florida Check Out These Relocation Tips And Resources Real Estate Buying Florida Relocation

Alabama Homestead Exemption And Property Tax Rates Tax Rate Homesteading Property Tax

Alabama Homestead Exemption And Property Tax Rates Tax Rate Homesteading Property Tax

Reality Check Applying For Property Tax Break Wlos

Reality Check Applying For Property Tax Break Wlos

Homestead Exemptions By U S State And Territory

Homestead Exemptions By U S State And Territory

Homestead Exemptions By U S State And Territory

Homestead Exemptions By U S State And Territory

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Tennessee Homestead Exemptions Chapter 7 Bankruptcy Flexer Law

Tennessee Homestead Exemptions Chapter 7 Bankruptcy Flexer Law

Homestead Exemption Laws States With Homestead Protection From Creditors

Homestead Exemption Laws States With Homestead Protection From Creditors

My Best Road Trip Tip Road Trip Fun Road Trip Road Trip Camping

My Best Road Trip Tip Road Trip Fun Road Trip Road Trip Camping

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home