How To Find Assessment Number For Property Tax In Tamilnadu

The state list in the VII schedule of the Indian Constitution provides for the levy of property tax. Corporation of Coimbatore Coimbatore - 641 001.

What To Do After Filing Your Provisional Patent In 2020 Legal Services Private Limited Company Service Level Agreement

What To Do After Filing Your Provisional Patent In 2020 Legal Services Private Limited Company Service Level Agreement

24615989 24615929 24615949.

How to find assessment number for property tax in tamilnadu. Property Tax - Tax Calculator District Select Ariyalur Chengalpattu Coimbatore Cuddalore Dharmapuri Dindigul Erode Kallakurichi Kancheepuram Kanyakumari Karur Krishnagiri Madurai Nagapattinam Namakkal Nilgiris Perambalur Pudukkottai Ramanathapuram Ranipet Salem Sivagangai Tenkasi Thanjavur Theni Thiruvallur Thoothukudi Tiruchirapalli. No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection GHMC offers the following modes Handheld machines of Bill Collectors are integrated with central server. 91 - 422 - 2390261 Email.

The due date for Chennai property tax payment is September 31 and March 31 every year and there is a 1 penalty every month for defaults. 367 142 Tamil Nadu Village Panchayat Assessment and Collection of taxes Rules 1999 GO. Designed Developed Maintained by Prematix Software Solution PVTLTD.

The following guide will help you get an insight into the whole property tax collection system in Chennai. 255 Rural Development Department Dated 13th December 1999 In exercise of the powers conferred by sections 171 172174 176 and sub section 1 of.

Here is the link for your perusal. I need to pay property tax under ground drainage tax online for SRIRANGAM ZONE. And Town Block Ward Survey Number Sub-Division Number in case of Urban Areas.

Select zone as Srirangam and proceed for payment. George Chennai 600 009 Tamil Nadu India. You can pay your Property Tax dues till 31-08-17 through the website given above.

Madurai Corporation Revenue Collection Centers list with name of the counter and contact phone number details for All Zones Zone 1 Zone 2 Zone 3 and Zone 4. Statutory assessment percentages are applied to appraised property values. Property is classified based on how the property is used.

In this article we look at the step-by-step process for payment of property tax in Tamil Nadu. You can choose the services for which you want to pay the tax. The assessment and payment of Chennai Corporation property tax can be done both online and offline.

Contents owned and updated by concerned Departments and coordinated by Information Technology Department Secretariat Fort St. The bribery is against the Law. You will be asked to select Tax type zone enter Assessment No.

Then multiply the product by the tax rate. The citizen may submit his request along with the following details through the online citizen portal available in website wwwchennaicorporationgovin. 91 - 422 - 2390167 Mobile.

How to pay TamilNadu Municipality property tax water UGD charges payment through online. In the Government of India Act of 1935 the parallel entry was Taxes on lands buildings berths and windows. Choose property tax over there.

My house is in Pappakurichi kattur. Kindly intimate the web site. The complaints about corruption may be sent to the Directorate of Vigilance and Anti-Corruption Chennai-28.

This procedure is different from paying your property tax online. Assessment of Property Tax. This video is about how to find new bill number and sub number in property tax in online this is useful to know your new property tax number from this you ca.

Government of Tamil Nadus Land Records e-Services enable citizens to view Patta. Property Tax Assessment Method. Lastly enter the mode of payment suitable for you.

To calculate your property tax multiply the appraised value by the assessment ratio for the propertys classification. The Corporation of Chennai has adopted the concept of reasonable letting value RLV for calculating the annual rental value which in turn is used to calculate the half yearly property tax for the. Other than this the water charges can be paid using the option too.

The citizen may follow anyone of the method for the submission of application for assessment of property tax. You can simply visit this link for finding out the Tamil Nadu Property tax assessment number by providing a few simple details and then verifying the captcha code to proceed. Now you have to enter the House Tax Assessment Number in the next blank.

The tax is designated as Taxes on lands and buildings.

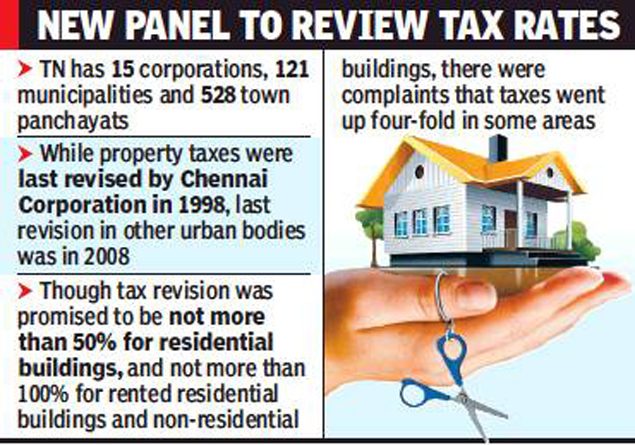

Tamil Nadu Government Rolls Back Property Tax Hike Old Rates Will Continue Chennai News Times Of India

Tamil Nadu Government Rolls Back Property Tax Hike Old Rates Will Continue Chennai News Times Of India

Download Property Tax Receipt Fy 2020 2021 View Upic Details Of Property Owner Tax Computations Youtube

Download Property Tax Receipt Fy 2020 2021 View Upic Details Of Property Owner Tax Computations Youtube

Tax Exemption Steps For Getting An 80g Certificate Tax Accounting Books Tax Exemption Tax

Tax Exemption Steps For Getting An 80g Certificate Tax Accounting Books Tax Exemption Tax

Download Property Tax Receipt Fy 2020 2021 View Upic Details Of Property Owner Tax Computations Youtube

Download Property Tax Receipt Fy 2020 2021 View Upic Details Of Property Owner Tax Computations Youtube

A For Adyar The Hindu Theosophical Society Scenery Banyan Tree

A For Adyar The Hindu Theosophical Society Scenery Banyan Tree

Empowering A New India With Skills Skilllearning Mastering Selfreliance To Strengthen India Www Nalayabharatham Org Skill Training Skills News India

Empowering A New India With Skills Skilllearning Mastering Selfreliance To Strengthen India Www Nalayabharatham Org Skill Training Skills News India

What Is A Circle Rate How Do I Find Circle Rate Of A Property

What Is A Circle Rate How Do I Find Circle Rate Of A Property

Company Registration In Pune Legal Services Private Limited Company Company

Company Registration In Pune Legal Services Private Limited Company Company

List Of Services That Need Mandatory Aadhaar Linking In 2020 Legal Services Private Company Opening A Bank Account

List Of Services That Need Mandatory Aadhaar Linking In 2020 Legal Services Private Company Opening A Bank Account

Are You On My Email List If So You Just Might Want To Check Your Email Not On My List Curious Send Me Your Email Addre Career Quiz Tech Startups Aptitude

Are You On My Email List If So You Just Might Want To Check Your Email Not On My List Curious Send Me Your Email Addre Career Quiz Tech Startups Aptitude

Tamil Nadu Government Rolls Back Property Tax Hike Old Rates Will Continue Chennai News Times Of India

Tamil Nadu Government Rolls Back Property Tax Hike Old Rates Will Continue Chennai News Times Of India

Policies And Procedures Template For Small Business Dental Business Plan Template Business Template

Policies And Procedures Template For Small Business Dental Business Plan Template Business Template

Tamil Nadu Property Tax Online Payment Know Details

Tamil Nadu Property Tax Online Payment Know Details

How To Find Fair Market Value Of Property As Per Income Tax Laws

How To Find Fair Market Value Of Property As Per Income Tax Laws

Yeida Has Revealed That In The Past One Year Investment Has Received A Major Boost In And Around The Yamuna Expressway Areas Investing Boosting Areas

Yeida Has Revealed That In The Past One Year Investment Has Received A Major Boost In And Around The Yamuna Expressway Areas Investing Boosting Areas

Realtymonks One Stop Real Estate Blog Property Tax Corporate Tax

Realtymonks One Stop Real Estate Blog Property Tax Corporate Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home