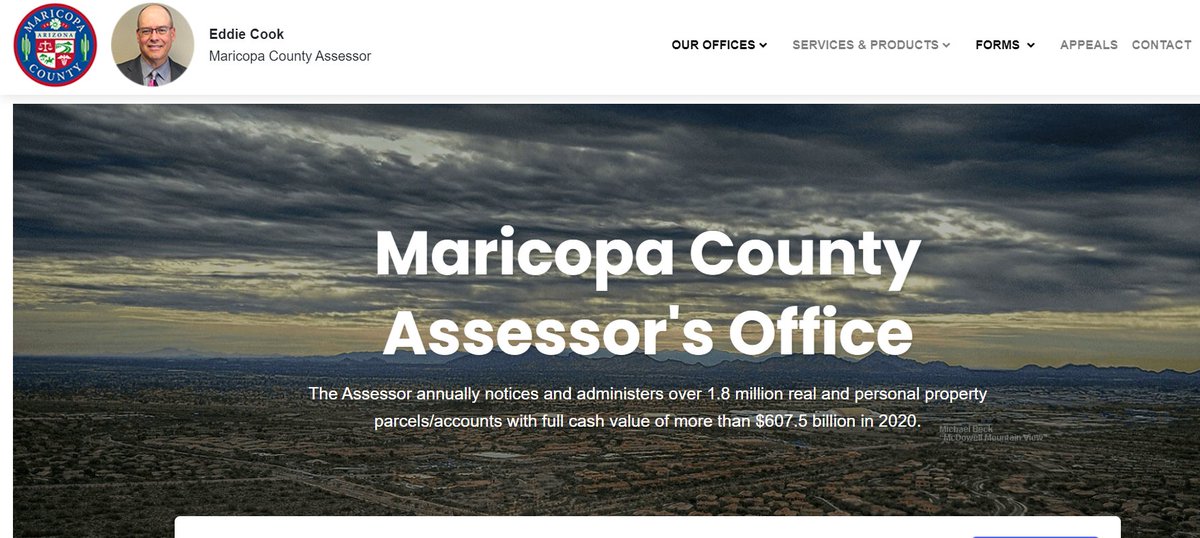

How To Find Out Who Owns A Property In Maricopa County

In addition each listing includes the Assessors full cash value of the land improvements and any. The mailing address may be different than the owner or the property address.

Pin By Code Of The West Realty On Houses For Sale Sale House Black Canyon City Land For Sale

Pin By Code Of The West Realty On Houses For Sale Sale House Black Canyon City Land For Sale

How do I find out about the easements located on or near my property.

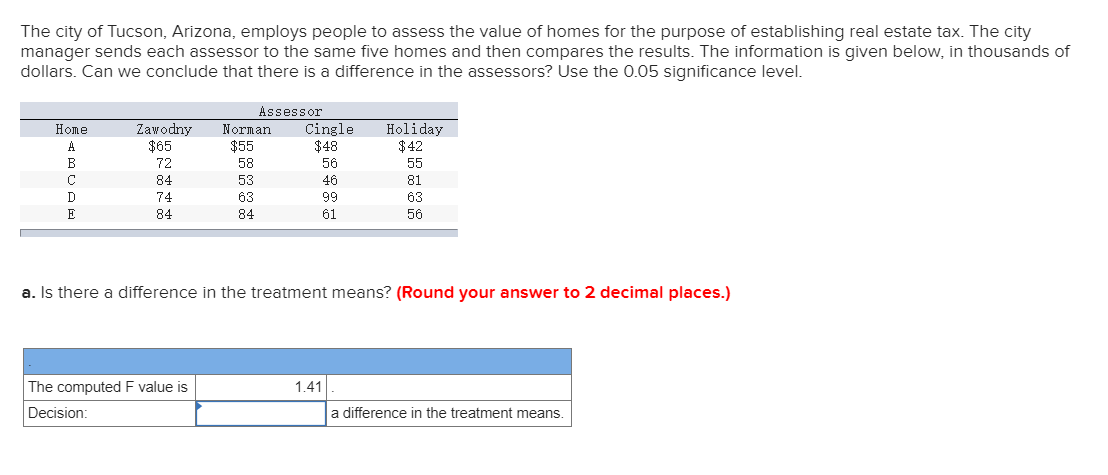

How to find out who owns a property in maricopa county. This website provides direct online public access to all property records and document data it has available for the United States and US. RECORDER website search using the lastfirst name section of the search screen httpsrecordermaricopagovrecdocdata. PlanNet Opens in New Window has been developed to provide easy access to the information and maps associated with the zoning annexations floodplain and other delineations within Maricopa County.

Maricopa County Assessors Office. Obtain assets and record a lien to secure debt in Arizona. Searches can typically be performed using an interactive map by parcel number address or owner name.

Visit the County Recorder or Register of Deeds Visit the County ClerkRecorders office and bring the address and parcel number with you. Deed and title searches in Maricopa County Arizona. Property owners may contact the Register of Deeds for questions about.

Maricopa County property records. A real property tax lien that is sold under article 3 of this chapter may be redeemed by. Property ownership and transfers.

Maricopa County Planning and Development has no records of easements on individual lots that are not part of a recorded subdivision. View property characteristics ownership information liens and title documents and use the interactive maps. Pursuant to ARS 42-18106 a listing of each parcel showing the parcel number delinquent tax amount the property owners name and the propertys legal description.

Search any address in Maricopa County AZ and find out who owns the property. Tools to research owners and LLCs. ASSESSOR website search can be done using name or address httpsmcassessormaricopagovindexphp.

Service is provided in the United States only. Arizona Maricopa County 111 S 3rd Ave Phoenix AZ 85003 Number. In Maricopa County property records are kept by the County Recorders office just as in the whole of the state of Arizona and the rest of the US.

Whenever a piece of land changes hands or is sold this information is necessarily recorded at the County Recorders office along with the amount that was paid. You will get detailed ownership records and ways to reach the owner with an easy search. You can also check for liens on the property and find out if the propertys ownership is disputed.

Visit the Maricopa County Treasurers Office website type in your Assessors Parcel Number APN and click on your tax bill to find districts or jurisdictions taxing your property with a. Access all property land and real estate records. The purpose of the Recorder of Deeds is to ensure the accuracy of Maricopa County property and land records and to preserve their continuity.

The mailing address is usually obtained from the Assessors Office who in turn receives the information from the Deed or Affidavit of Value recorded with the Recorders Office. BEGIN TITLE SEARCH HERE. Trusted nation-wide property records reporting service.

Any person who has a legal or equitable claim in the property including a certificate of purchase of a. Obtain preliminary title reports and full chain of title searches for Arizona and County Recorder deeds and documents. The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with full cash value of more than 6075 billion in 2020.

The owners agent assignee or attorney. There you can search title books to see who currently owns the property and who previously owned it. This kind of information is not only helpful to find out who owns a certain property in Maricopa County.

A surveyor real estate attorney or a schedule B from a title company may be able to assist you with the location of easements. Maricopa County Resources The Permit Viewer Tool allows you to explore building zoning and code violation cases in unincorporated Maricopa County. We suggest you be proactive and check the public records in our office as well as the ownership records with the Assessor office.

For counties without an online database County Assessors offices may be contacted via phone email fax mail or in person. Phone numbers when available. Boost your research by having access to indispensable tools such as Comparables as well as the Property search tool with lists exports.

Any person that wants to pay on behalf of the owner by making a charitable gift. PropertyShark is your One-stop-shop for comprehensive real estate.

Read more »