How To Apply For Homestead Exemption In Pa

For properties considered the primary residence of the taxpayer a homestead exemption may exist. If you no longer qualify for the Homestead Exemption you must file the changeremoval form.

How Do I Claim The Florida Homestead Exemption Epgd Business Law

How Do I Claim The Florida Homestead Exemption Epgd Business Law

You may pre-file for exemptions anytime after you take ownership of the property become a permanent resident or become eligible for specific exemptions for the following years taxes.

How to apply for homestead exemption in pa. School districts are required to notify homeowners by December 31 of each year if their property is not approved for the homestead or farmstead exclusion or if their approval is due to expire. How to apply. 2021 Homestead Exemption application deadline to file was March 1 2021.

You can fill out the online application or print one of the application forms and send them by mail to. If the property has more than one owner signatures of additional owners are not required. Application Based on Age An application to receive the homestead exemption is filed with the property valuation administrator of the county in which the property is located.

To receive a homestead or farmstead exclusion on your property file an application form with your county assessor. PA Department of Community and Economic Development The mission of the Department of Community and Economic Development DCED is to foster opportunities for businesses to grow and for communities to succeed and thrive in a global economy. Registerpre-register for COVID Vaccine registrations.

Homestead property owners are able to transfer their Save Our Homes SOH benefit up to 500000 to a new homestead within two years of giving up their previous homestead exemption. The exemption may be used for homes condos co-ops mobile homes and burial plots. Initial application for homestead exemption and other exemptions must be made at the Property Appraisers Office by March 1st of the year you are applying for.

If you meet ALL of the criteria below. Carefully review the requirements described below and select the application process that applies to you. When you apply for the homestead exemption you can also apply for other personal exemptions such as widows widowers blind disability and service connected disability.

Eligible property owners have to file an official application with their local County Assessors Office. This application must be signed by an owner for whom this property is his or her primary residence. In order to file online the property you wish to file on must reflect ownership in your name.

If the assessor determines that your property is eligible you will receive the exclusion s if they have been implemented by your county school district andor municipality township borough or city. This Lackawanna County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. There are two ways to apply depending on certain criteria.

Regardless of the type of tenancy it is recommended that all persons whose names appear on the deed and reside on the property apply for the exemption to safeguard your benefits from ownership. You can apply by using the online Homestead Exemption application. The deadline to file for 2022 is Monday March 1st 2022.

This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st. Welcome to the Lee County Property Appraisers Office on-line filing for Homestead Exemption. Online filing is available for Homestead Senior Age 65 and older WidowWidower Disability and Disabled Veteran Exemptions.

Filter documents by title or description. The application must be filed by March 1 to receive a homestead exclusion for that year. By signing this application the applicant is affirming or swearing that all information contained in the application is.

Property owners with Homestead Exemption and an accumulated SOH Cap can apply to transfer or Port the SOH Cap value up to 500000 to a new homestead property. To receive school property tax relief for tax years beginning July 1 or January 1 an application for homestead or farmstead exclusions must be filed by the preceding March 1. Additional instructions for the conditional Homestead Exemption.

The federal bankruptcy homestead exemption amount is 22975 as of 2013. While the Pennsylvania exemption system does not provide for a robust homestead exemption equity in your home may be protected if you opt to use the federal bankruptcy exemption scheme. First-time Homestead Exemption applicants and persons applying for the Homestead.

This is called Portability. Welcome to the Sarasota County Property Appraisers online homestead exemption application. If a previous owner is listed submit a paper application instead.

Seasonal or temporary rental of the homestead may be considered abandonment of the homestead exemption contact the PA Office for information. Applicants must file an original Homestead application in office to apply for the homestead exemption on the new homestead. Find information regarding COVID-19.

Filing For Homestead Exemption In Florida Real Estate Information Florida Homesteading

Filing For Homestead Exemption In Florida Real Estate Information Florida Homesteading

Will You Lose Your Homestead If You Go To Jail Epgd Business Law

Will You Lose Your Homestead If You Go To Jail Epgd Business Law

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

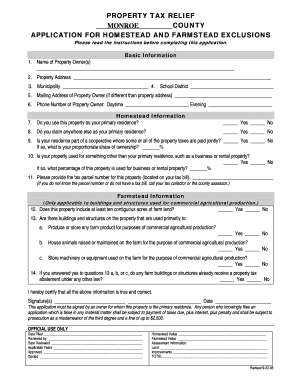

Monroe County Pa Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Monroe County Pa Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Homestead Exemptions By State With Charts Is Your Most Valuable Asset Protected 2020 Update

Homestead Exemptions By State With Charts Is Your Most Valuable Asset Protected 2020 Update

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Deadline To File Homestead Exemption Is March 1 Ecb Publishing Inc

Deadline To File Homestead Exemption Is March 1 Ecb Publishing Inc

Homestead Exemptions For Seniors Fort Myers Naples Markham Norton

Homestead Exemptions For Seniors Fort Myers Naples Markham Norton

Homestead Laws Taxes And Exemptions And The Homestead Act Homestead Laws Taxes And Exemptions And The Homestead Act Estas En El Lugar Correcto Para Hobby Pa

Homestead Laws Taxes And Exemptions And The Homestead Act Homestead Laws Taxes And Exemptions And The Homestead Act Estas En El Lugar Correcto Para Hobby Pa

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Florida Homestead Exemption Why You Need An Attorney Realty Times

Florida Homestead Exemption Why You Need An Attorney Realty Times

Agent Resources Homestead Exemption Letter 1 2019 Doc Nexthome Excellence

Agent Resources Homestead Exemption Letter 1 2019 Doc Nexthome Excellence

Don T Forget To File Your Homestead Exemption The Deadline Is April 1st It Will Save You Money On Your Annual Tax Bill Save Homesteading Don T Forget Forget

Don T Forget To File Your Homestead Exemption The Deadline Is April 1st It Will Save You Money On Your Annual Tax Bill Save Homesteading Don T Forget Forget

Vote No On Homestead Exemption Nether Providence Democrats

Vote No On Homestead Exemption Nether Providence Democrats

Residence Homestead Exemption Information Williamson Cad

Homestead Laws Taxes And Exemptions And The Homestead Act

Homestead Laws Taxes And Exemptions And The Homestead Act

How To File For Florida Homestead Exemption Tampa Bay Title

How To File For Florida Homestead Exemption Tampa Bay Title

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home