Does Japan Have Capital Gains Tax

Someone in the uppermost tax bracket can go from a 37 tax rate on a capital gain to a 20 rate. It is their only source of capital gains in the country.

Red China Taxes Capital Relatively Lightly Tax Foundation Capital Gains Tax Tax Countries Of The World

Red China Taxes Capital Relatively Lightly Tax Foundation Capital Gains Tax Tax Countries Of The World

You are required to appoint a tax representative in Japan to file your tax return on your behalf.

Does japan have capital gains tax. In Japan cryptocurrency trading mining lending and other income is classified as miscellaneous income subject to a tax rate up to 55. In general business enterprise tax is assessed on business income in excess of JPY 29 million at a rate of 3 4 or 5 depending on the type of business. 34 Capital gains taxation 35 Double taxation relief 36 Anti-avoidance rules 37 Administration 38 Other taxes on business 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties 44 Branch remittance tax 45 Wage taxsocial security contributions 46 Other 50 Indirect taxes 51 Consumption tax 52 Capital tax 53 Real estate tax.

In the lowest brackets a 10-12 tax rate can turn into 0. Currently capital gains and dividends are subject to a 20 percent tax consisting of a 15 percent income tax and a 5 percent residential tax. Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident.

The property is directly and jointly owned by husband and wife. Capital gains should be added to regular income and they should be declared in a tax return. It has appreciated in value by 100 over the 10 years to sale.

Capital gains tax of corporate income tax 275 IRES on gains derived from disposals of participations and extraordinary capital gains. On my Japanese tax return for this year I will have to report capital gains from the sale of some US stock. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

If you are living overseas and sell your property in Japan you will be taxed by the Japanese taxation office upon the sale of property and any capital gain must be reported in a final income tax return. The exit tax is effective for covered individual departing Japan on or after 1 July 2015. The list focuses on the main indicative types of taxes.

The Finance Ministry hopes to. A house or bonds. I believe that if you were permanently resident for tax purposes in Japan when you cashed out your ISA you would be expected to declare and pay capital gains tax in Japan.

A special tax regime exit tax to impose income tax on unrealized capital gains on financial assets held at departure from Japan was introduced. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. All I can find online is information saying that capital gains from the sale of overseas stock is reported separately from ordinary income in Japan and is also subject to separate taxation.

When living in Japan a resident must pay capital gains tax on all income that. The rate paid by residents and non-residents differs because of the local inhabitant tax component. Capital gains are in principle aggregated with other income after deductions for necessary expenses and after a statutory deduction of a maximum of JPY 500000.

Capital gains tax is paid on profits received through selling assets or investments eg. Im a permanent resident of Japan. Capital gains taxes.

For individuals IRPEF capital gains shall incur a 26 tax. They have owned it for 10 years. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax.

Local management is not required. A resident must pay capital gains tax on all income received either in Japan or abroad. Determining Your 2020 California Income Tax.

Capital Gains Tax As with income tax a non-resident or non-permanent resident is only required to pay capital gains tax on income received in Japan. In Japan from 1989 to 2003 there were two options for paying tax on capital gains from the sale of. Compared to Japans taxes on stock profits of a flat 20 crypto gains are very highly taxed dissuading individuals and companies from properly reporting their.

This means your capital gains taxes will run between 1 up to 133 depending on your overall income and corresponding California tax bracket. Capital gainslosses arising on transfers of assets are taxable as part of a companys taxable income while capital gains arising from transfers of fixed assets between Japanese resident companies in a tax consolidated group or a 100 group are deferred.

What Is Investment Income Definition Types And Tax Treatments

What Is Capital Gains Tax And When Are You Exempt Thestreet

What Is Capital Gains Tax And When Are You Exempt Thestreet

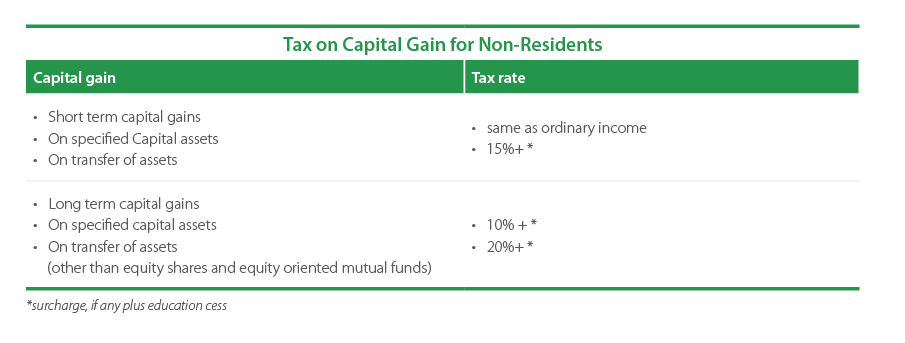

Capital Gains Tax In India An Explainer India Briefing News

Capital Gains Tax In India An Explainer India Briefing News

Inflation Cruelty And The Evil Capital Gains Tax Washington Times

Inflation Cruelty And The Evil Capital Gains Tax Washington Times

Pin By Eris Discordia On Economics In 2021 How To Plan Tax Rate Dividend

Pin By Eris Discordia On Economics In 2021 How To Plan Tax Rate Dividend

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

The World S Most Popular Tax Havens Tax Haven Capital Gains Tax Inheritance Tax

The World S Most Popular Tax Havens Tax Haven Capital Gains Tax Inheritance Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

Bloomberg Proof Of Stake Token Investors Could Use Staking For Gains During Bear Market Bear Market Capital Gains Tax Investment Advisor

Bloomberg Proof Of Stake Token Investors Could Use Staking For Gains During Bear Market Bear Market Capital Gains Tax Investment Advisor

Japanese Crypto Investors To Pay Tax Of Up To 55 Percent On Profits Capital Gains Tax Paying Taxes Capital Gain

Japanese Crypto Investors To Pay Tax Of Up To 55 Percent On Profits Capital Gains Tax Paying Taxes Capital Gain

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Steps To Take In Calculating Capital Gains For Selling Foreign Property

Steps To Take In Calculating Capital Gains For Selling Foreign Property

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gain Bonds Nhai And Rec Tax Exemption Bonds Photo This Photo Was Uploaded By Rrfinance Find Other Capital Gai Capital Gains Tax Capital Gain Taxact

Capital Gain Bonds Nhai And Rec Tax Exemption Bonds Photo This Photo Was Uploaded By Rrfinance Find Other Capital Gai Capital Gains Tax Capital Gain Taxact

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Yield Cgy Formula Calculation Example And Guide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home