Property Tax Calculator Fort Worth Texas

The most common property tax exemption in Texas is the homestead exemption which allows a rebate of at least 25000. DFW counties property tax rates.

Dallas Fort Worth Property Tax Rates

Tarrant County Texas whose county seat is Fort Worth is one of the most populous counties in the country.

Property tax calculator fort worth texas. 252 rows Net worth calculator Budget calculator Budget worksheet Savings goal calculator Total. So your big Texas paycheck may take a hit when your property taxes come due. Property tax tates for all 1018 Texas independent school districts are available by clicking on this Texas school districts property tax rates link.

How You Can Affect Your Texas Paycheck. The percentage depends on local tax rates from schools and other county concerns so it varies per area. Fort Worth Fort Worth isd 287.

Fort Worth hurst-euless-bedford isd 287. 825 is the highest possible tax rate 76101 Fort Worth Texas The average combined rate of every zip code in Fort. Texas has 254 counties with median property taxes ranging from a high of 506600 in King County to a low of 28500 in Terrell CountyFor more details about the property tax rates in any of Texas counties choose the county from the interactive map or the list below.

Property taxes in America are collected by local governments and are usually based on the value of a property. Fort Worth northwest isd 297. Fort Worth Azle isd 272.

Enter your Over 65 freeze amount. 0746200 per 100 of valuation. Weatherford Fort Worth Texas 76196.

Fort Worth Castleberry isd 293. For property tax rates in other jurisdictions refer to the Tarrant County Appraisal District. Overview of Property Taxes.

The money collected is generally used to support community safety schools infrastructure and other public projects. All taxes are per 100 of taxable value. Tarrant County has the highest number of property tax accounts in the State of Texas.

In Fort Worth however the city rate is 0748 and the school district rate is 1378 which adds up to a total rate of 236. Enter your Over 65 freeze year. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States.

Each jurisdiction sets its tax rate to provide for police and fire protection public schools roads and streets district courts water and sewer systems and other public services. Fort Worth Texas vs Medford Oregon Change Places A salary of 200000 in Fort Worth Texas should increase to 204660 in Medford Oregon assumptions include Homeowner no Child Care and Taxes are not considered. Residents of both cities pay the countys general rate of 0234.

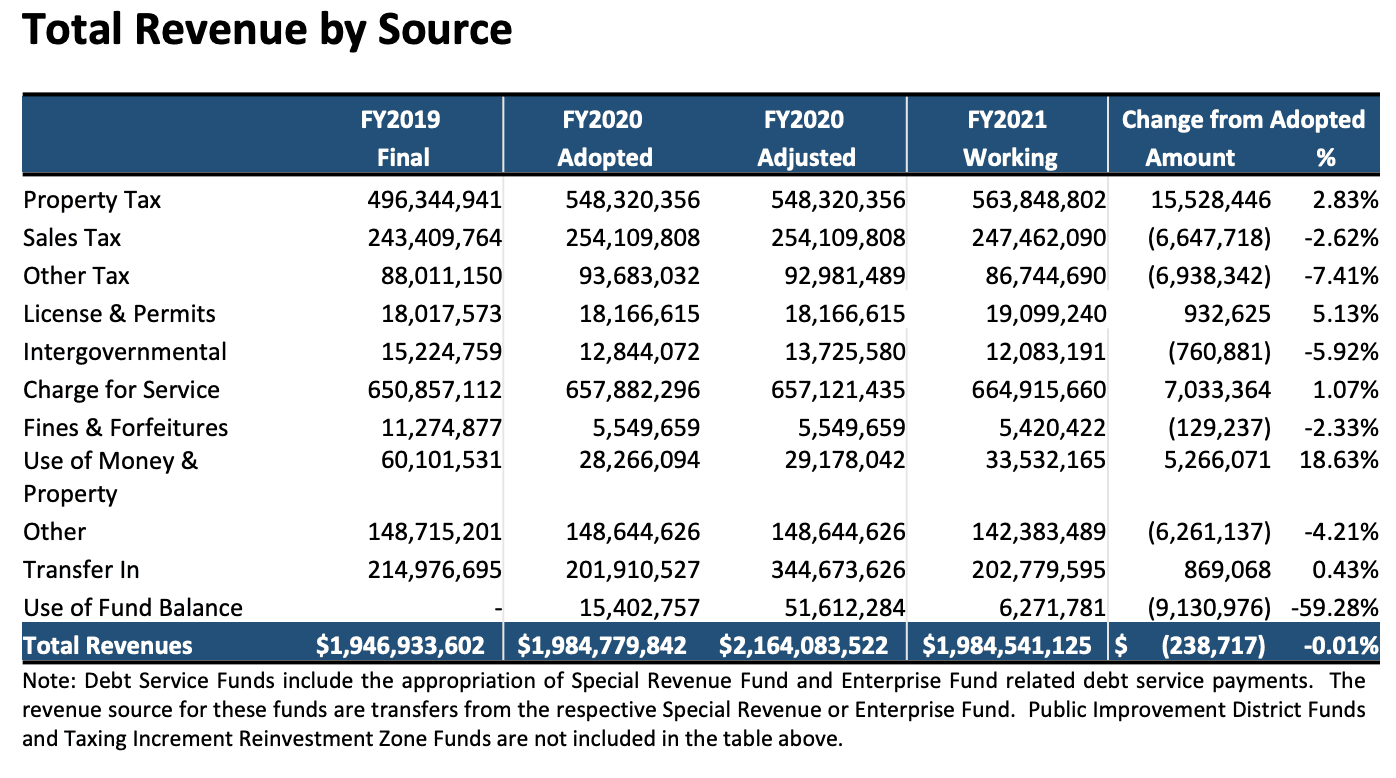

The following table provides 2017 the property tax rates for 13 Dallas Fort Worth area counties that are included in the Dallas-Fort Worth-Arlington metropolitan area. Please refer to the Texas website for more sales taxes information. Fort Worth city rates 63 is the smallest possible tax rate 76178 Fort Worth Texas 8 are all the other possible sales tax rates of Fort Worth area.

School districts are required to offer this. Property tax rates in Texas are levied as a percentage of a homes appraised value. Fort Worth Birdville isd 297.

WELCOME TO TARRANT COUNTY PROPERTY TAX DIVISION. Property Tax Calculator - Dallas-Fort Worth Area Calculator for Property Tax Payments Enter the amount you owe in property taxes and an estimated monthly payment and your savings with a property tax loan will automatically calculate. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

At 210 the county also has the fifth-highest average effective property tax rate of Texas. TAD is responsible for property tax appraisal and exemption administration for over seventy jurisdictions within Tarrant County. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

In part to make up for its lack of a state or local income tax sales and property taxes in Texas tend to be high. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. For example a house appraised at 250000 in Houston or one of its suburbs has an effective tax.

In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. Fort Worth Keller isd 306. Fort Worth Crowley isd 317.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. 254 rows Property taxes are higher in Fort Worth than in Arlington. Fort Worth Burleson isd 306.

Be aware though that payroll taxes arent the only relevant taxes in a household budget. Fort Worth Lake Worth isd 319. The Texas Property Tax Code offers several exemptions to help lower your property taxes in Texas.

Property Tax White Settlement Tx

Dfw Property Tax Rates In Dallas Fort Worth Texas

Dfw Property Tax Rates In Dallas Fort Worth Texas

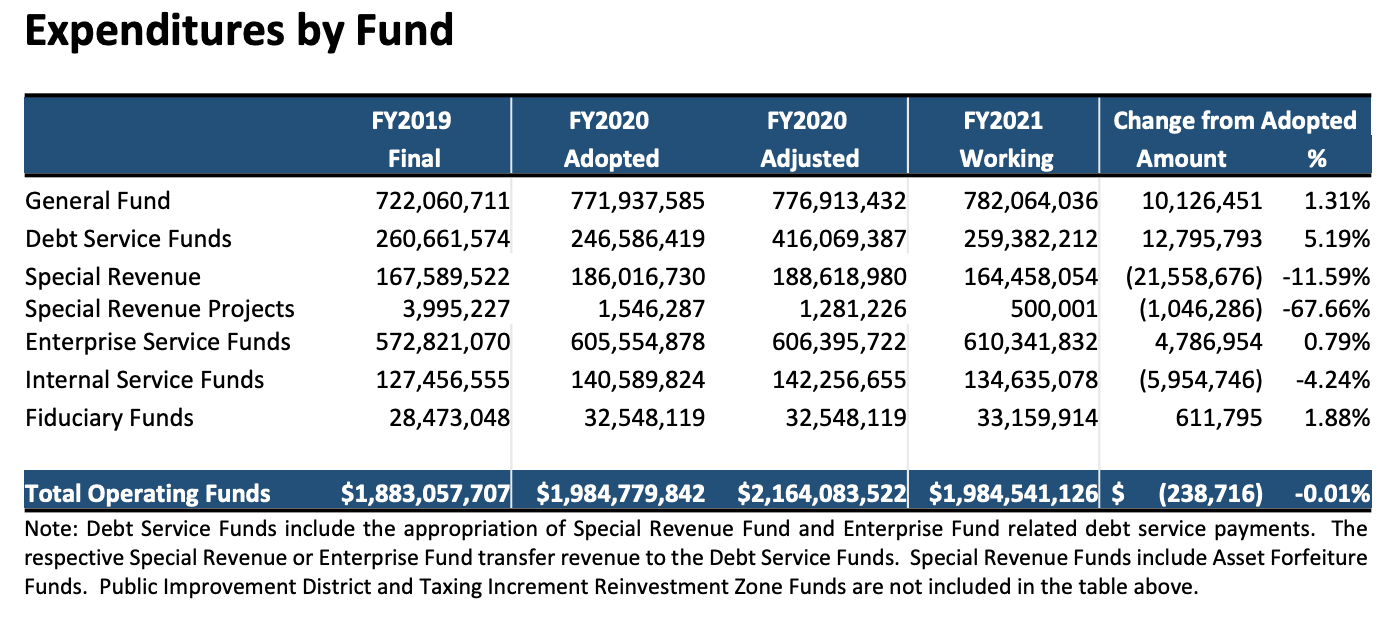

Fort Worth Budget Lower Spending Slight Tax Increase More Police Texas Scorecard

Fort Worth Budget Lower Spending Slight Tax Increase More Police Texas Scorecard

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Https Www Attomdata Com News Market Trends Top 10 Metros With The Lowest Property Tax Rates

Texas Income Tax Calculator Smartasset

Texas Income Tax Calculator Smartasset

Dfw Property Tax Rates In Dallas Fort Worth Texas

Dfw Property Tax Rates In Dallas Fort Worth Texas

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Property Tax White Settlement Tx

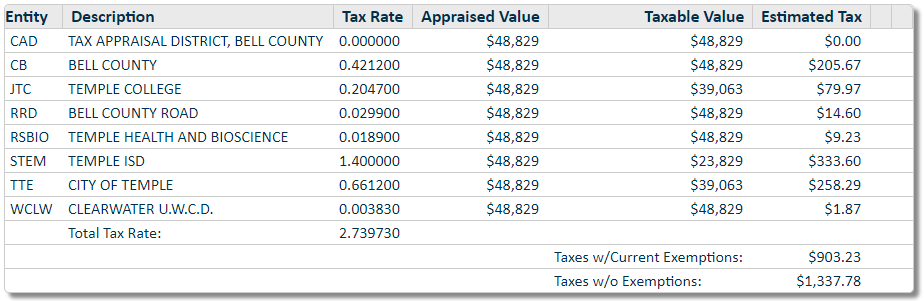

Tax Information Tax Information

Tax Information Tax Information

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Fort Worth And Arlington Isds Pass Property Tax Rates Above Limit Requires Voter Approval The Texan

Fort Worth And Arlington Isds Pass Property Tax Rates Above Limit Requires Voter Approval The Texan

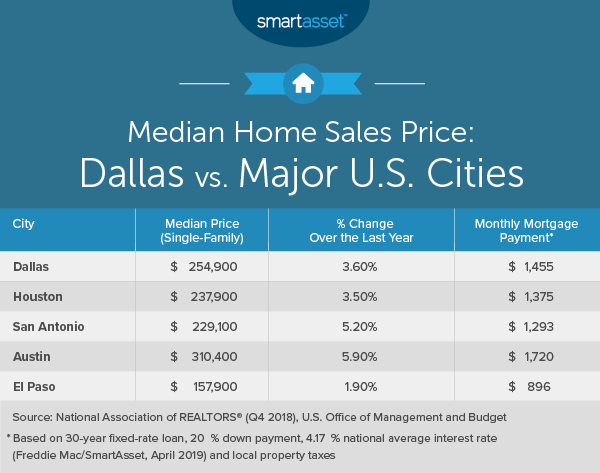

Cost Of Living In Dallas Smartasset

Cost Of Living In Dallas Smartasset

Everything You Need To Know About Fort Hood Tx Property Taxes

Everything You Need To Know About Fort Hood Tx Property Taxes

Property Tax White Settlement Tx

Fort Worth Budget Lower Spending Slight Tax Increase More Police Texas Scorecard

Fort Worth Budget Lower Spending Slight Tax Increase More Police Texas Scorecard

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Labels: calculator, property, texas

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home