How To Get Ptin Number Ghmc

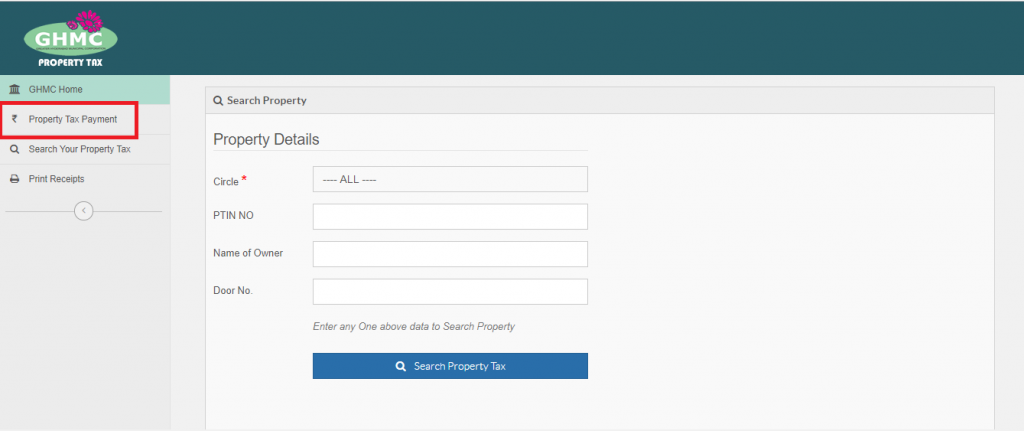

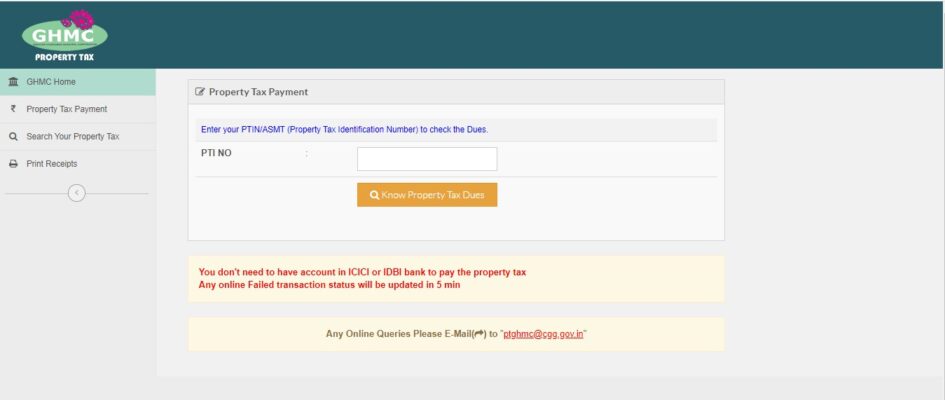

Select your GHMC Circle and Enter your Property Tax Identification Number or PTIN Number in the box as shown below. 72 Mee-Seva Centres in GHMC limits Citizen Service Centres in all 19 Circles and GHMC Head Office Online NEFT and RTGS modes of payment and 537 branches of 8 Banks.

Dharani Portal Telangana Search Land Details Youtube Telangana Portal Landing

Dharani Portal Telangana Search Land Details Youtube Telangana Portal Landing

Enter your door number.

How to get ptin number ghmc. How to generate PTIN online. Go to the options. 2 If you have your mobile number registered with GHMC you will receive an SMS when the property tax for the current is assessed along with a direct link to the GHMC payment portal.

Get Your PTIN After completion of the online application your PTIN is provided online. Here is the way to know your PTI Number Online before going to pay Tax Online Step 1 Visit GHMC Online Payment Website ptghmconlinepayment Step 2 Click on Search your Property Tax Step 3 Select your Circle. Click Search Property Tax.

After physically verifying the property and all the legal documents a PTIN and house number is issued to the owner by the authority. PropertyAdviser a realestate propertydirectory explains in brief. Disclaimer Designed and Developed by Centre for Good Governance.

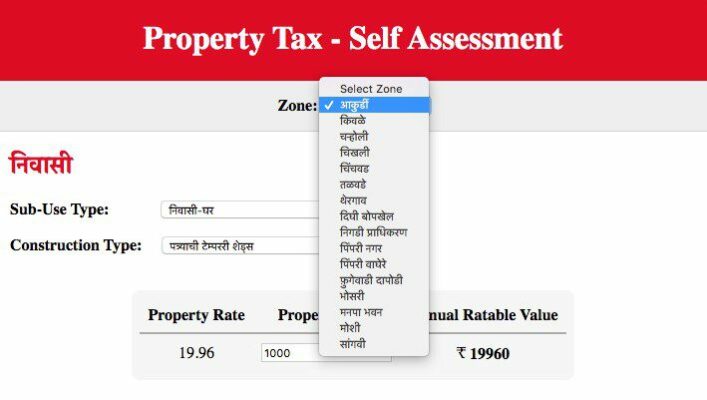

Apply for your PTIN Complete the online application. Owners of new properties have to get a PTIN generated by giving an application to the city deputy commissioner along with copies of their sale deed and occupancy certificate. Click on the self-assessment form by logging on to the official website of GHMC.

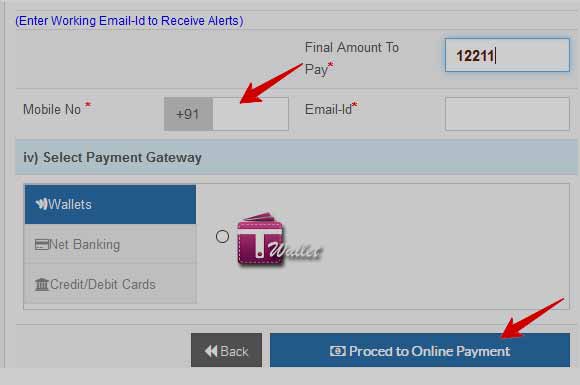

You dont need to have bank account to pay the property tax Any Online failure transaction status can be updated in 5-mins Information Provided Online is up-to Date and Physical Visit to the GHMC Office Department is Not Required. Last Name. On the homepage key in the PTIN number.

Log on to the official GHMC online payment portal Correctly enter your PTIN into the field and click on the tab Know Your Property Tax Dues They will also check and verify the legality of the title deed of the property along with other property documents. Proceed to click on the know property tax dues. Do you know about PTIN and how it is used to make property tax payment in Hyderabad.

1 Online payment through the GHMC Online Payment Portal. How to generate PTIN. You will need your Social Security Number personal information business information.

For finding your PTIN visitLocality Search and enter your Property Circle and your name or door number. Go to this link. Enter your card details and click Pay The GHMC has classified properties in Hyderabad into 18 Circles and you can know your PTIN number OldNew from GHMC website.

How to apply for a PTIN. Enter your PTINASMT Property Tax Identification Number to check the Dues. Create your account You can set up your online account here.

PTI NO Know Property Tax Dues. You can get your PTIN in 4 steps. You can click on the link and verify the details of your property and make payment online.

Once you have entered the details click submit. Unique Property Tax Identification Number PTIN is generated once the authorities physically verify and inspect the property. Choose your GHMC Circle.

Luckily its a relatively painless process to get one. Arrears property tax interest on arrears adjustments etc. In fact the IRS says the process can take as little as 15 minutes.

All PTIN correspondence is delivered through secure online messaging in your PTIN account. Pay Your Fee The application will transfer you to our partner bank where you will make your payment of 3595 by creditdebitATM card or eCheck. It is 14 digits for old PTINs and 10 digits for new PTINs.

Follow the steps given below to find your PTIN. To initiate the process for self-assessment the following steps have to be followed. If you dont have a PTIN and you know your door number you can use your door number to find out the PTIN.

Read more »