Property Tax Exemption For Veterans In Mi

For the purposes of the exemption statute Michigan Compiled Laws 2117b this means. Minnesota Property Tax Exemptions.

Military Retirees Retirement Military Retirement Military

Military Retirees Retirement Military Retirement Military

Veterans Property Tax Exemption A property tax exemption is available for disabled veterans.

Property tax exemption for veterans in mi. Specifically this Act changed MCL 2117b to read as follows. Exemption of Real Estate for Veteran with Service Connected Disability A disabled veteran or his or her surviving spouse who has not remarried may be eligible for 100 exemption of property taxes if certain criteria are met. In accordance with MCL 2117b real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or the disabled veterans un-remarried surviving spouse.

161 Disabled Veterans Exemption Disabled Veterans Exemption - Selling of the Veterans Property - March 27 2014 Disabled Veterans Exemption FAQ Updated. You must have been determined by the US Department of Veterans Affairs to be. For more Information on other property tax exemptions.

Department of Military and Veterans Affairs. They must have a 100 disability rating to be eligible. You have been determined by the United States Department of Veterans Affairs to be permanently and totally disabled as a result of military service and are entitled to veterans benefits at the 100 rate.

Public Act 161 which went into effect November 12 2013 applies to a homestead property of a disabled veteran who was discharged from the United States armed forces under honorable conditions. 1 Real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or by an individual described in subsection 2 is exempt from the collection of taxes. In the State of Minnesota veterans rated as 100 totally and permanently disabled may be eligible for a property tax valuation exclusion up to 300000.

For veterans with lesser disabilities 70. Eligible taxpayers can apply for a summer tax deferment with the City Treasurer. 161 of 2013 amended MCL 2117b relating to the exemption for disabled veterans.

To obtain the exemption an affidavit showing the facts required by this section and a description of the real property shall be filed by the. 52 rows Disabled veterans in Missouri who are seeking eligibility for home property. You must be a disabled veteran.

Michigan Public Act 161 of 2013 Effective November 12 2013 you are eligible for residential property tax exemption if you meet at least 1 of the following criteria. Summary of Michigan Military and Veterans Benefits. Minnesota veterans qualify for a full property tax exemption on up to 300000 in assessed value.

Industrial Facilities Exemption A property tax exemption to manufacturers for renovation and expansion of aging facilities building of new facilities and establishment of high tech facilities. 1 Real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or by an individual described in subsection 2 is exempt from the collection of taxes under this act. 1 Real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or by an individual described in subsection 2 is exempt from the collection of taxes under this act.

For more information on the Disabled Veterans Exemption Information and Property Tax Information for Veterans and. A disabled veteran in Minnesota may receive a property tax exemption of up to. Those with disability ratings at 70 or higher may be eligible for the same consideration at a maximum of 150000.

Qualification for this exemption requires that you precisely satisfy the following requirements. Related Documents Assessors Authority to Grant the Disabled Veterans Exemption Bulletin 22 of 2013 PA. Pursuant to MCL 21151 senior citizens disabled people veterans surviving spouses of veterans and farmers may be able to postpone paying property taxes.

Property Tax Waiver 100 percent permanently and totally disabled veterans and veterans who are entitled to veterans benefits at the 100 percent rate or unremarried surviving spouses if the veteran passes away before the tax break is granted may request a property tax waiver. A property tax exemption for real property owned and used as a homestead by a disabled veteran or the disabled veterans un-remarried surviving spouse. Michigan offers special benefits for its military Service members and Veterans including property tax exemptions Michigan National Guard Tuition.

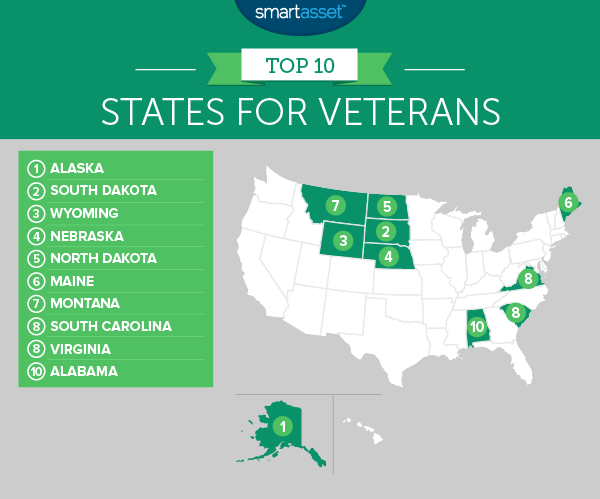

The Best States For Veterans Smartasset

The Best States For Veterans Smartasset

Vietnam Veteran Fights For Tax Exemption Vietnam Veterans Veteran Vietnam

Vietnam Veteran Fights For Tax Exemption Vietnam Veterans Veteran Vietnam

Veterans Financial Needs Consumer Credit Financial Tips Air Force Families Veteran

Veterans Financial Needs Consumer Credit Financial Tips Air Force Families Veteran

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Veterans Property Tax Exemption By State Pro Tips

Veterans Property Tax Exemption By State Pro Tips

Free Income Tax Assistance For Veterans Military Veterans Resource Center

Free Income Tax Assistance For Veterans Military Veterans Resource Center

Turbotax Offers Free Tax Filing For Military Active Duty And Reserve The Turbotax Blog

Turbotax Offers Free Tax Filing For Military Active Duty And Reserve The Turbotax Blog

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Property Tax Exemptions For Disabled Veterans In Michigan And Missouri Homesite Mortgage

Property Tax Exemptions For Disabled Veterans In Michigan And Missouri Homesite Mortgage

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Https Www Plainfieldmi Org Veterans 20exemption 20requirements Pdf

Labels: exemption

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home