How To Know My Land Registration Online In Andhra Pradesh

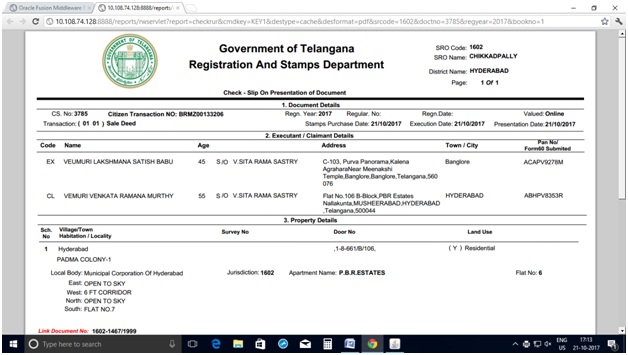

You will be redirected to a new page where you will be able to search for the EC using following parameters. You will need to open Adhaar on the web page option in the menu bar.

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

We will be your partner through out the investment process.

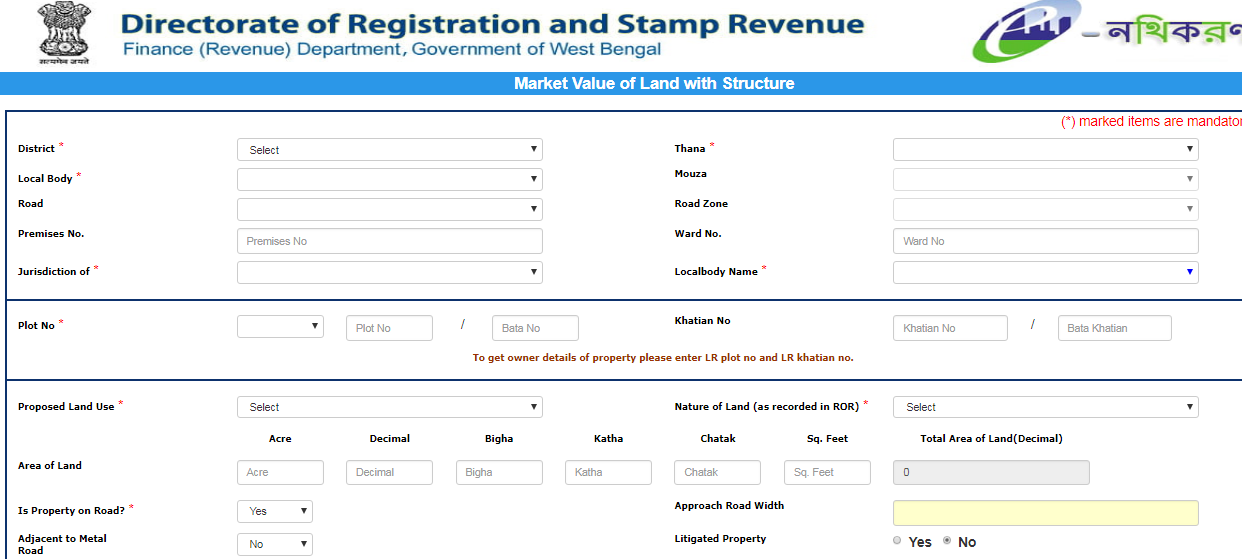

How to know my land registration online in andhra pradesh. Visit the official meebhoomi website httpsmeebhoomiapgovin. The government has found out that middlemen play a vital role in registration of land. Enter the required details such as district zone village name account number and mobile number.

To know further details on AP land registration charges and stamp duty go through the Andhra Pradesh State government official websitehttpregistrationapgovin Property Stamps and Registration charges in Andhra Pradesh in 2018. Document number or year of document registration. Open the Mee Bhoomi Andhra Official Website Click on the Aadhar and Other Identities option in the Menu Bar and then Aadhar Linking in the Drop Down Menu It displays the below form with the following fields Click on the Account Number or Aadhar Number of your Choice.

1 is through online re gisteration on the website htt pregistrationapgovin by entering all the required det ails related to the buyer and seller and then submit the doc uments on the designated day a t the sub registrars office. Enter your Aadhar Number as well as other details like Name of the Zone Account Number village Name and district name. Follow this procedure.

Visit the Meebhoomi portal and click on Aadhaarother identities from the top menu and choose the second option Mobile number linkingbased on identity documents from the drop-down menu. You will be redirected to a new page. With its latest directives the Andhra Pradesh government has doled out different land registration prices for urban and rural areas.

This service used to get the Certified Copy of Registration Document. Enter the code given on the website and submit the details by pressing on CLICK. We function on the fundamentals of.

In urban areas where land prices are more than. The project of computerizing the services of the department was originally conceived in August 1996 and implemented at two test sites in August September 1997. We offer professional advisory services for Real Estate investors in Amaravati CRDA Area - Andhra Pradesh.

There is an app called AP stamps and registration download that app and when u open that u can see ec online and cc online in blue underline click any of them and enter the land document number and registration year remember land document number wouldnt be same for all years. Welcome to Registration Stamps Department - The Registration Stamps Department is one of the oldest wings of the Government. At present a minimum of five per cent will be charged from land buyers as a registration fee.

Transparency Reliability Professionalism are our promise to you. There is an app called AP stamps and registration download that app and when u open that u can see ec online and cc online in blue underline click any of them and enter the land document number and registration year remember land document number wouldnt be same for all years. Click on Get details.

How to calculate registration fee for Agriculture land House sites plots httpregistrationapgovin. There are 2 ways of land registration in Andhra P radesh. Click on the Electronic Passbook option.

By having the document copy the citizen can solve the legal problems if heshe is facing regarding the property or other site issues which the land is been registered. The Certified Copy of Registration Document is to get the Duplicate copy of the Registration Document which is done at Sub Register office. Click on Encumbrance Search EC from the right menu.

Last year the land registration charges were capped at ten per cent. This act amends the Andhra Pradesh Record of Rights in Land and Pattadar Pass Books Act 1971 Library Resource Andhra Pradesh Land Grabbing Prohibition Act 1982 - Andhra Pradesh Land Grabbing Amendment 1987. So u have to put that particular document number in that year to show your land details.

Document No Registration Year. Then enter the code given in the box. How do I check land records online for Andhra Pradesh.

Now Click on the click button. Mention the district zone village and account number. In a bid to eliminate the role of middlemen the registration and stamps department is set to introduce an online portal from November 2 that will allow people to draft their own documents.

With an amendment to the Andhra Pradesh Record of Rights in Land and Pattadar Pass Books Act 1971 officials of the Registration Department have been appointed as provisional recording officers. Read the disclaimer and click Submit.

Read more »