Property Management Company Valuation Multiples

The only exception was 2018 when deals less than 500k and less than 250k had practically the same multiple rate. 198 rows Valuation Multiples by Industry.

What You Need To Do Before You Rent Out Your Home Real Estate Rentals Rental Property Management Being A Landlord

What You Need To Do Before You Rent Out Your Home Real Estate Rentals Rental Property Management Being A Landlord

Approximately 100 of annual.

Property management company valuation multiples. Take the property management monthly contract and do a monthly multiplier on that. They should be used as a benchmark and not to calculate the value of the company in the same way the average price of a used car should be used as a. The common ratio is 60 percent of revenue from property management fees and 40 percent of revenue from value-add services.

In property management companies the bigger the deal size the higher the multiple so the bigger your business the more profit youll get for it. All of these things become factors. Property Management Business Valuation Formula.

5-10 Year company maybe 25 to 30 start-up 35. The gross income multiplier approach is a relative valuation method that is based on the underlying assumption that properties in the same area will be valued proportionally to the gross income. Property Management Companies - free guide to industry information research and analysis including industry trends and statistics financial ratios salary surveys and more.

Your assigned property manager will address maintenance concerns to help maintain the value of your rental property and to ensure tenant retention. Some people might diminish such services but its starting to change as the buyers now value those fees. The table below summarises eVals current month-end.

Because it does not weigh all the inputs included in a DCF model. Multiples reflect the average price of a company when compared to a value driver in this case EBITDA. Property Management businesses sell for a much higher multiple because they generally appeal to a very large buyer pool they are considered easier businesses to operate and they are pure service businesses with no inventory and can be operated with little overhead.

Perform qualitative and quantitative comparisons to sample companies Apply multiples based on above analysis Pay attention to level of value if valuing a controlling position make sure the comparable transactions were for control positions Challenges with this method Limited number of transactions Staleness of transactions. Typically the multiple is around 10x due to the fact that a book of business is being valued. Then multiply from eight to sixteen depending on the seller the buyer and the area youre in.

Bizbuysell says nationally the average business sells for around 06 times its annual revenue. If a company has 100 properties at 100 per month then thats 10000 a month in management contracts. Buyers guided by appraisers and business valuation experts use rules of thumb to value businesses based on multiples of business earnings.

For an established mature Property Management Company the discount rate is generally 20 25. Private company sales transaction data for over 800 industries. Heres how we calculate what the business is worth.

Total Sales Cost of Goods Sold Expenses Owners Wage. We calculate the multiple for the business in question based on profit using SDE sellers discretionary earnings for business. While valuation guidelines and example selling multiples by industry and many times more accurate than generic overall rules of thumb its important to understand that every business is different and thus your valuation may differ.

Why RatioMultiple Valuation methods are bad for the SELLER. With a clearer understanding of what your business is worth you can begin taking steps to increase the value of your property management firm prior to. There are some national standards depending on industry type and business size.

This is a general business valuation formula or method for established Property Management companies or businesses based on a percentage of annual gross revenues that can be used to help determine an approximate value and asking price to market an existing small property management business. Market Your Property We assess your rental properties current market rent value promote your rental property on our website and multiple national websites such as Zillow Trulia HotPads etc. Try to aim for a 5050 ratio when it comes to these figures.

Understanding Business Valuation And Multiples For Startups Cleverism Career Tips Business Career Clever Business Valuation Start Up Business Start Up

Understanding Business Valuation And Multiples For Startups Cleverism Career Tips Business Career Clever Business Valuation Start Up Business Start Up

What Do Property Management Companies Do Property Management Marketing Rental Property Management Property Management

What Do Property Management Companies Do Property Management Marketing Rental Property Management Property Management

Multiple Openings Qatar Qatar Contracting Company Job

Multiple Openings Qatar Qatar Contracting Company Job

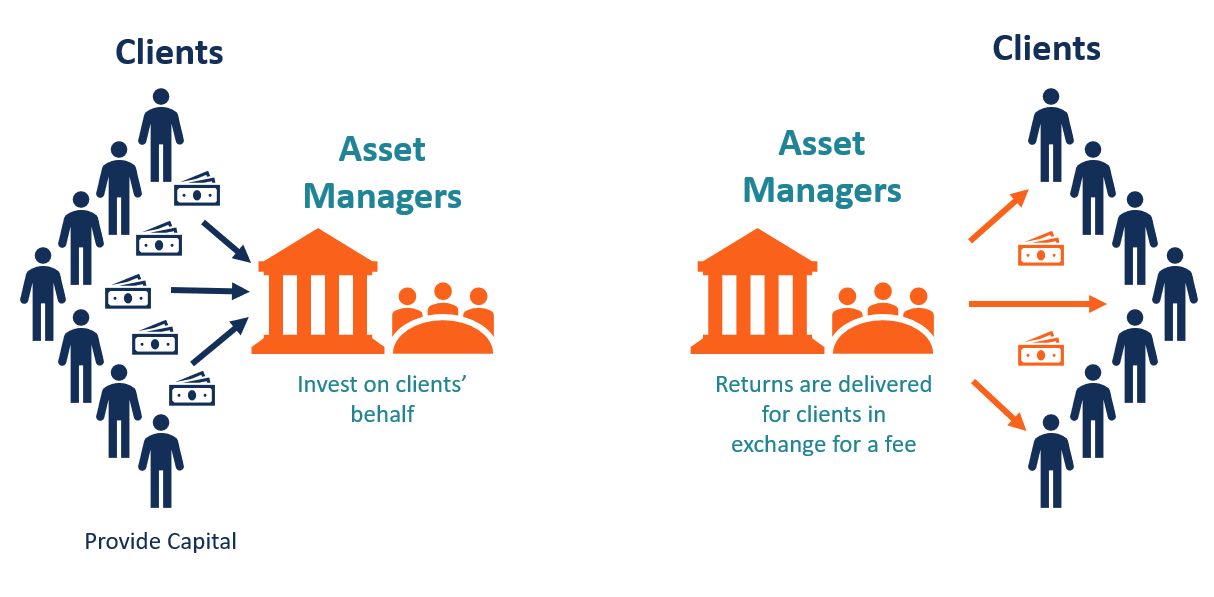

Asset Management Company Amc Overview Types Benefits

Asset Management Company Amc Overview Types Benefits

Property Valuation Service West Kenya Real Estate Property Letting Property Management And Sales Property Valuation Property Rental Property Management

Property Valuation Service West Kenya Real Estate Property Letting Property Management And Sales Property Valuation Property Rental Property Management

Download Rental Property Management Excel Template Exceldatapro Rental Property Management Property Management Rental Property

Download Rental Property Management Excel Template Exceldatapro Rental Property Management Property Management Rental Property

Pure Automate Automate Is Suitable For All Types Of Firms Acquainted In Hospitality Industry From Hotel Motels Re Hotel Management Pure Products Management

Pure Automate Automate Is Suitable For All Types Of Firms Acquainted In Hospitality Industry From Hotel Motels Re Hotel Management Pure Products Management

Why The Commercial Real Estate Is In More Demand Commercial Real Estate Commercial Real

Why The Commercial Real Estate Is In More Demand Commercial Real Estate Commercial Real

Infographic For New Landlords Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Infographic For New Landlords Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Rental Property Spreadsheet Template For 25 Properties Business Rental Property Management Property Management Marketing Property Management

Rental Property Spreadsheet Template For 25 Properties Business Rental Property Management Property Management Marketing Property Management

This Is Graph Of Property Management Property Management Marketing Rental Property Management Property Management

This Is Graph Of Property Management Property Management Marketing Rental Property Management Property Management

Largest Reit Stocks Get More Expensive As Valuations Outpace Broader Reit Sector Real Estate Investment Trust Real Estate Investing Capital Market

Largest Reit Stocks Get More Expensive As Valuations Outpace Broader Reit Sector Real Estate Investment Trust Real Estate Investing Capital Market

Keys To A Successful Property Management Website 4businessand Life Property Management Rental Property Management Management

Keys To A Successful Property Management Website 4businessand Life Property Management Rental Property Management Management

Free Rental Property Management Spreadsheet In Excel Rental Property Management Rental Property Rental Property Investment

Free Rental Property Management Spreadsheet In Excel Rental Property Management Rental Property Rental Property Investment

Being A Property Landlord In Ontario Can Mean A Lot Of Responsibility Fortunately Property Managemen Property Management Being A Landlord Management Company

Being A Property Landlord In Ontario Can Mean A Lot Of Responsibility Fortunately Property Managemen Property Management Being A Landlord Management Company

Is It Time To Hire A Property Manager Infographic Property Management Property Management Marketing Rental Property Management

Is It Time To Hire A Property Manager Infographic Property Management Property Management Marketing Rental Property Management

Rental Cash Flow Analysis Spreadsheet For Excel Cash Flow Spreadsheet Investment Analysis

Rental Cash Flow Analysis Spreadsheet For Excel Cash Flow Spreadsheet Investment Analysis

What Does A Property Manager Do Rental Property Management Property Management Marketing Property Management

What Does A Property Manager Do Rental Property Management Property Management Marketing Property Management

Exclusive Property Management Agreement Rental Property Management Property Management Management

Exclusive Property Management Agreement Rental Property Management Property Management Management

Labels: company, management, property, valuation

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home