How To Know My Land Valuation In West Bengal

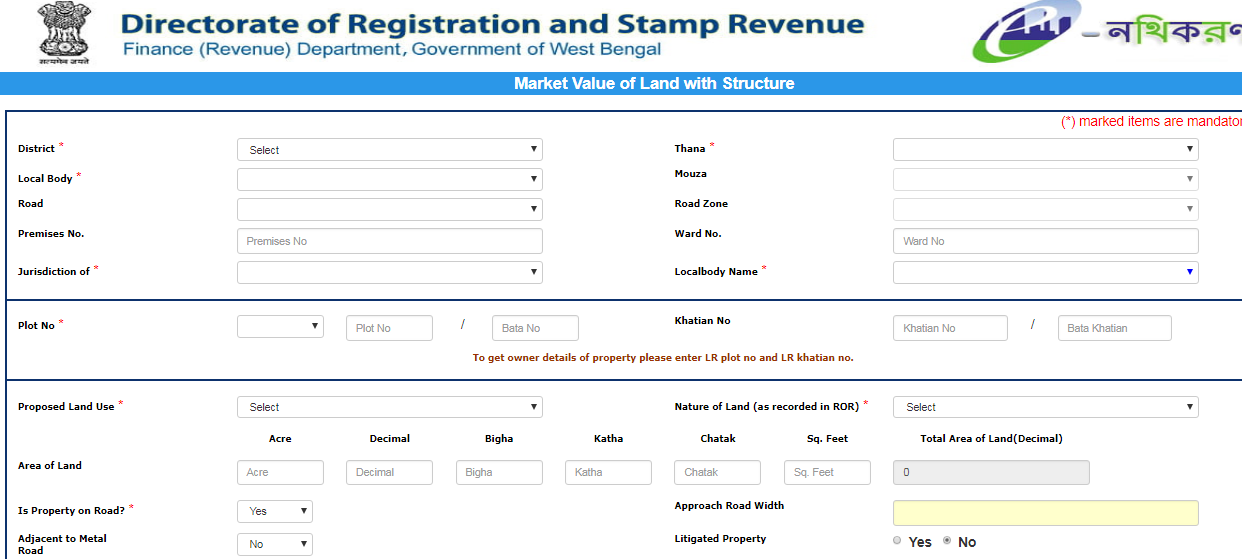

User can view the market value of land selecting District Thana Local bodyMouza RoadPlot No Khatian No proposed land use area etc. Here we are discussing about Land Classification which means banglarbhumi valuation of land this option will be available at Citizen services in that sub menu of Land Classification option will display.

West Bengal Land Valuation Application Procedure Indiafilings

West Bengal Land Valuation Application Procedure Indiafilings

The first step is to browse the wbregistrationgovin.

How to know my land valuation in west bengal. Open the official portal of Banglarbhumi. To know your Land Classification click on option and first select your district that all. Contribution to this fund entitles you to claim 100 deduction under section 80G of the Income Tax Act.

A person who wants to buy property or land in West Bengal and wants to know land detail like owner area Khata number current value of the land can visit the Jharbhoomi online portal. The land classification is referred as the Banglarbhumi valuation of Land which is available at the citizen services option. Market Value of Land in West Bengal.

The portal stores the records and reforms of land for general people. People can easily find Khatian and plot information on that website. The West Bengal website for the valuation of the property provides you with different options to get the valuation.

The West Bengal Central Valuation Board Act 1978 was a legislation intended to bring forth a uniformity in the valuation of urban properties in West Bengal Read More Process of Valuation. Arrow Fill up Incomplete e-Requisition Form. Fill in all the details as per the requirements especially the mandatory fields.

After the ULB adopts a resolution to re. This helps the user to know the valuation and other stats of the land. The next page opens up with a public registration form.

How to Find Land Valuation in West Bengal -2018 How To Know Valuation Of LandFlat OnlineWebsite Link- httpwbregistrationgovinMy Website Link- http. After filling in the. The West Bengal State Government Appeals ALL to contribute in West Bengal State Emergency Relief Fund and assist the State in prevention and control of situation arising out of unforeseen emergencies like COVID-19 CORONA.

Fees Status of e-Payment Application. In the West Bengal Bhumi website we can get the khatian plot information of West Bengal land. The name of the website where you can get online property valuation in West Bengal is wbregistrationgovin.

Next on the homepage click on the signup button. Contribution to this fund entitles you to claim 100 deduction under section 80G of the Income Tax Act. Anyone can access the site anytime for free.

The Land and Reforms Department of West Bengal has made it easy to find documents concerning citizens land online on their httpsbanglarbhumigovin. The West Bengal Prevention Of Under-Valuation of Instruments Rules 2001 The West Bengal Registration Filing of True Copies Rules 1979 The West Bengal. West Bengal Valuation Board.

In Banglarbhumi valuation of land web portal we can find out the West Bengal land information. Easy way to check land record in West Bengal. User can also view the Onwer of the property as per Land records giving the.

As per the present system valuation of any ULB takes place in every five years. Registration at the Banglarbhumi portal. Printing of e-Assessment Slip e-Payment of Stamp Duty Regn.

Visit the Banglarbhumigovin offical website. This means that you can now check if the property is real and its value through the Banglarbhumi website. The West Bengal State Government Appeals ALL to contribute in West Bengal State Emergency Relief Fund and assist the State in prevention and control of situation arising out of unforeseen emergencies like COVID-19 CORONA.

Banglarbhumigovin is an online portal runs by Government of West Bengal. Steps to follow for the Valuation of Land.

Read more »