Real Estate Management Definition English

Normally the fees charged by a property manager are a widely varying percentage of the gross rentals depending on the services. Management agreements specify the nature of services to be provided and the extent of authority a property manager has.

An interest vested in this also an item of real property more generally buildings or housing in general.

/home_equity__rental_gowth_shutterstock_582996238-5bfc33374cedfd0026c27e4a.jpg)

Real estate management definition english. Real estate is different from personal property which is not permanently attached to the land such as vehicles. A buydown is a mortgage-financing technique lowering the buyers interest rate for anywhere from a few years to the lifetime of the loan. Property managers are generally responsible for the day-to-day operations of the real estate from screening tenants to.

Real estate management definition in English dictionary real estate management meaning synonyms see also realrealfor realreal estate. Real estate n mainly US immobilier m He invested his money in real estate. Business travel service the administration and development of land the building of first and second homes and real estate management.

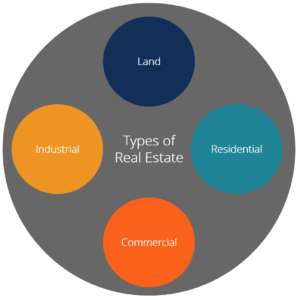

Study all of the important real estate glossary terms and definitions and pass with confidence. The business of managing land and buildings including activities such as keeping buildings in good. Immovable property of this nature.

So real estate asset management unlike traditional money management requires experienced individuals who can optimize the value of propertiesIn fact in many ways a real estate asset manager. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. Property Management Definition of Property management Tyrone Powell Real Estate Agent Vision Realty Centers Operating property for business use such as managing an office complex.

The business of managing land and buildings including activities such as keeping buildings in good condition and organizing the renting of property Property management is the daily oversight of residential commercial or industrial real estate by a third-party contractor. They understand real-estate law construction and property management. Poorly managed properties end up costing the owner of a property significantly in a variety of different.

Property management is the oversight of real estate by a third party. The business of managing land and buildings including activities such as keeping buildings in good. Property managers are hired to handle the operations maintenance and administration of property rentals for an owner.

Real estate agents are required to work under the supervision of a broker. Real estate management definition. Their work among many other tasks includes marketing rentals and finding renters ensuring rental rates are competitive while covering taxes and overhead collecting rent and complying with rental laws.

Usually the property seller or contractor makes. At the directly or indirectly held real estate project companies real estate management is responsible for operational and strategic risk management. Enrich your vocabulary with the English Definition dictionary.

Free Real Estate Vocabulary Flashcards Pass the real exam by knowing all of the vital real estate vocabulary terms that are crucial to passing the real estate licensing examination. Real estate management meaning. Property management is a critical aspect of a property performing to its full potential.

The most spectacular piece of real estate he had ever imagined. Contractual agreement between a commercial or industrial rental property owner and an individual or firm who agrees to maintain the property.

Read more »Labels: definition, english, management, real

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)