How To File Homestead In California

For more information about the Homestead Declaration and information on Low-Income Exemptions please contact your legal adviser or refer to the California Code of Civil Procedure Sections 704710-704850 and 704910-704995. New California Homestead Exemption Amount 2021 Signed by Governor Gavin Newsom on September 18 2020 the new homestead exemption in California under AB 1885 will become effective January 1 2021.

Pma Loans How To File A Homestead Exemption Application In California

Pma Loans How To File A Homestead Exemption Application In California

Specifically homestead laws allow individuals to declare a portion of their property as homestead and therefore mostly off-limits to creditors.

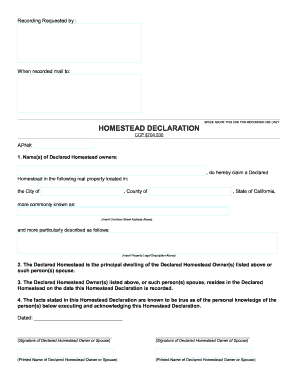

How to file homestead in california. The form must be completed signed and notarized in order to be recorded in the County Recorders Office. County of _____ State of California commonly known as _____ Street Address. Declaration of Homestead Along with the homestead exemption offered by California you may declare a homestead by filing a single-page document with the County Recorder.

And more particularly described as follows. Fill out the form. Blank Declaration of Homestead forms are available at stationery stores that carry legal forms.

Statement that the facts are known to be true. Buy a declared homestead form from an office-supply store or download a form from the Registrar-Recorders website. One simply files the standard form executed and notarized with the County Recorder in the County in which the property is located.

Such filing with the recorder is called Recording. I am the declared homestead owner of the above declared homestead. Description of the property must be located in Sacramento County For example a complete street address including city and state is acceptable.

Your home may be protected under California homestead laws. Record the Homestead Declaration at the Recorders Office. Sign the form and have it notarized.

Filing a declaration of. A Declared Homestead does not change or. Contact the Registrar-Recorders office where the property is located for fees and.

This was noted by Gov. The Governor also announced today that he has signed the following billsAB 1885. Learn how these laws can help understand your rights and protect one of your greatest assets.

Unpacking The Enhanced California Homestead. The Homestead Declaration must be notarized and then filed in the Recorders Office of the county in which the property is located. A big part of the change is that the increased homestead is available to homeowners regardless of age health or marital status.

An attorney can prepare a Declaration of Homestead for you. Homestead protection laws protect homeowners and other small property owners from being left homeless during times of economic strife. I own the following interest in the above declared homestead.

You must choose from several types. Youll have to fill in information such. All you have to do to declare a dwelling as a homestead is to fill out a declaration form available online including from California law library websites.

On January 1 2021 Californias homestead exemption grew from a prior low of 75000 to a minimum of 300000 to as much as 600000 depending on county wide home prices. How can I file. Under California homestead laws property owners may declare at least 75000 worth of their property as a protected homestead.

The Homestead Declaration must be recorded with the County Recorder to be valid. In California the bankruptcy homestead exemption is automaticyou dont have to file a homestead declaration to claim the homestead exemption in bankruptcy but youll still need to claim the homestead exemption when filling out your bankruptcy paperwork. California Assembly Bill AB1885 increases the homestead exemption to a minimum of 300000 and a maximum of 600000 depending on median county home prices.

To declare a Homestead you can file your completed Homestead Declaration with the County Recorder in the county where the property is located. Newsom in an unrelated press release which provides that. RECORDING THE HOMESTEAD It is easy and inexpensive to record the homestead.

You Dont Need to Declare a Homestead in California. Give complete legal description _____ _____ 2. Name of owner sdeclarant s Statement declaring the homestead.

Read more »Labels: california, file