Property Lines Map Henry County Ga

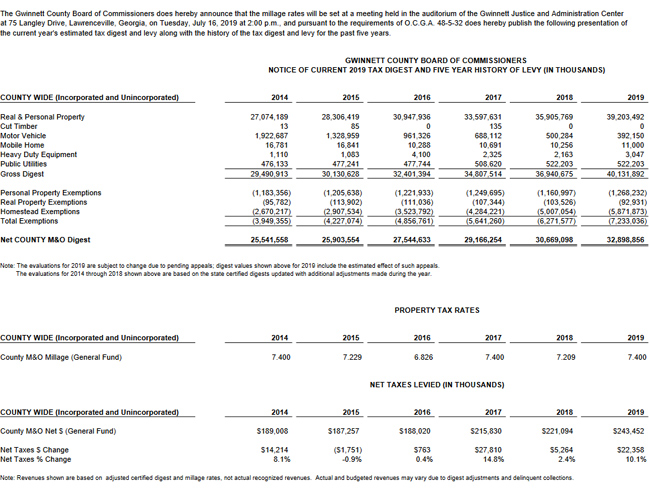

Rockford Map provides highly accurate Henry County parcel map data containing land ownership property line info parcel boundaries and acreage information along with related geographic features including latitudelongitude government jurisdictions school districts roads waterways public lands and aerial map imagery. County Maps Plat Maps and other Map Products.

GIS Property Maps is not affiliated with any government agency.

Property lines map henry county ga. The property maps represented on this site are compiled from information maintained by your local county Assessors office and are a best-fit visualization of how all the properties in a county relate to one another. Plat maps with property lines are available on. The AcreValue Henry County VA plat map sourced from the Henry County VA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres.

Find Georgia Maps to get accurate Property and Parcel Boundary Data Aerial Maps School District Maps and GIS Data for every county within Georgia. For information related to unemployment income please read FAQ 3. Plat maps include information on property lines lots plot boundaries streets flood zones public access parcel numbers lot dimensions and easements.

Henry County Land Records are real estate documents that contain information related to property in Henry County Georgia. The AcreValue Henry County TN plat map sourced from the Henry County TN tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. This department handles all your mapping needs for the Henry County Georgia area.

What are the different zoning districts. 2015 Henry County Map Created Date. An Official Zoning Map is a map of Henry County on which each property is assigned one or more of these zoning districts.

AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. Search for Georgia plat maps. Within the map view the property lines for each parcel in addition to the parcel number acreage and owner name.

The Henry County Assessors Office makes every effort to produce the most accurate information possible. The AcreValue Henry County GA plat map sourced from the Henry County GA tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. ArcGIS Web Application - Henry County.

All maps are interactive. These records can include land deeds mortgages land grants and other important property-related documents. The property lines are determined by examining detailed property descriptions on deeds and by using surveys created by a.

AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. Information found on GIS Property Maps is strictly for informational purposes and does not construe legal or financial advice. Henry County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Henry County Georgia.

Zoning district means the use classification of parcels of land as generally defined under this ULDC. GIS stands for Geographic Information System the field of data management that charts spatial locations. This map can be found at this link.

Property boundary lines are depicted on recorded plats available at the Henry County courthouse or can be determined by employing the services of a licensed surveyor. Henry County qPublic Zoning Map. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books.

Henry County Maps Once the map has loaded click on the Zoom tool and you can zoom in on a specific area. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. Third party advertisements support hosting listing verification updates and site maintenance.

Read more »