What Is A Homestead Declaration In California

In 1741 John Hart married Deborah Scudder 1721 1776. Under California homestead laws property owners may declare at least 75000 worth of their property as.

Why Filing A Homestead Declaration Before Bankruptcy Is Wise

Why Filing A Homestead Declaration Before Bankruptcy Is Wise

There is a standard 25000.

What is a homestead declaration in california. California - San Diego County Recorder Information. The Florida homestead exemption is an exemption that can reduce the taxable value of your home by as much as 50000. The current homestead exemption in California is automatic homeowners dont necessarily have to file a homestead declaration with the County Clerk.

A homestead generally refers to the primary residence owned and occupied by a person or family. The statements made on this web page and any page that follows within the Chicago Title website are not intended and shall not be construed to expressly or impliedly issue or deliver any form of. Labor historyThe dispute occurred at the Homestead Steel Works in the Pittsburgh area town of.

If you qualify you can reduce the assessed value of your homestead up to 50000. Florida residents can take advantage of several homestead exemption categories to reduce their property taxes. The homestead tax exemption.

The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident. The Clerk-Recorder is responsible for maintaining records for real property located in San Diego County. Specifically homestead laws allow individuals to declare a portion of their property as homestead and therefore mostly off-limits to creditors.

California also offers an automatic homestead exemption that does not require filing a declaration. For information about how the homestead exemption works in both Chapter 7 and Chapter 13 bankruptcy see The Homestead Exemption in Bankruptcy. The declaration of homestead protects the equity in your home for up to 500000 in the event you are sued.

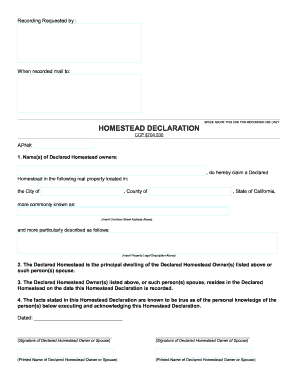

All Court Forms. The facts stated in this Declaration are true as of my personal knowledge. Homestead Declaration Homestead Declaration-Spouses Abandonment of Declared Homestead Sample filled-in forms with instructions are available at the end of this Guide.

Here youll find specific information about the homestead exemption in California. He was the son of Captain Edward Hart a farmer public assessor Justice of the Peace. However your decision requires some consideration of which homestead choice is the best option.

Homestead exemption in California is automatic so you dont necessarily have to file a homestead declaration with your County Clerk. The homestead exemption is a legal provision that helps shield a home from some creditors following the death of a homeowners spouse or the declaration of bankruptcy. While the homestead exemption encourages homeowners to build equity in their homes the laws have provided no such generous protections for other assets like expensive cars boats or bank accounts which are generally available for creditors in state court and bankruptcy proceedings.

So a homestead exemption is a legal provision designed to protect the value in a principal dwelling place. The county property appraiser handles the processing and approval of the application. 1400 - First page of all titles not associated with the Real Estate Fraud Fee 85 x 11 1700 - First page of all titles associated with the Real Estate Fraud Fee 85 x 11.

The updated homestead exemption encourages acquisition of equity in California homeowners houses. Quite simply an estate of homestead is protection for a persons residence from most creditors. Declaration of Abandonment of Homestead Declaration of Abandonment of Homestead Declaration of Service Declaration of Service Defendant Bond English.

Notarize The Homestead Declaration must be notarized and then filed in the Recorders Office of the county in which the property is located. John Hart born between 1706 and 1713 May 11 1779 was a public official and politician in colonial New Jersey who served as a delegate to the Continental Congress and also signed Declaration of Independence. Thus homestead exemptions can provide asset protection from creditors for at least some of the value in the homestead.

Homestead DeclarationExemption To qualify youll need to be a Vermont resident and occupy your home as a primary residence by April 1 of the year you apply for the exemption. The above homestead is strike inapplicable clause my principal dwelling the principal dwelling of my spouse and strike inapplicable clause I am my spouse is currently residing on the declared homestead. A homestead exemption protects equity in your home from creditors attempting to collect a debt and when you file for bankruptcy.

The battle was a pivotal event in US. Homestead Exemptions by State and Territory. However if you do file it your homestead isnt lost after your home sells whether thats involuntarily or voluntarily.

The Massachusetts Homestead Protection Act is one of the biggest no- brainers for any homeowner in Massachusetts to take advantage off. The Homestead strike also known as the Homestead steel strike Homestead massacre or Battle of Homestead was an industrial lockout and strike which began on July 1 1892 culminating in a battle between strikers and private security agents on July 6 1892. Here you will find court forms that are commonly used in the Southern District Court of California.

Homestead protection laws protect homeowners and other small property owners from being left homeless during times of economic strife. All court forms can be viewed or searched by keyword or category. Your exemption amount varies based on your homes value local tax rates and your income.

Its offered based on your homes assessed value and offers exemptions within certain value limits.

Read more »Labels: california, declaration, homestead, property